-

8/31/2011

DJI = 11614 +54 la/ma=

1.031 21-dmaROC= -.267 P =

+134 (+126 ) IP21= .078 V= - 49 OP= +.292

BREADTH STATISTICS:

123 (-26) MAXCP

stocks Bullish New Highs and MAXCP Stocks

11 (+2) MINCP stocks

Bearish MINCP Stocks

MAXCP stocks

are those showing Tiger Closing Power making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

Also use the BOTHUPs condition with MAXCPs and BOTHDOWNS MINCPS.

Sell S7s occur when Professionals are much more bearish than the Public is.

8 new highs on NASDAQ. 5 new lows on NASDAQ

20

new

highs NYSE

1 new lows on NYSE

8/31/2011

===> See Key

Peerless TigerSoft Index Charts: Industry Groups and ETFs

DIA

SPY QQQ

DJIA-Peerless TigerDJI TigerSPY

TigerQQQ GLD

SLV Crude

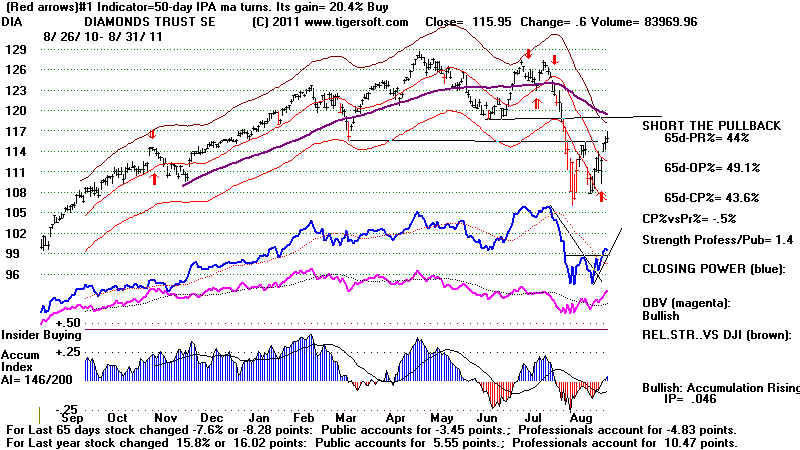

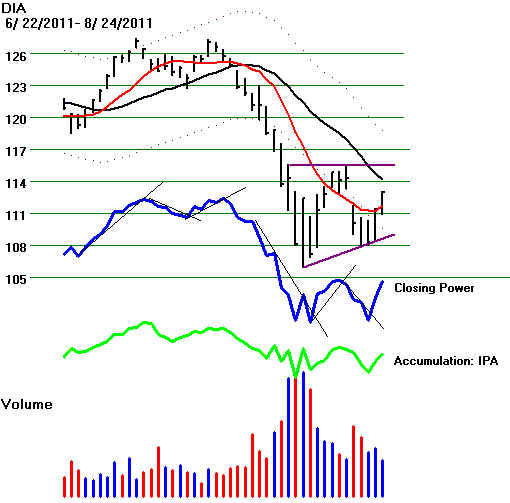

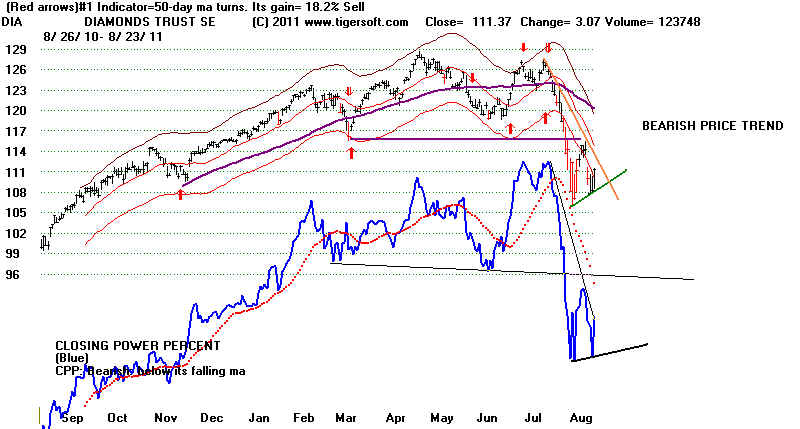

8/31/2011 Peerless remains on Buys. The Closing Powers

are still rising.

Defensive Stocks Have Led The Recovery.

This is not good.

See the Key Peerless TigerSoft Index Charts

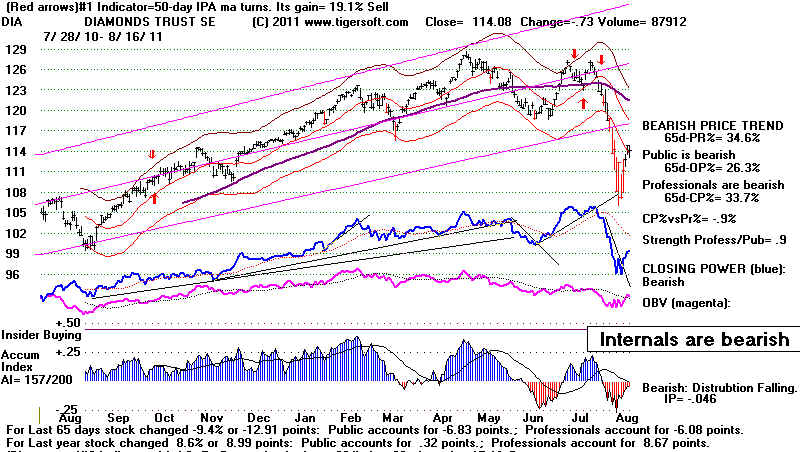

I have decided to take profits in many of the

stocks bought for this rally on our

Tiger Stocks' Hotline, but will wait for the

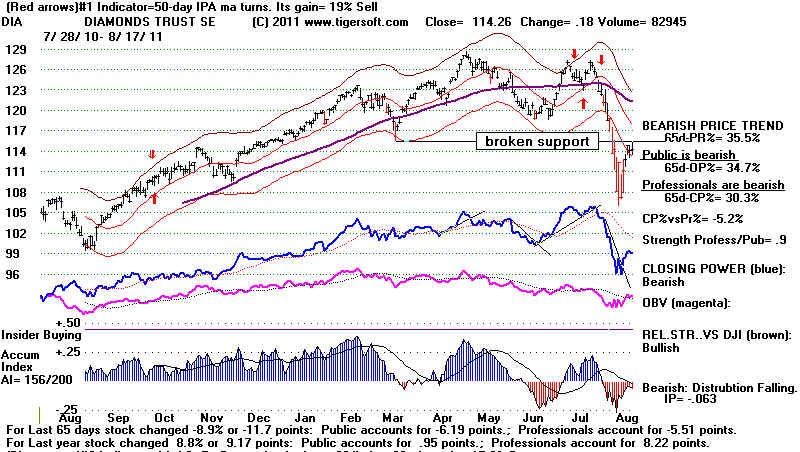

Closing Power uptrend to be broken to sell DIA.

Volume remains so low, I would think that

another day up ot two is about all we

can expect of the advance without some very

good news to send it higher. 118-119 will be

very tough resistance for the DIA on this

advance. It closed at 115.95. I would just hold

DIA and the other long positions, except where

the stock has fallen more than 15% and

has got back up to its old highs or stall out

at the falling 65-dma. There I would take profits.

See Bullish New Highs and MAXCP Stocks

Short sales do not seem a good idea yet.

The number of MINCP stocks, is very low.

DJIA

|

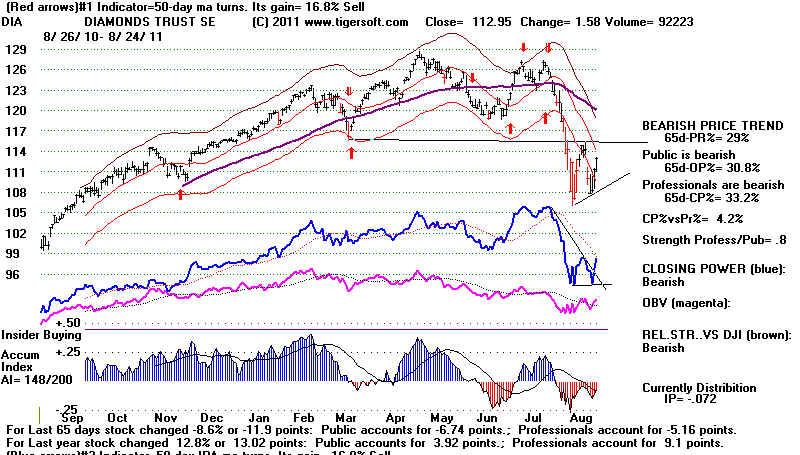

DIA - Daily

|

DIA - Exploded Chart

|

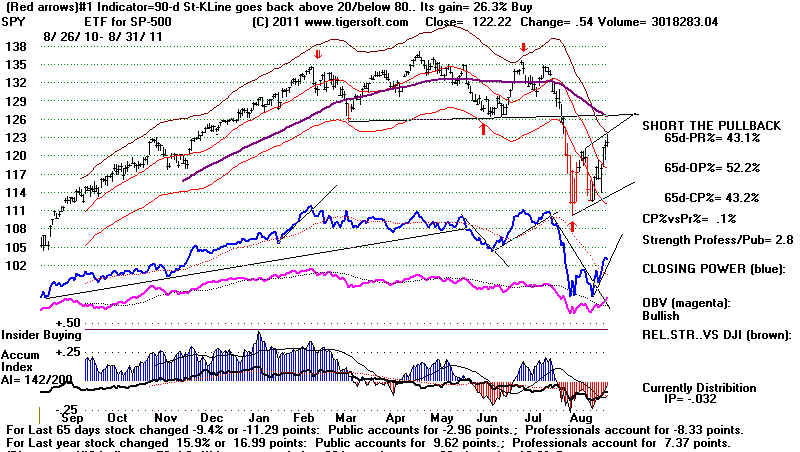

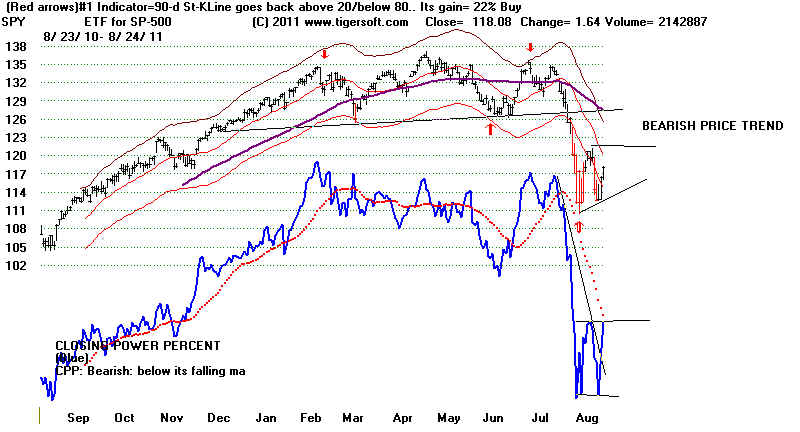

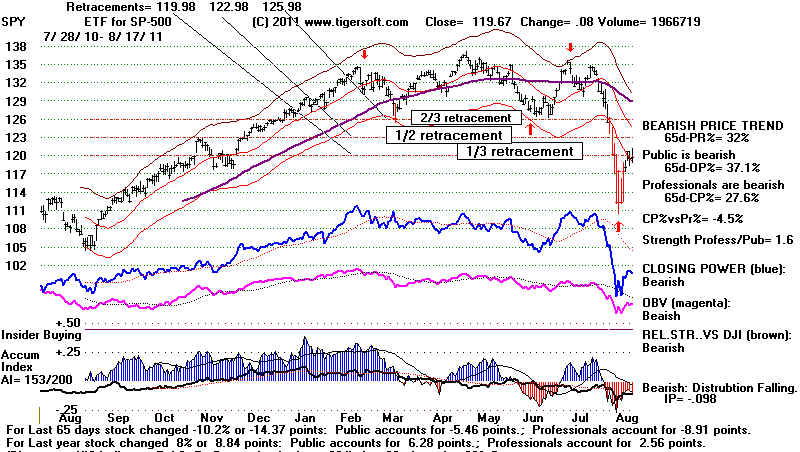

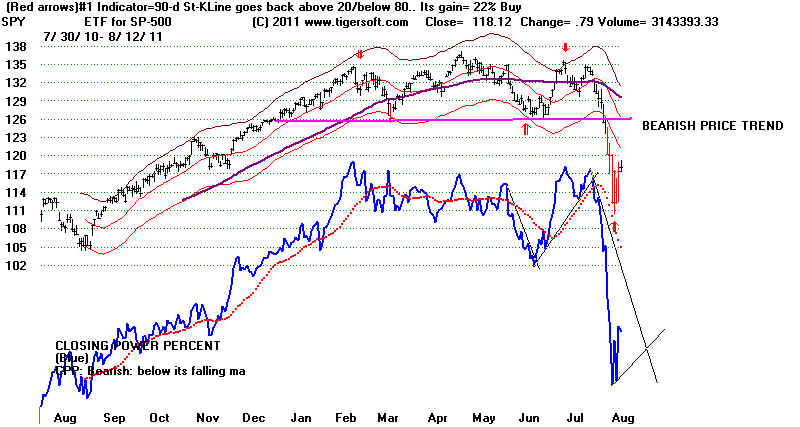

SPY

SPY - Exploded Chart

|

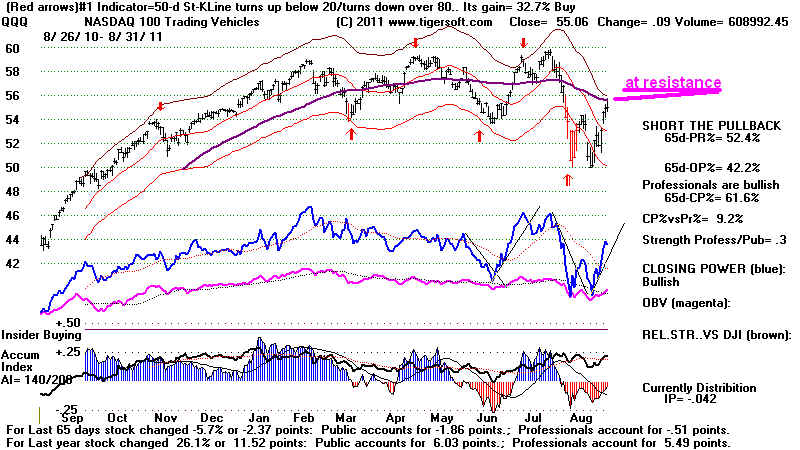

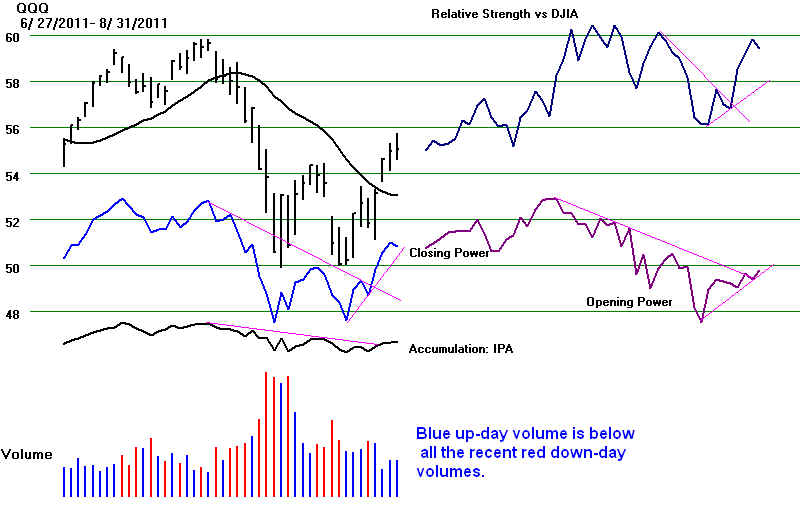

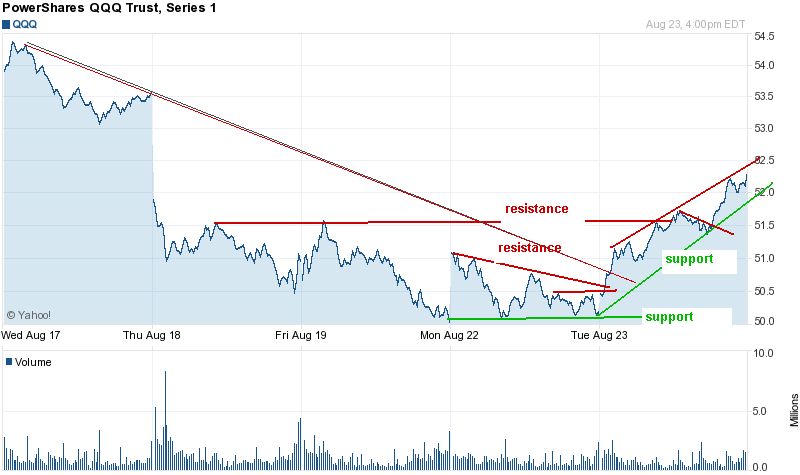

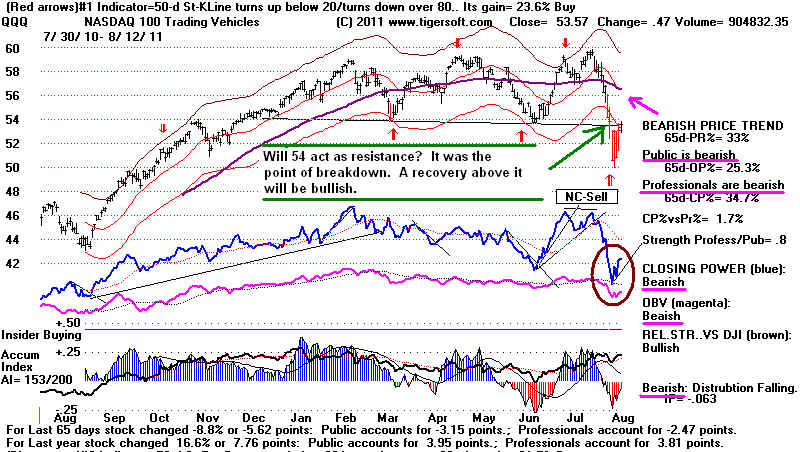

QQQ

QQQ - Exploded Chart

|

===================================================================================

OLDER HOTLINES

===================================================================================

8/30/2011

DJI = 11560 +21 la/ma=

1.025 21-dmaROC= -.603 P =

+7 (+29 ) IP21= .047 V= - 122 OP= +.217

BREADTH STATISTICS:

149 (+20) MAXCP stocks Bullish MAXCP

Stocks

9 (+3) MINCP stocks Bearish MINCP

Stocks

MAXCP stocks

are those showing Tiger Closing Power making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

Also use the BOTHUPs condition with MAXCPs and BOTHDOWNS MINCPS.

Sell S7s occur when Professionals are much more bearish than the Public is.

17 new

highs on NASDAQ. 12

new lows on NASDAQ

21

new

highs NYSE

0 new lows on NYSE

8/30/2011

===> See Key

Peerless TigerSoft Index Charts: Industry Groups and ETFs

DIA

SPY QQQ

DJIA-Peerless TigerDJI TigerSPY

TigerQQQ GLD

SLV Crude

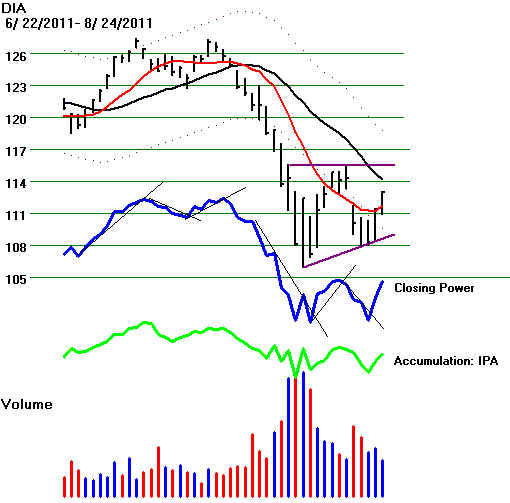

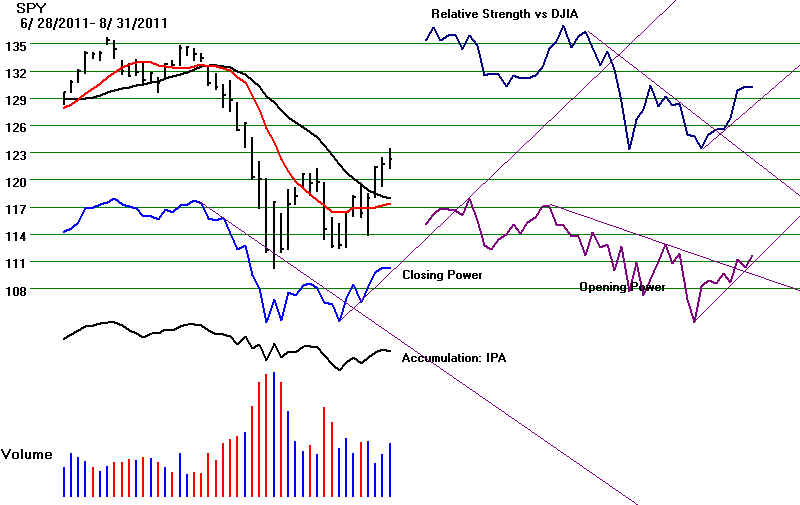

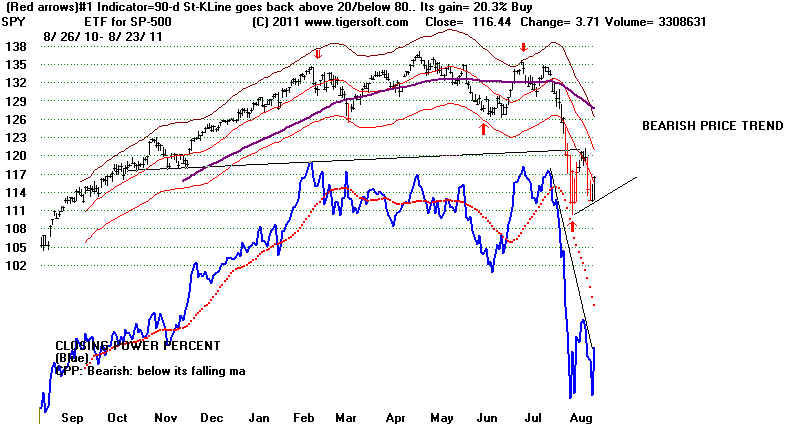

8/30/2011 Peerless remains on Buys. The Closing Powers

are rising.

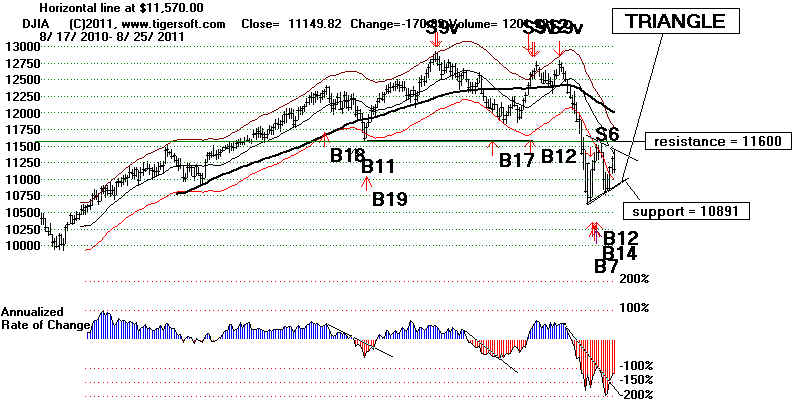

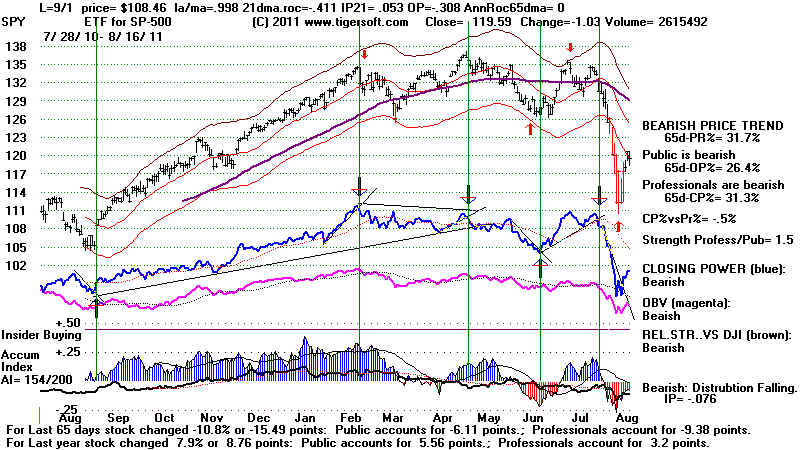

Though the DJI rose from early weakness, at

the close it backed off the

overhead resistance at 11600.

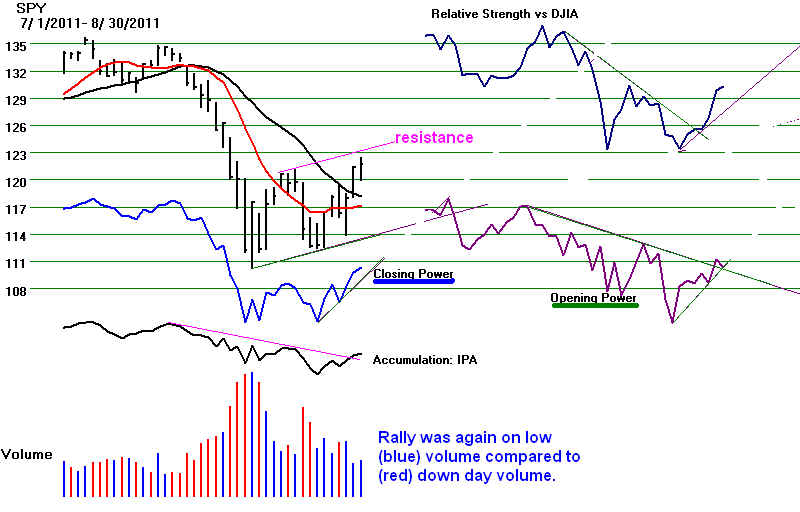

Volume remains low on the rally. (See the short-term

SPY just below.) As a result,

it is not clear that there will be sufficient buying to eat

up the overhead supply of stock. Still

this is a short-term bullish period and Professionals

are not bearish yet, as there are only 9 stocks

making CP new lows, but 149 making CP

new highs.

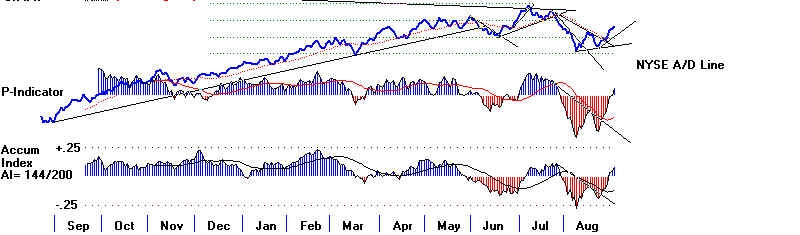

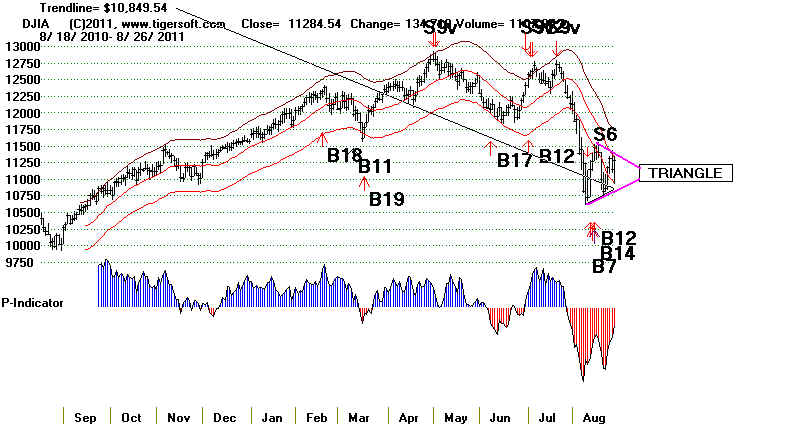

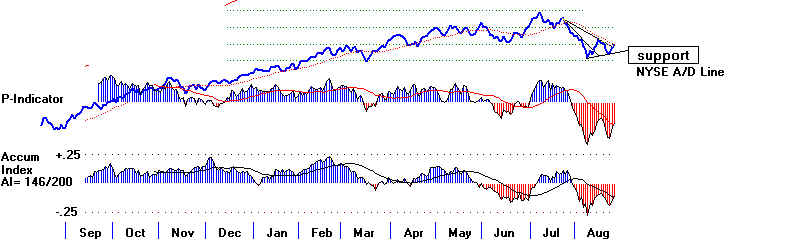

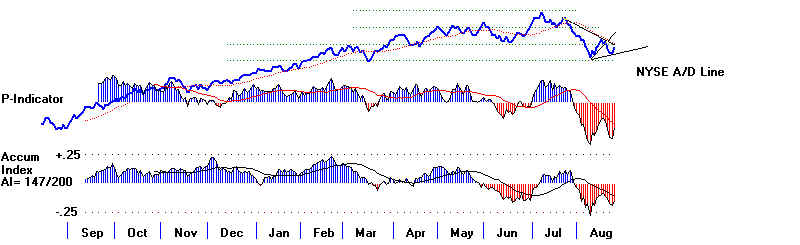

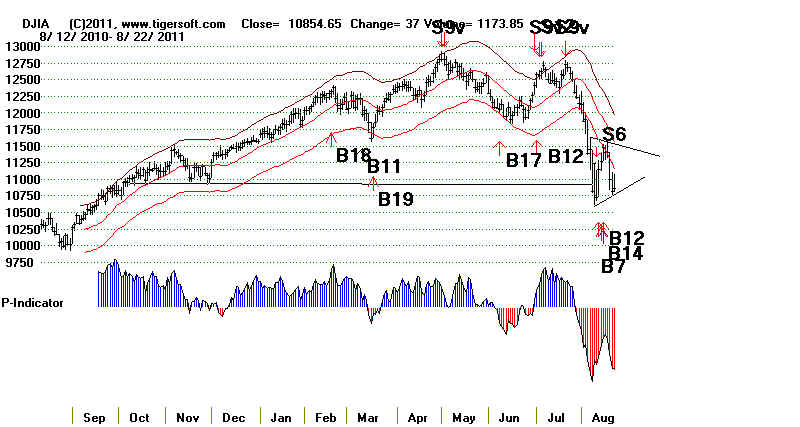

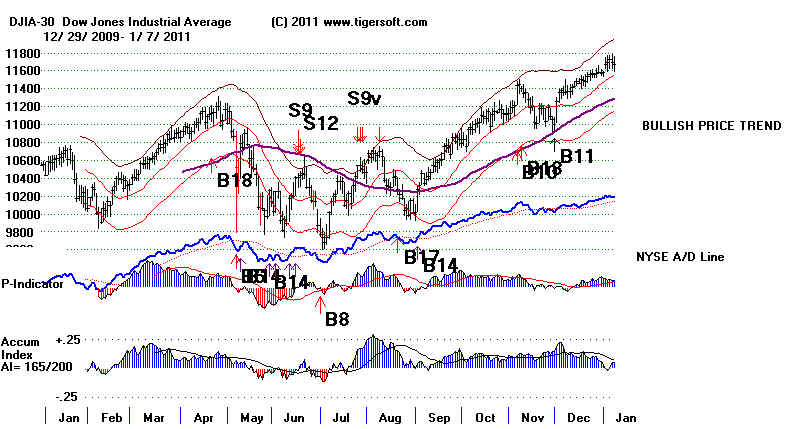

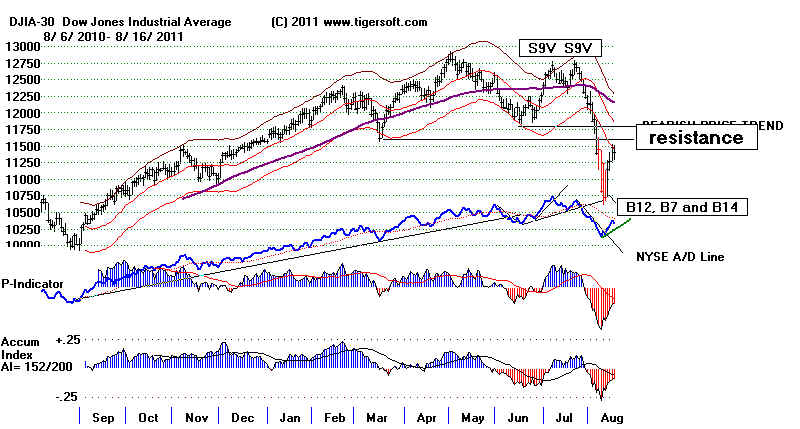

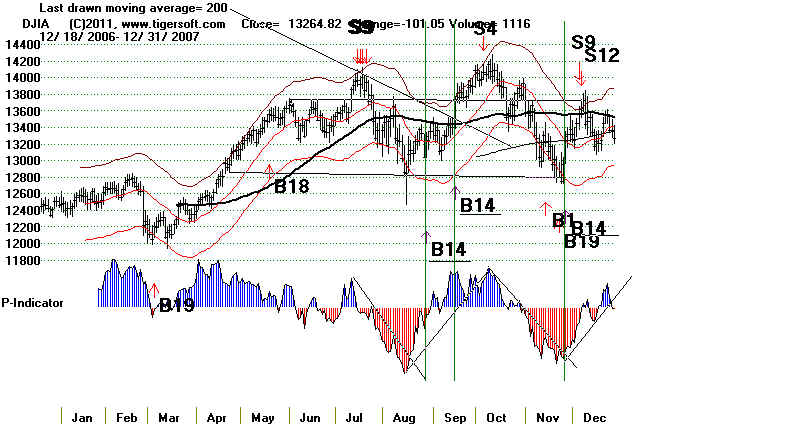

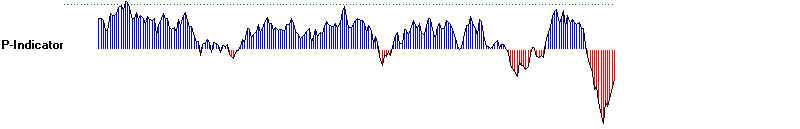

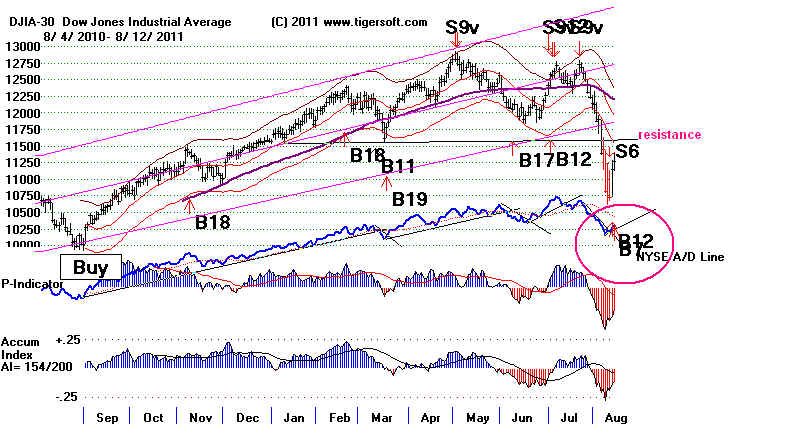

In the DJI chart below, the P-Indicator and

IP21 are only slightly positive. Peerless could

easily produce a Sell S9 or Sell S12 on a close

nearer 11600 if these indicators turn

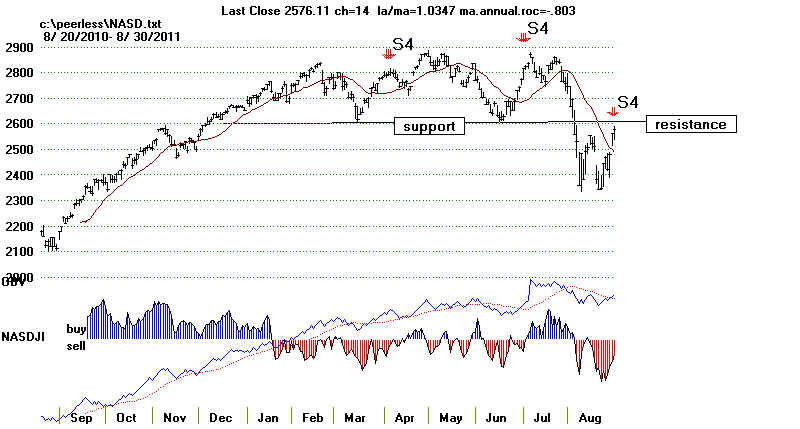

negative. The NASDAQ chart (below) does

show a Sell S4 based on negative Accumulation

and Relative Strength Tiger "NASD"

readings.

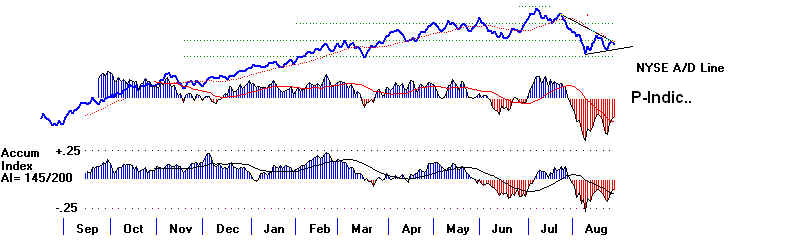

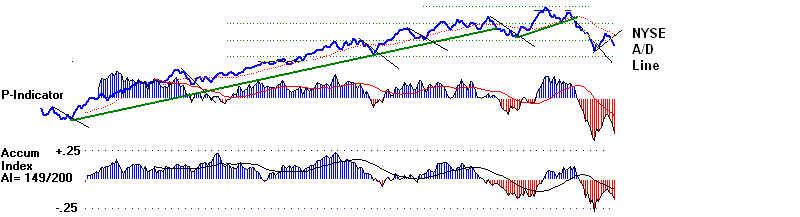

The uptrends of the Closing Power and the A/D

Line are still rising and Peerless is

still on a buy. I think we should hold

our long positions.

===================================================================================

OLDER HOTLINES

===================================================================================

8/29/2011

DJI = 11539 -171 la/ma= 1.021 21-dmaROC= -.635 P = -23 (+170 ) IP21= .035 V= - 143 OP= -.154

BREADTH STATISTICS:

129 (+73)

MAXCP stocks Bullish MAXCP

Stocks

6 (-28) MINCP stocks Bearish MINCP Stocks (Friday's)

(MAXCP stocks are those

showing Tiger Closing Power making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

At this point these are extended a long ways, so - use well-tested CP trendbreaks

to close out positions. Sell S7s occur when Professionals are much more bearish

than the Public is.

20 new

highs on NASDAQ. 7

new lows on NASDAQ

22

new

highs NYSE

4 new lows on NYSE

8/29/2011

===> See Key

Peerless TigerSoft Index Charts: Industry Groups and ETFs

DIA

SPY QQQ

DJIA-Peerless TigerDJI TigerSPY

TigerQQQ GLD

SLV Crude

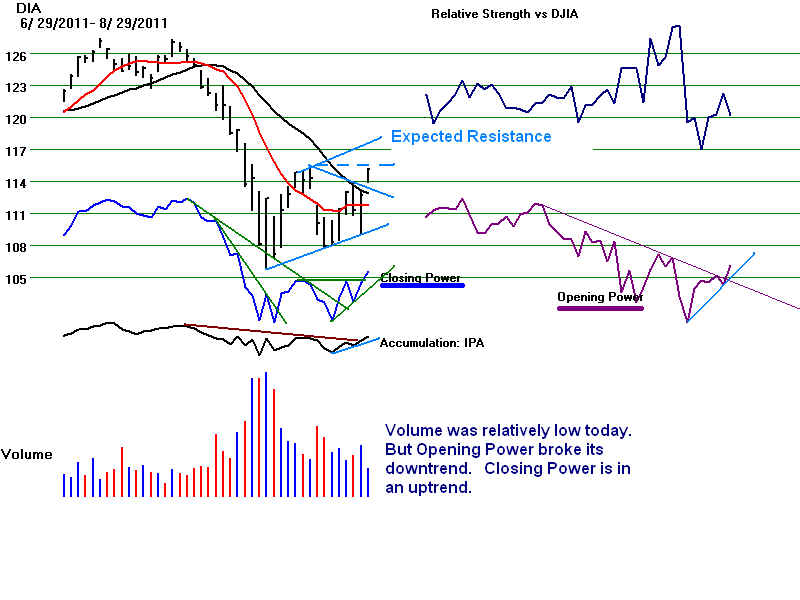

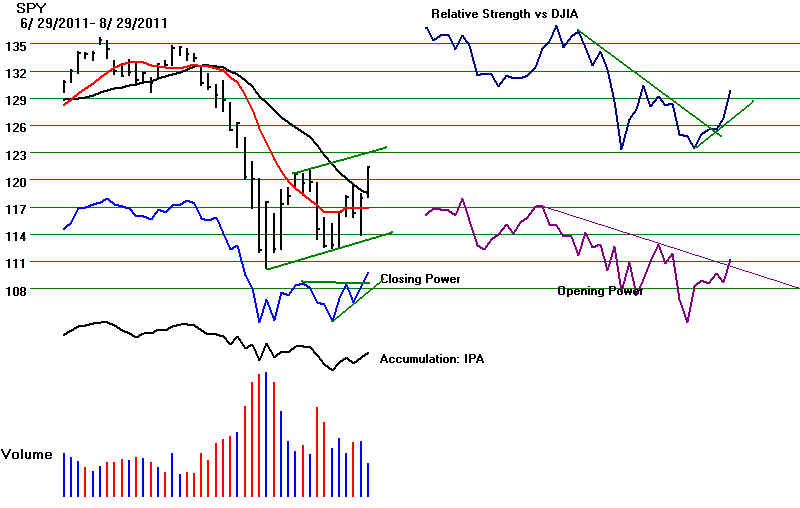

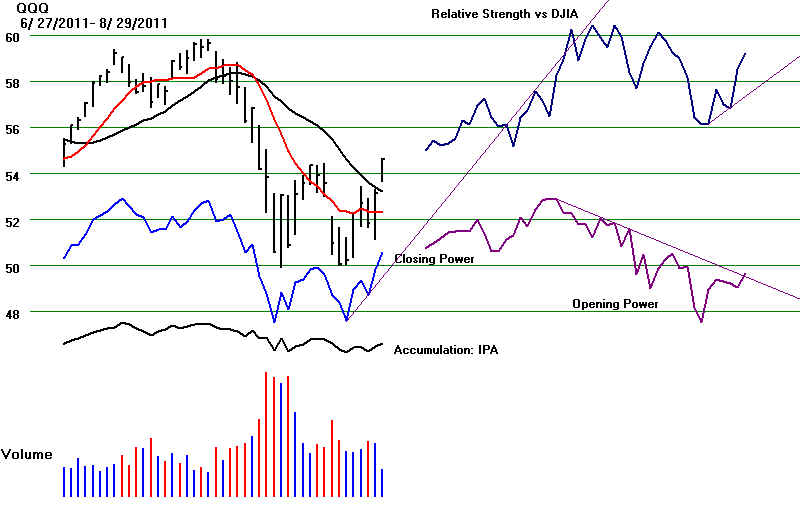

8/29/2011 A Low Volume Rally to early August's

Resistance. But Hold...

Only a shallow pullback is expected, as long as

uptrend of Closing Powers

have not been violated. The DJI closed

2.1`% over the 21-day ma. Look for a

rally and a close to 3.0% (la/ma = 1.03 in key

daily Peerless statistics above).

We should also get a Sell signal if the

P-Indicator is near or below 0 or if the

IP21 is below 0.

Peerless gave a reinforcing Buy

B14 today because the ratio of NYSE up volume

was so high to NYSE down volume.

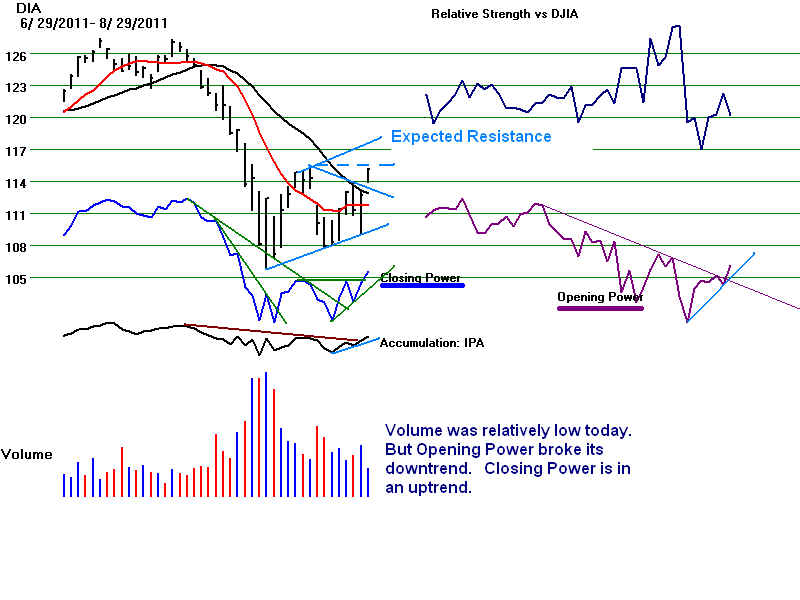

The ETFs Closing Powers are rising and the Opening

Powers broke their downtrends.

The DJI's resistance at 11500 from the early August peak

is probably not as important as the

broken support at 11700. I would hold the longs

a while more. A rally through

through Thursday's close is most common before Labor Day

weekend. We are not short anything.

A number of biotechs did well today as did the

best of the REITs. I would

limit purchases to the very best of the REITs. And note how

well the 5-day Stochastic does with the

index of BESTREIT which I will start re-posting

on our Key ETFs and SECTOR Charts.

It would helpful and bullish here if there were stocks, other than defensive ones,

leading the rebound. That is not

the case so far. Last night's Hotline painted

a picture of America in stagnation with

no ready way out, given Obama's orthodox

economic thinking and the anger of the

tea-party Government-is-bad Congress.

The 1930s' history shows that the forces

of economic nationalism will get much stronger

if there is no improvement and no

re-industrialization. Economic nationalism

clashes sharply with the

internationalism of Wall Street, Obama and much of the

Democratic Party.

Right now, Obama and the Fed will

do everything they can to paper over the cracks

until after the next election.

They may not be able to do that. Sooner, rather than later,

these antagonisms and

contradictions will probably drop the DJI sharply. I think that

Obama is quite vulnerable to a

populist Democratic challenge. Wall Street would

not like that. Right now, no

one is even in the wings. But that could change, especially

if Obama's Labor Day speech on Jobs

offers nothing more than some subsidies for

companies who do more hiring in the

US.

This is what I argue in the latest

Tiger Blog

8/27/2011 CAN THE US ESCAPE

ECONOMIC STAGNATION?

Deepening

Contradictions between Main Street and Wall Street:

The Lessons of the

1930s Bode Poorly for Wall Street.

Watch for next the 5-day Stochastic Red Sell on BESTREIT.

Biotechs and REITs are usually strong

until the end of a bull market, but it would be

unusual for them not to back off when

they hit the resistance of their falling 65-dma.

Watch their rising Closing Power uptrends

for a break, too.

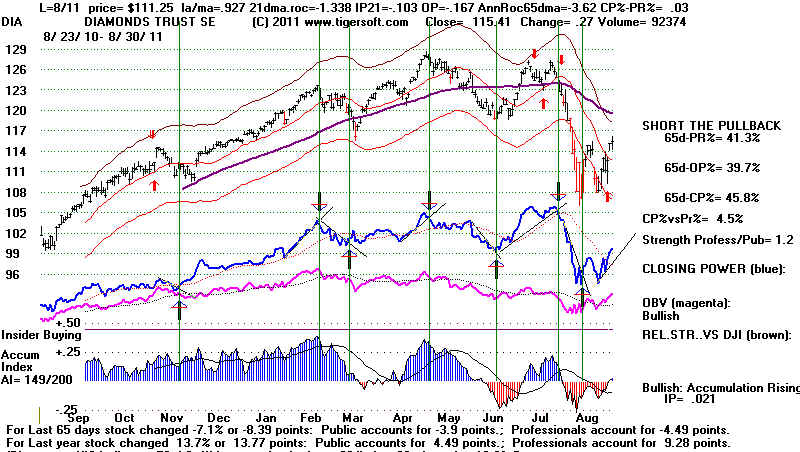

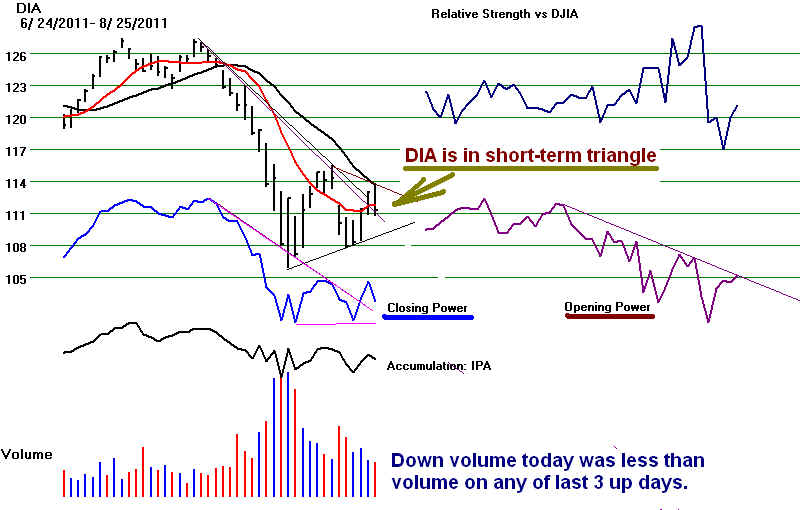

DIA' s

Exploded Chart shows rising CLosing Power trend, but volume was quite

low on the rally.

DJI and Peerless Signals

|

DIA - full chart

|

DIA - CandleStick

|

SPY enlarged chart

|

QQQ Enlarged Chart.

|

====================================================================================

OLDER HOTLINES

====================================================================================

8/26/2011

DJI = 11150 -171 la/ma= .98 21-dmaROC= -1.201 P = -325 (+44 ) IP21= -.086 V= - 386 OP= -..035

BREADTH STATISTICS:

47 (+19) MAXCP stocks Bullish MAXCP Stocks

34 (-78) MINCP stocks Bearish MINCP Stocks

(MAXCP stocks are those showing Tiger Closing Power

making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

At this point these are extended a long ways, so - use well-tested CP trendbreaks

to close out positions. Sell S7s occur when Professionals are much more bearish

than the Public is.

4 new

highs on NASDAQ. 30 new lows on NASDAQ

9

new

highs NYSE

7 new lows on NYSE

8/26/2011

===> See Key

Peerless TigerSoft Index Charts: Industry Groups and ETFs

DIA

SPY QQQ

DJIA-Peerless TigerDJI TigerSPY

TigerQQQ GLD

SLV Crude

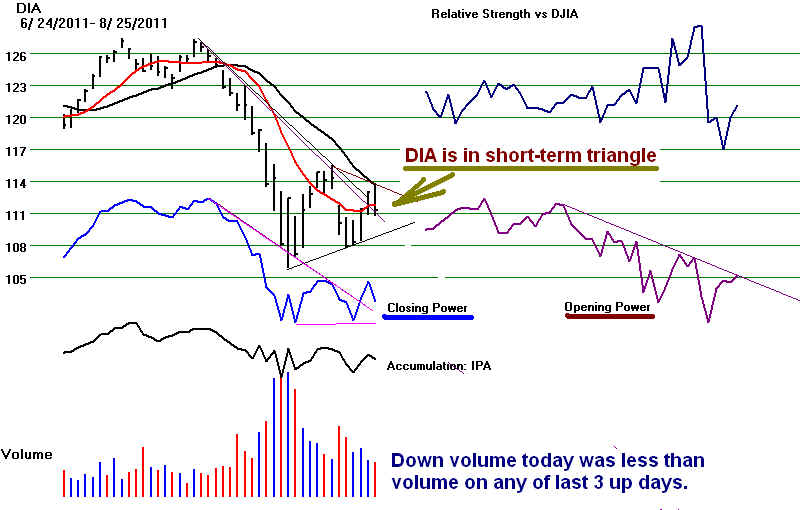

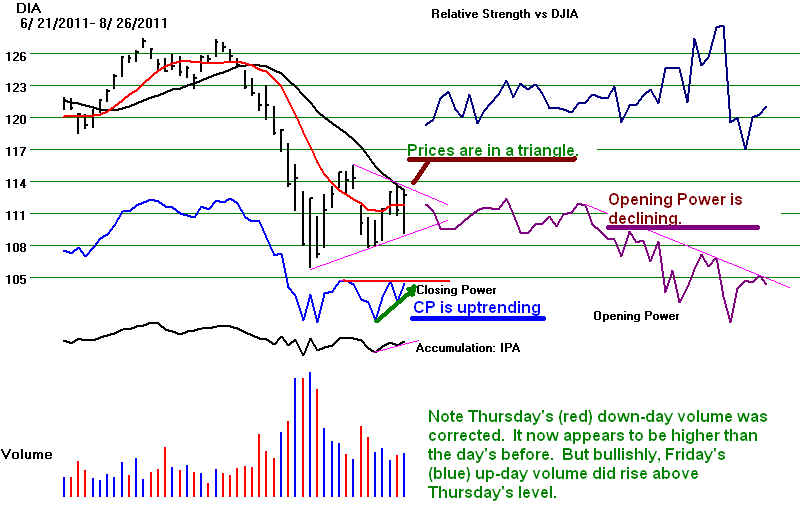

8/26/2011 The

DJI and key ETFs are locked in triangle patterns. The Peerless

Buys and the DJI's rising support line have made us bet on an upside

breakout.

The Closing Powers are in short-term uptrends. A breakout in the

DIA's CP above

its recent flat resistance would be bullish, as would a breaking in its

Opening Power's

downtrend. A very strong Opening which is added onto by an even

more powerful

Close would break these downtrends. Wall Street dodged a

hurricaine. Maybe, it's

luck is improving.

Volume did not rise much on Friday. Investors are scared.

Rising prices will

give traders more confidence. The rising uptrendline-support in the DJI is about 10900.

A close below this would probably mean the DJI is breaking down again.

If that is broken, the next support level is expected to be 9800.

A few more trading days'

hesitation is predicted by the history of the DJI since 1965. But

a week from now the DJI

should be higher, based on the fact that since 1965, the DJI has risen

64.4% of the time

in the five trading days after August 28th. The margin of

MAXCP stocks over MINCP

stocks is only 47 to 34, a hardly convincing number. Biotechs

often offer good long trades

late in a bull market cycle. As long as the ones, picked in the Bullish MAXCP Stocks' list show

rising Closing Powers, they are appealing. The bearish MINCP

stocks have already fallen

a very long way. My guess is that shorts will be happy to take

profits in most of them if

the market moves higher as we go into the 3-day Labor Day weekend.

Can Pumped Up Stocks Escape Trouble?

The world economy still has huge problems. Will stocks be able to

stay up? The Fed has

done a marvelous job in keeping the stock market rally alive for 27

months by generously

loaning vast sums to all the biggest banks at very little cost,

by printing new money to buy

bonds and by keeping interest rates low, despite quickly rising

gold and commodity prices.

Bernanke is fighting the forces of economic stagnation and high

unemployment

with only monetary policies. They are not enough, he is the

first to say. More stagnation,

higher unemployment and the loss of more manufacturing to Asia

and Europe are in

the cards. A longer economic stagnation and higher

unemployment will cause, I expect,

a re-thinking of economic orthodoxies, especially free trade and

balanced budgets.

Globalism Will Likely Break Down

The 1930s caused many countries and economists to rethink

orthodox economics.

I think the same will happen again. Now Budget Balancing is

all the rage in Washington,

London, Berlin, Paris and now Spain. Its dire effects in

Europe and the US in the 1930s

seem unknown or forgotten. But if history repeats, when

these countries' economies

worsen and unemployment jumps to unacceptable levels, as happened

in 1931 and

1932, there will be more and more cries for Deficit Spending,

Protectionism, Public works,

Curbs on Exports of Capital, Wage and Price controls and even the

Confiscation of Gold.

Germany's leading banker of the 1920s, Hjalmar

Schact, a free trader and budget balancer,

read Keynes and dramatically reversed himself completely in 1929.

Keynes himself switched

to protectionism in 1933, as did Neville Chamberlain, the

Chancellor of the Exchequer.

Imagine in our time, if someone like Bernanke or Buffett suddenly

switched to strongly

favoring Public Works, Tariffs, Autarchy (national economic

self-sufficiency) and even the

Repudiation of International Debts, as Schact did. Wall

Street would take a very big hit!

Yet these were many of the policies adopted in the aftermath of

the world wide economic

collapse of 1931 and 1932. Wall Street has bet big on

multinationals. The biggest "American"

stocks are all multinationals. I think wrenching challenges

lie ahead to stock prices,

especially if the current rally fails and Obama and the Tea Party

leaders offer no new ideas

in early September about how to create millions of jobs by

re-industrializing America.

Many economists think that the 1929 stock market collapse was partly a

response to the growing

realization then that the Smoot Hawley

legislation was going to pass, with its big jump in tariffs.

The dependence on international trade is much greater now. Wall

Street and the major

corporations would never allow such an increase in tariffs. Yet,

without some restrictions

on imports or subsidized industrial production here, a massive pubic

works program, like TVA,

the Hoover, Grand Coulee Dam or Civilian Conservation Corp., would be

much less effective

as an economic stimulus. Consider high speed trains as a US

public works program to modernize

the infrastructure. Presently, much of the steel would have

to be imported. And the newly

hired workers would probably buy lots of Chinese imports from Wal-Mart.

Keynes'

"multiplier effect" with public works projects in the US is

much lower now than it was in 1933.

Tennessee

Valley Authority Grand Coulee Dam

Hoover Dam

CCC

The easiest path politically now in the US is still relying

on Bernanke to boost Wall Street

and hope that there with be some trickle-down to American

workers, even though the export

of jobs goes on unabated.

Tariffs do have their downside. Which industries

should be protected? Across-the-board?

The links below argue that the Obama Adminstration has not

bargained any more aggressively

with US trading partners, particularly China, than he

did with the tea party Republicans. Should

goods produced unsafely by underpaid serfs be allowed into

the US? When it comes to

campaign contributions, the importers generally speak

louder than the unemployed workers

that have been displaced. Whereas once up a time, the

corporations that made steel or

sneakers or autos might have complained bitterly, now they

own many of the factories

abroad that are sending goods here.

References to Obama's failure to fight against unfair foreign trade practices

that hurt American manufacturing:

http://www.examiner.com/political-buzz-in-lafayette-la/obama-s-trip-to-china-could-further-destroy-america-or-is-that-the-plan

http://www.highbeam.com/doc/1G1-233548728.html

http://americanmanufacturing.org/blog?p=12026

http://citizen.typepad.com/eyesontrade/2011/08/pelosi-pushes-back-against-obama-backed-unfair-trade-agreements.html

http://www.punxsypage.com/news/start/68431_Casey_to_Obama__Protect_dairy_farmers_from_unfair_trade_practices.htm

http://www.mittromney.com/blogs/mitts-view/2011/07/president-obamas-retreat-china-costing-america-jobs http://www.prnewswire.com/news-releases/dnc-chair-debbie-wasserman-schultz-mitt-romney-will-not-stand-up-for-american-workers-in-the-global-economy-126280603.html

Tariff legislation, though probably easily made

popular now, as a way to save jobs here,

would almost certainly mean antagonizing China, which has

built whole industries

around exports to the US. There would be retaliation

by all the trading partners in

the US. Foreign US Debt holders would likely sell.

That would mean the Fed would have to

print lots more Dollars or a very sharp rise in interest

rates.

So, the future does not look good. The 1930s

should warn us about how quickly the world

can deteriorate. Gold is a haven until there is

another violent Crash, as in October 2008.

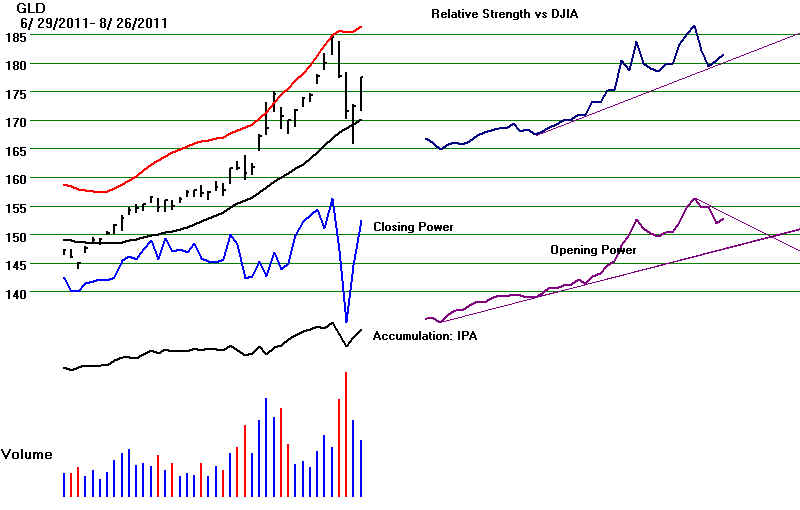

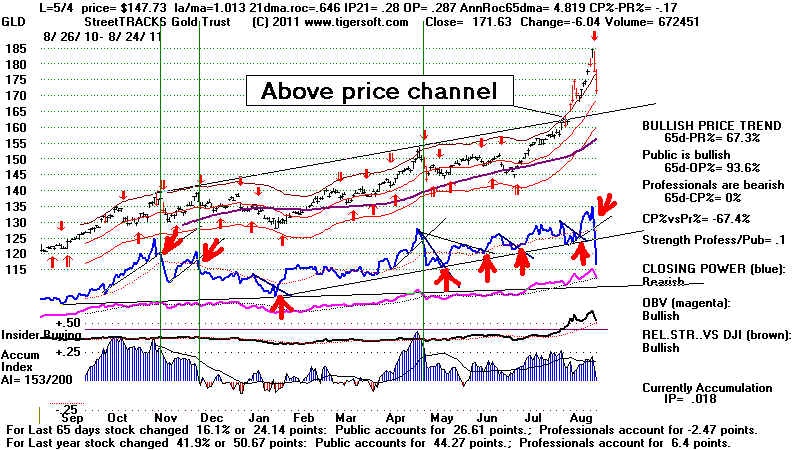

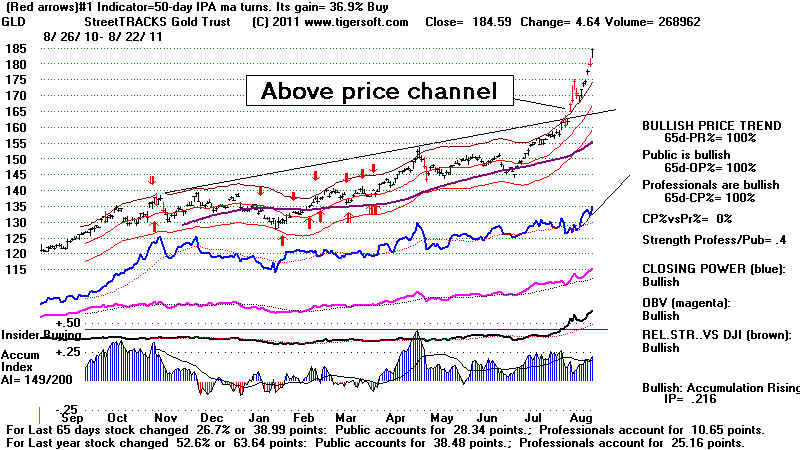

That Gold turned up sharply the last two trading days this

week suggests a crash is not

imminent, but it probably is coming, tragically. I

suggested taking profits in Gold earlier

this week. Now it is roaring back. Look how the

Closing Power has reversed. Buy it back

if GLD' Closing Power makes a new high, my suggestion is

Buy GLD again. I would

also buy GLD on another retreat by the Closing Power back

to a point near its year-long rising

CP uptrend. See the expanded chart below and

the yearly chart among the key Industries'

and ETFs' charts. http://tigersoft.com/811hotline/Charts/index.html

GOLD's Hyperbolic Uptrend

===================================================================================

OLDER HOTLINES

===================================================================================

8/25/2011

DJI = 11150 -171 la/ma= .98 21-dmaROC= -1.201 P = -325 (+44 ) IP21= -.086 V= - 386 OP= -..035

BREADTH STATISTICS:

28 (-57)

MAXCP stocks Bullish MAXCP

Stocks

112 (+90) MINCP stocks Bearish MINCP Stocks

(MAXCP stocks are those showing Tiger Closing Power

making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

At this point these are extended a long ways, so - use well-tested CP trendbreaks

to close out positions. Sell S7s occur when Professionals are much more bearish

than the Public is.

2 new

highs on NASDAQ. 42 new lows on NASDAQ

2

new

highs NYSE

30 new lows on NYSE

8/25/2011

===> See Key

Peerless TigerSoft Index Charts: Industry Groups and ETFs

DIA

SPY QQQ

DJIA-Peerless TigerDJI TigerSPY

TigerQQQ GLD

SLV Crude

8/25/2011

DIA and DJI turned back down from falling 21-day ma.

The rising support in the DJI at about 10891 is now the level to watch.

A close below this would probably mean the DJI is breaking down again.

The next support level is expected to be 9800.

The ETF's Closing Powers backed off from the resistance of their

falling 21-day ma.,

but the CP downtrend has been broken. Volume did not pick

up on the decline.

Though the number of MINCP stocks picked up a lot today, our

Stocks' Hotline

closed out most of our short sales and went long. We are only

long a limited number

of stocks. The recent "Tahiti" stocks, CVX, CAT

and IBM, are the ones I would

favor.

The DIA, SPY and

QQQ's Closing Powers are locked in their own flat trading range

while the DJI decides if it will break out above or below its triangle.

The operative

Peerless Buys signals and the fact that the DJI's price-support-line is

rising

are bullish, as is the expectation the Bernanke will act soon to

provide additional

stimulus. I can't believe Warren Buffett would invest $5 billion

in BAC if he did not

have advance assurances of this.

Seasonality is bearish for 4 more trading days, on average, with the

DJI rising only

40% of the time. But over the next two weeks, the DJI rises

57.8% of the time

since 1966. I

continue to expect a Labor Day rally.

The software for the new TigerSoft Short Term

Chart program

should be posted for Elite Subscribers and those getting the

"S9v updates" this weekend. Use the commands:

Peercomm + Charts - 2011 + Daily Stocks + DIA

+ Lines +

Explode Selected Screen Area + OK + click twice to show boundaries

of new graph.

====================================================================================

8/24/2011

DJI = 11321+322 la/ma= .99 21-dmaROC= -1.224 P = -369 (+100 ) IP21= -.105 V= - 371 OP= -..049

BREADTH STATISTICS:

85

MAXCP stocks Bullish MAXCP Stocks

22 MINCP stocks

Bearish MINCP Stocks

(MAXCP stocks are those showing Tiger Closing Power

making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

At this point these are extended a long ways, so - use well-tested CP trendbreaks

to close out positions. Sell S7s occur when Professionals are much more bearish

than the Public is.

5 new

highs on NASDAQ. 23 new lows on NASDAQ

10 new

highs NYSE

13 new lows on NYSE

8/24/2011 ===> See Key Peerless TigerSoft Index Charts: Industry Groups and ETFs

DIA

SPY QQQ

DJIA-Peerless TigerDJI TigerSPY

TigerQQQ GLD

SLV Crude

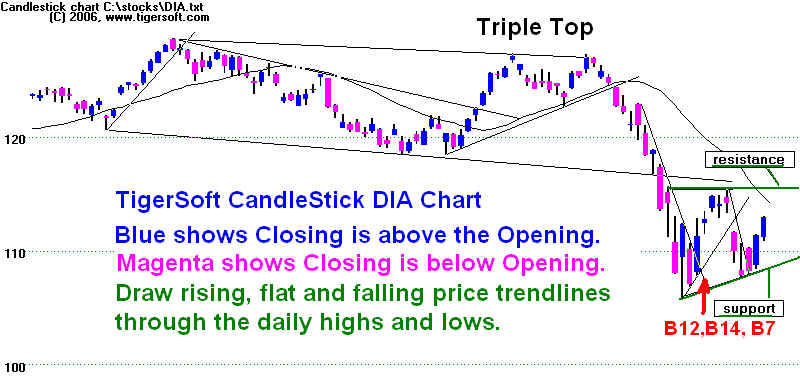

8/24/2011

The Peerless Buy Signals Should Be Given Another Chance. See the

B12, B14 and B7

on the DJIA chart further below. The Closing Powers did break their down-trendlines

for the DIA, SPY and QQQ. Gold's

uptrending CLosing Power line was also broken

decisively today. I have to

advise taking profits in the GLD

position taken near 1500.

We do not want a profit disappear.

DJI's Rising Price Bottoms Are Bullish

I also have to suggest

buying DIA. This is risky, volume

is low on the rally and we do not

know what Bernanke will say about a

further monetary stimulus or helping the big

banks. Nevertheless, we can watch

the rising Closing Powers and abide by them.

We can sell on a rally back to the recent

highs at 116 and, if needed, cut any losses

short by selling if the Closing Power

uptrend is violated. I do

like the rising bottoms

in the DJIA. This has been a bullish signature on earlier DJI

declines from a top before

a strong recovery: 13 Examples

July 1950,

Oct. 1955, Oct 1959, July 1965, April 1980,

Oct. 1989, Feb 1990, Oct. 1990, April

1994, Nov 1997, April

2001 and Sept. 2001.

See 13 Charts where

rising bottom produced a fine rally after a bull market sell-off.

I can find only 3 cases where

the rising price support line was violated and

a bear market followed: March 1966,

March 1973 and Aug 2008. See their Charts.

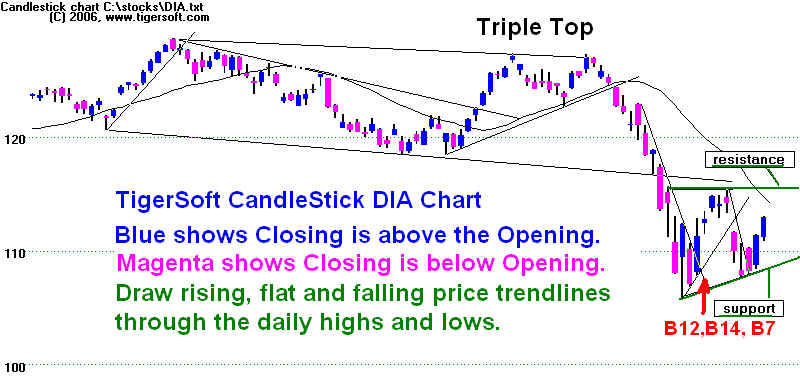

DIA - TigerSoft Candle

Stick Chart

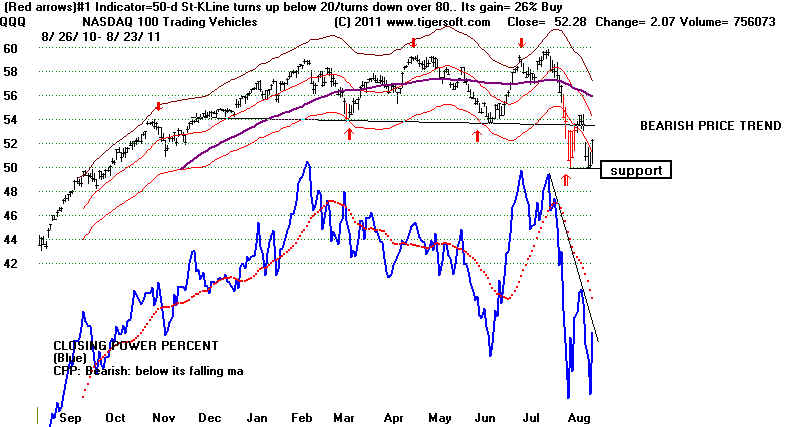

THE NASDAQ-100

The resignation of AAPLE's founder and

leader, Stephen Jobs, today will probably

cause some weakness in the NASDAQ.

I would bet there will be some great

biographies out on him soon.

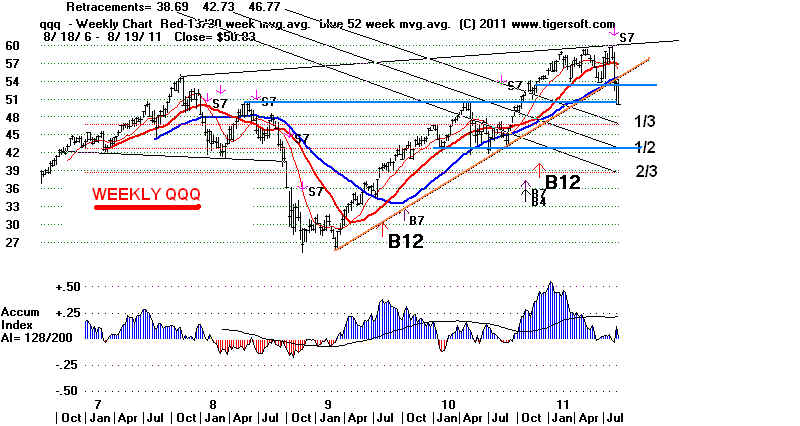

For the present, I would wait on buying QQQ.

The number of MAXCP stocks now outnumbers the number of MINCP stocks. One of

the problems I've had in being bullish

has been the absence of many good

MAXCP stocks. There are a few more

tonight. I would favor those with a positive

current Accumulation Index.

Better Very Short-Term TigerSoft Charts

I think the new more focused charts I am working will help us all, not just very

short-term

traders. Some of you may have ideas

of what could be displayed. The idea is to show

about 30 trading days, broken into two

sides. On one side, will be the Price Chart,

Closing Power, IPA and Volume will be The

Relative Strength Quotient, Opening Power

and the Accumulation Index, though

something else could be displayed, too, at the

pleasure of the user.

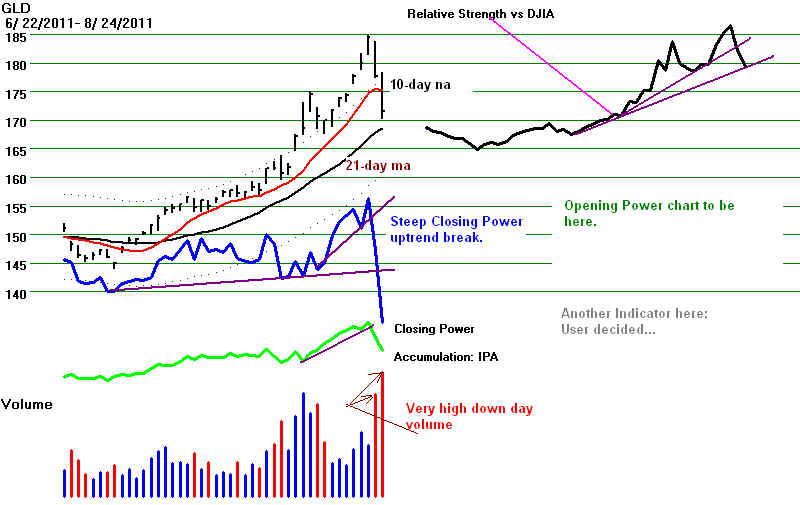

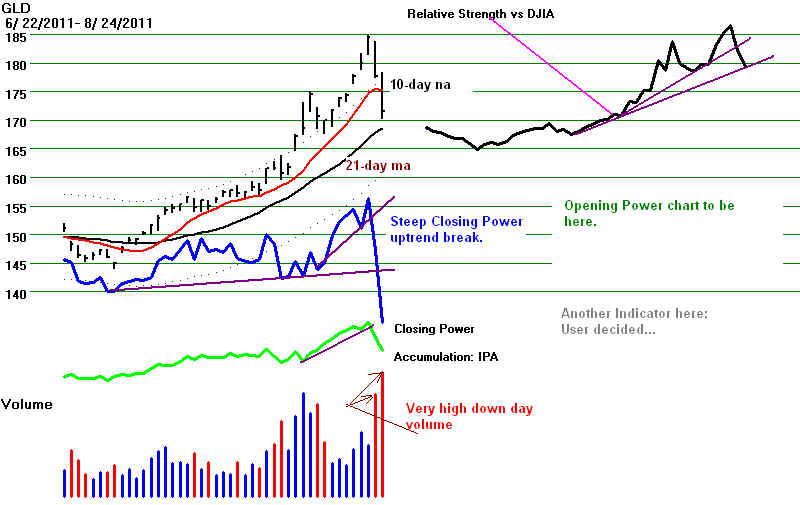

In the chart of GLD below, you can see

that the red down-day volume of yesterday

was very high. That was a bearish

sign. It might have meant taking more seriously

the steep Closing Power uptrend of

yesterday. See the new GLD chart below.

GLD - Draft of New Tiger Short-term Chart

GLD - Gold ETF - Closing

Power's Uptrend was broken.. In the past such breaks

have cooled off the advance for a while.

But with Gold being heavily speculated in,

it may just bounce up off the rising

21-day ma and start up again. See below how positive

Accumulation Index is. That

suggests buyers in the wings will scoop GLD on a decline.

If Bernanke loosens further public funds

to protect the big banks, the monetary scenario

that is most bullish for Gold will

continue. Of course, speculation in Gold could be

reduced by increasing margin requirements

here, as Shanghai has done. But Obama's

regulators may not be so inclined to

intrude. They have been loathe to offend the big

banks or Wall Street since March 2008.

|

PEERLESS DJIA

|

DIA and CLosing Power

|

SPY and Closing Power

|

QQQ and CLosing Power

|

==================================================================================

OLDER HOTLINES

===================================================================================

8/23/2011

DJI = 11177+322 la/ma= .973 21-dmaROC= -1.459 P = -469 (+191 ) IP21= -.149 V= - 404 OP= -.115

BREADTH STATISTICS:

53

MAXCP stocks Bullish MAXCP Stocks

165

MINCP stocks Bearish MINCP Stocks

(MAXCP stocks are those showing Tiger Closing Power

making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

At this point these are extended a long ways, so - use well-tested CP trendbreaks

to close out positions. Sell S7s occur when Professionals are much more bearish

than the Public is.

3 new

highs on NASDAQ. 132 new lows on NASDAQ

4 new

highs NYSE

159 new lows on NYSE

8/23/2011 ===> See Key Peerless TigerSoft

Index Charts: Industry Groups and ETFs

DIA

SPY QQQ

DJIA-Peerless TigerDJI TigerSPY

TigerQQQ GLD

SLV Crude

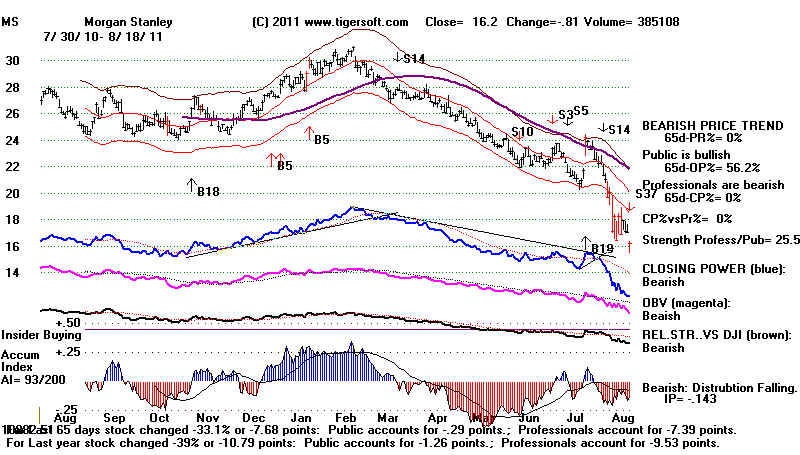

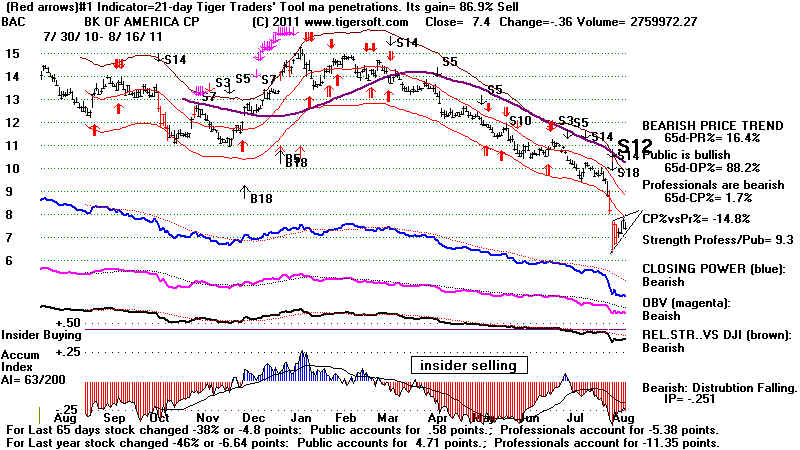

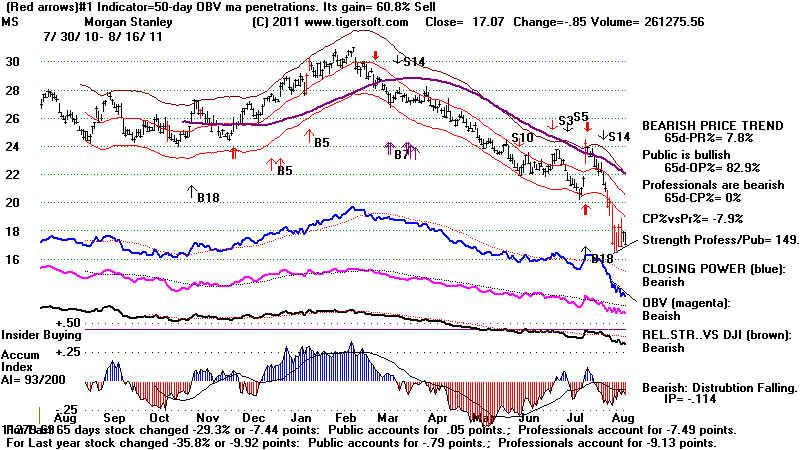

The Financial Canary Looks Very Ill

Again.

How much of a rally can there be when the biggest banks stocks like BAC,

GS, C and MS

hardly turn up on a day the DJI rises

more than 300? The big banks show very heavy

red distribution and falling Closing

Powers The weakening housing market is a

huge problem and none of the home building stocks we follow is now above its 65-dma.

These are the same conditions we saw in 2007 and 2008. This

time around, however,

it will be very hard politically for the

FED and Congress to bail out the big banks.

I think Obama, Geithner and

Bernanke may try to do something on their behalf in a few days,

rather than next year in the middle

of the Presidential campaign. That may bring a Labor Day

bounce for the market. Here

is a new group-chart which I will call BIGBANK. The data for

these will be available starting

tomorrow on our Tiger Data Page.

If the bank stocks do not turn up

soon, we will be entering the normally bearish period of

September and October and they will

be even more susceptible to heavy professional

shorting. The leveraged short

ETF on Financial, FAZ, gives traders

a way to really hurt

these stocks. It will be hard

to ban shorting on financials, as France has done, and still

allow shorting ot other stocks.

Watch the Closing Power Downtrendlines

Hold the Bearish MINCP Shorts as long as

their CLosing Powers are in tact.

Stay Long Gold, where the CLosing Power

is still in an uptrend. The Peerless Buys

are treated with high suspicion here

until the DJI gets back within the normal 3.5%

bands and the 21-Day ANROC rises back

above -1.00. The first condition is now

extant. The DJI is now 2.7%

below the 21-day ma. But the momentum is still too deeply

down. The 21-Day ANROC is

-1.459. (See the discussion of ANROC last night and

the the day before, too).

Watch the key ETF's CLosing Power downtrends.

The rally today did not break their

downtrends. Despite today's rally, there

are 3x more MINCP than MAXCP stocks.

Market leadership is extremely defensive and

very scattered. Both the Opening

and CLosing Powers are falling. This is

when there is greatest risk of a steep decline.

Prices are apt to open lower and then do much

lower at the close.

Very short-term computerized traders jumped

aboard when they saw that there would not be

a follow-through decline this morning.

They understand that the DJI's rising bottoms

offer a useful uptrendline. shown below in green. As

long as that uptrendlineis not violated,

some quick traders are willing to hold and see

if a base for a bigger bounce forms.

It is a simple matter of risk reward for them. Other computerized traders, with their

ability to trade in a nanosecond, and trade

overseas if needed, are apt to sell if the

markets are not up tomorrow after the first 30

minutes. Their loyalty to holding is measured

in minutes, not months.

Day Trading

Day traders, the only way I know to trade these

one day moves is to understand that

once short-term support holds, a rally looking

for resistance usually develops. Draw

trendlines on a very short-term chart. Accept

modest profits when there is so much overhead

supply of stock and the 21-day momentum is down

steeply, as now Yahoo provides useful

5-day charts, but 10-day charts are better.

I will have to write something that produces this.

Usually, I would say trade the trend predicted

by the Peerless operative signals. Here

that would mean trading on the Buy side.

But because of how far below the 21-day ma the

DJI was when they occurred, they are very

suspect.

DJIA and Automatic Peerless

DIA, QQQ and SPY with Closing Power Downtrends

Work in progress

=====================================================================================

OLDER HOTLINES

=====================================================================================

8/22/2011

DJI = 10855 +37 la/ma= .939 21-dmaROC= -1.868 P = -661 (-11 ) IP21= -.19 V= - 452 OP= -.183

BREADTH STATISTICS:

26(-25) MAXCP stocks

Bullish MAXCP

Stocks (only gold looks

good)

553 (+222)

MINCP stocks - Bearish MINCP Stocks

(MAXCP stocks are those showing Tiger Closing Power

making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

At this point these are extended a long ways, so - use well-tested CP trendbreaks

to close out positions. Sell S7s occur when Professionals are much more bearish

than the Public is.

3 new

highs on NASDAQ. 132 new lows on NASDAQ

4 new

highs NYSE

159 new lows on NYSE

8/22/2011 ===> See Key Peerless TigerSoft

Index Charts: Industry Groups and ETFs

DIA

SPY QQQ

DJIA-Peerless TigerDJI TigerSPY

TigerQQQ GLD

SLV Crude

Hold

the Bearish MINCP Shorts, Stay Long Gold and Watch The CLosing Power Downtrends.

Our Bearish MINCP Stocks keep falling and Gold keeps rising. Until these plays break

their Closing Power trends, I would just

keep doing what is working. Gold is due for

another pullback, but it will probably be

short-lived.

TESTING for A BOTTOM in QUICKSAND?

A break in the CP downtrend will be needed to

bring a trustworthy rally. The key

markets are again testing their recent

lows' support. The recent Peerless Buys are trying

to produce a rally going into Labor Day's

bullishness, but both Opening and Closing

Powers are still falling and the indexes

are too far below their 21-day moving avgs. to

trust the Peerless Buys.

. .

Today's rally at the opening fizzled

away, but the DJI still closed up. The Closing Powers

for the DIA,

SPY and QQQ are in falling

trands. Notice how Professionals have turned

to selling and shorting 20x more stocks

than they are buying: the ratio of MAXCP

stocks to MINCP stocks is 553 to

26. The DJI is clearly trying to hold up at the recent lows

just above 10600. Because of the

ways the DJI has knifed through higher support

levels, my guess is that we should expect

a test of 9800, which represents a 50% correction

of the last two and a half years' gain,

from 6550 to 12800.

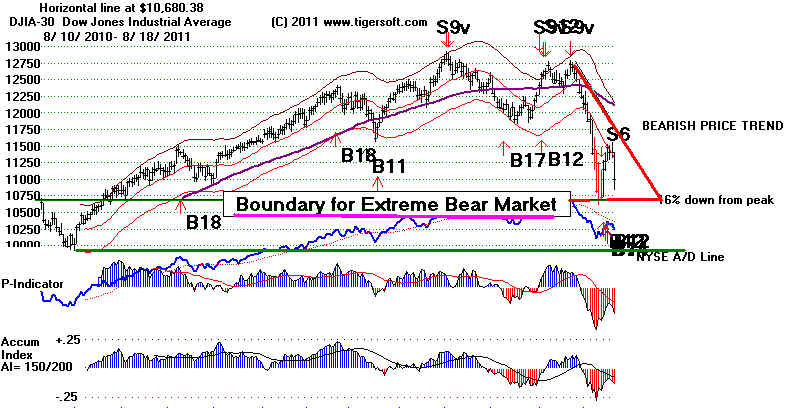

The problem remains the unusual speed of

the decline. We measure that using the

daily rate of change of the 21-day ma

times 250. This is Tiger's "AROC". As in 2008,

below, the DJI is trying to hold up after

falling almost 16%. In 2008, despite the rate of

decline, when the DJI's AROC broke its

downtrend, the DJI made one last attermpt to

get up past the falling 65-dma. It

could not and instead the AROC uptrend was broken

and the extreme bear market followed.

This seems a good model for now. If the AROC

downtrend here (below) breaks its

downtrend, we should see a rally here, back up

towards 11600. The falling Closing

Powers trends will have to be broken first. Until then,

be suspicious of openings.

|

|

=====================================================================================

OLDER HOTLINES

=====================================================================================

8/19/2011

DJI = 10818 la/ma=

.929 21-dmaROC= -1.935 P =

-650 (-163 ) IP21= -.171 V= - 458

OP= -.25

BREADTH STATISTICS:

51 (-21) MAXCP stocks Bullish MAXCP Stocks

(only gold looks

good)

231 (+167)

MINCP stocks - Bearish MINCP Stocks

(MAXCP stocks are those showing Tiger Closing Power

making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

At this point these are extended a long ways, so - use well-tested CP trendbreaks

to close out positions. Sell S7s occur when Professionals are much more bearish

than the Public is.

4 new

highs on NASDAQ. 187 new lows on NASDAQ

4 new

highs NYSE

203 new lows on NYSE

8/19/2011 ===> See Key Peerless TigerSoft

Index Charts: Industry Groups and ETFs

DIA

SPY QQQ

DJIA-Peerless TigerDJI TigerSPY

TigerQQQ GLD

SLV Crude

Friday's news that Hewlett Packard's plan to get out of the personal

computer business

rattled IBM, APPL and many of HPQ's

suppliers. HPQ, a DJI-30 stock, fell 20%. They

would not be exiting this field if

they felt consumers were going to have lots of money to buy

new computers. They would not

be getting out of the business if they thought that Microsoft

and other vendors were on the verge

of offering break-through new software products. This

news is another wave breaking over

the markets and dampening confidence. Each few

days in a bear market, something

new befalls the market. At some point a new technology

will emerge that will attract

investors and we will watch for it. But right now, Professionals

are seeing more opportunity in

short-selling. (Perhaps, short-selling should be banned, so

that boosters of new technologies

would always be paid more attention to. But that, of

course, is not how the system

works. Short-selling we are told by Wall Street is good for

markets and somehow good the

general economy.). Given the leveraged short ETFs and

the unlimited short selling on down

ticks using phantom borrowed shares, I would

definitely respect the trend, which

is now down. I would be surprised if the DJIA does not

re-test 9800-10000.

Considering the speed of the

decline, I would remain bearish and advise being heavily

short the bearish MINCP stocks

despite the recent Peerless Buys. The QQQ needs

to correct at least 1/3 of its

advance since the bottom in March 2009.

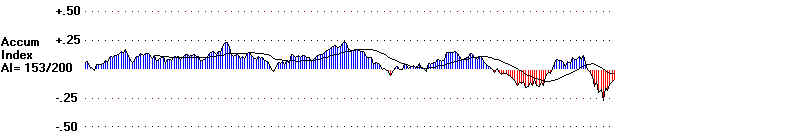

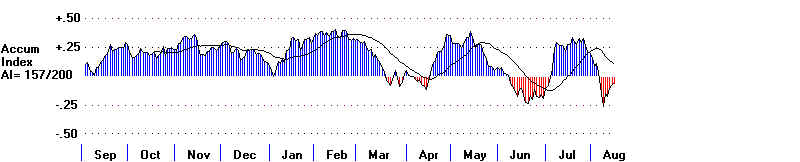

The weekly QQQ (below) and weekly DIA do show much stronger Accumulation Index

readings than they did in July 2008

just before the markets collapsed. The daily Accumulation

Index readings are more important,

I think, and they are bearishly negative. Another

difference from 2008 is that gold

and gold stocks are not collapsing. Not quite everything

is being hastily sold in a

panic. Will this save the market from a comparable decline. I think

so, but right now, more weakness

seems likely.

TRADING SHORT-TERM

We will want to keep watching the

CLosing Powers' declining trends for the DIA,

SPY

and QQQ. A break in them to the upside will likely

bring another bounce from

the oversold condition we are

in. I noticed that these ETFs' data have been changed

from their first posting.

Look here for the charts using the last posted data.

There is some bullish news and the Opening appears to be up.

.

1) It looks like Libya will

soon be free of Gadhafi. That will end one of America's 3

expensive.

2) Congress and the President

are on vacation. They cannot make things worse.

3) Seasonality will soon turn

bullish. Though the DJI has risen only 46.7% of the time

over the 3 trading days after

8/21 since 1966, it rises 57.8% of the time over the

next two weeks.

A DJI close clearly below 10600

will probably bring a Sell S13. It would reverse

the now active Buy signals that we

have been largely ignoring because of the speed

of the decline and because of the

DJI being so far below the normal 3.5% bands.

It may even come close to also

causing us to switch to "Extreme Bearish Mode".

That would require an S13E.

The difference between a Sell S13 and Sell S13E is mainly

that a still deeper decline must

occur. See the discussion of Sell S13s and Sell S13Es

since 1929. (Some additional

programming is being done to show these signals

automatically and to document the

parameters used. Folks who have gotten the S9V

updates will get these

automatically. The Peerless updates are also be posted on the

Elite Subscribers' Page (ESP).

For now let's wait to see what

happens over the next two weeks. If there is a new

decline, we will need to see what

the internals of the market are then and test them,

to see how well they match the past

cases shown that have produced Sell S13s.

GOLD - Still

the best Long Bet?

Gold's

continued rise shows how universal are fears that currencies are endangered by

the significant weakening of

world economies, especially in Europe and the US. There

does not appear to be any

other better investment. So speculators are attracted, of course,

too. Will Gold keep

rising? Probably. After all, Silver has risen 800% since 2003. Low

interest rates make holding

zero-dividend gold in a vault cheap. In 1980, Gold rose even

when interest rates went over

10%. Only a deliberate FED deflationary policy that was

willing to bring a deep

recession stopped gold's rise.

I don't see the FED worrying

soon about Gold's rise, although there are those that consider

3 dissenters to be an

"open revolt", as there were when Bernanke put forth his

promise that the Fed would

keep rates low for two years. (See "Term at the Fed"

(2004)

by Laurence Meyer.) The

dissenters were from the middle of the country, Dallas,

Kansas

City,

and Minneapolis,

far away from the financial centers and the biggest banks. So long as

the Dollar is not weaker than

a basket of other countries, I don't see how the Fed's policies

will become restrictive

before the Election next year. Keep checking the US Dollar

chart

we show most nights.

Even some gold stocks are

rising now. They have been lagging for more than a year.

It is the Public and

foreigners who are buy the likes of NEM. Professionals, as judged

by the Closing Power, have

been steady sellers. If the red Distribuition were end and

CLosing Power start an

uptrend, I would recommend it. But right now, GLD is still

preferred. When you

view Gold and SIlver stocks using TigerSOft understand that

speculative stocks can go up

a long way simply because of higher openings caused

by overseas buyers and public

speculators. Using the Tiger RSQ (Relative Strength

Quotient trends works well.)

===================================================================================

Older Hotlines

====================================================================================

8/18/2011

DJI = 10991 -420 la/ma=

.937 21-dmaROC= -1.594 P =

-488 (-145 ) IP21= -.13 V= - 382

OP= -.17

BREADTH STATISTICS:

51 (-21) MAXCP stocks Bullish MAXCP Stocks

(only gold looks

good)

231 (+167)

MINCP stocks - Bearish MINCP Stocks

(MAXCP stocks are those showing Tiger Closing Power

making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

At this point these are extended a long ways, so - use well-tested CP trendbreaks

to close out positions. Sell S7s occur when Professionals are much more bearish

than the Public is.

1 new

highs on NASDAQ. 174 new lows on NASDAQ

1 new

highs NYSE

134 new lows on NYSE

8/18/2011 ===> See Key Peerless TigerSoft

Index Charts: Industry Groups and ETFs

DIA

SPY QQQ

DJIA-Peerless TigerDJI TigerSPY

TigerQQQ GLD

SLV Crude

The recent Buys are not looking so good! Not a big surprise to

readers here...

Hold Gold. Sell any long stocks if their Closing Power uptrends are

broken and

Add to your Short Sales among the Bearish

MINCP stocks. The recent Peerless Buy

signals will probably be reversed by a

Sell S13 if the DJI closes below 10500.

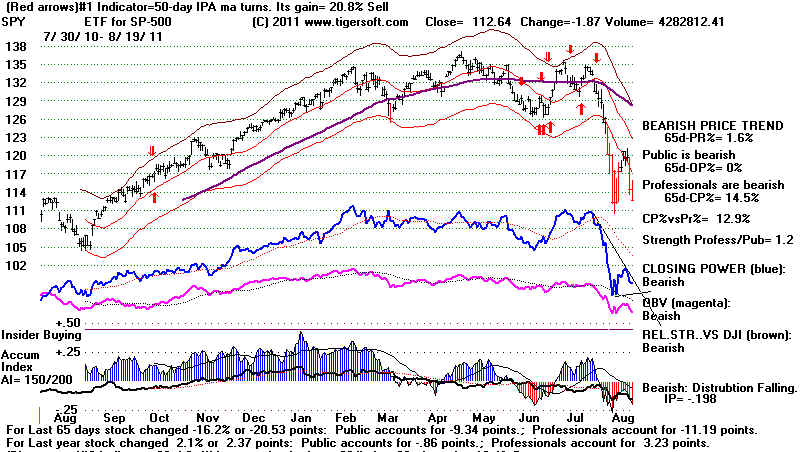

The Velocity of This Decline Is Terrifying.

The severity of the decline today comes closer

to causing an automatic Sell S13, which

would force us to use the Extreme Bearish

Mode. NYSE down volume was almost 40:1.

Volume picked up on the decline. The

market is hanging by a "Fed" and his low interest

rates. Gold and Bonds are the only strong

groups. This sure looks like the

start of a

big bear market. 9700 is the next

support, it the market breaks down to new lows.

It would seem none of the political leaders has read Keynes or studied the

tragic effects

of budget balancing in 1930, 1931 and 1932..

The financial stocks slumped badly today,

just as they did in 2007 and 2008 before each

big sell-off.

The main hope rests in the low interest rates.

That helps hold up the A/D Line. But

rising A/D Lines can follow the DJI down a long

ways. This was true in 1977 and 2001.

Japan's 1990's experience is a warning about

the limits of monetary policy. There comes

a tipping point past past which low interest

rates can no longer keep stocks rising and they

must fall.

http://www.tigersoftware.com/TigerBlogs/February-21-2009/index.html

http://www.tigersoft.com/tiger-blogs/February-04-2008/index.htm

Professionals have shifted to the Sell and

short side. The MINCP stocks now outnumber

the MAXCP stocks by 6:1. The keys ETFs

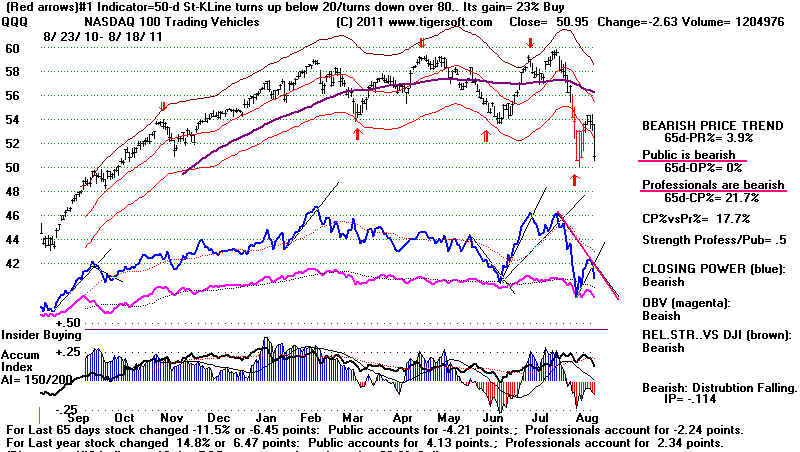

Closing Powers are declining. See the QQQ

below and the SPY and DIA in the page with the

key charts. Note the downtrend-line

that starts at the July high and goes down

through the recent peak.

A New Sell S13 To Switch To Bearish Mode

I have been warning that we seem to be in a

perfect financial sorm. I won't repeat what I

have been writing for the past few weeks.

But there comes a point in a very sharp decline

where we must not only switch completely to a

Sell, but also make it much more difficult

to get a major Buy signal. Presently, the

Peerless software produces an automatic Sell S13

when the decline accelerates past a threshold

based on the annualized rate of change of the

21-day ma. I have shown here that when

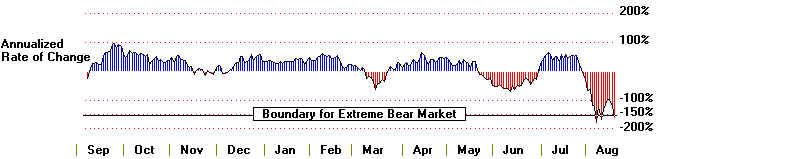

the AROC drops below -1.5 on a DJI decline down

from a high, a bigger decline becomes a high

probability.

http://tigersoftware.com/TigerBlogs/8-15-2011/index.html

A new very simple rule to produce a Sell

S13 should probably be introduced now.

It would protect us from being caught in

what would certainly become a much deeper

decline. This new Sell S13 would

occur when the DJI falls more than 16% in only

21-trading days after being at or close

to its bull market high. It is highly unusual.

But you can see in the charts below its

usefulness in 1929, 1937, 1940, and 1987.

These are its only occurrences.

More details will be posted this weekend on the S13.

====================================================================================

OLDER HOTLINES

====================================================================================

8/17/2011

DJI = 11410 +4 la/ma=

.966 21-dmaROC= -1.181 P =

-343 (-57 ) IP21= -.11 V= - 307

OP= -.141

BREADTH STATISTICS:

72 (+3) MAXCP stocks - Bullish

MAXCP Stocks

64 (+36)

MINCP stocks - Bearish MINCP Stocks

(MAXCP stocks are those showing Tiger Closing Power

making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

At this point these are extended a long ways, so - use well-tested CP trendbreaks

to close out positions. Sell S7s occur when Professionals are much more bearish

than the Public is.

8 new

highs on NASDAQ. 59 new lows on NASDAQ

13

new

highs NYSE

9 new lows on NYSE

8/17/2011 ===> See Key Peerless TigerSoft

Index Charts: Industry Groups and ETFs

DIA

SPY QQQ

DJIA-Peerless TigerDJI TigerSPY

TigerQQQ GLD

SLV Crude

Peerless remains on Buys. The A/D Lines are still rising

Short-Term. MAXCP Stocks

Bullishly Outnumber MINCP Stocks.

Unfortunately, I have been warning that

we seem to be in a perfect financial

storm, brought on by political leaders in

Europe and the US who show no knowledge

of the 1930s ( http://tigersoftware.com/TigerBlogs/83---2011/index.html

)

and that these Buys have occurred when

the market was showing:

1)

unusually bearish downward momentum,

2) much

farther below the lower band than is safe and

3) with the

DJI having slipped more than 13.5% from its highs, usually an important

bearish tipping point.

Continue to hold Gold

and hedge with bearish MINCP stocks against any long holdings

in the bullish MAXCP stocks. It is

not good that the markets are falling back after

merely brushing the resistance of their

broken supports. This frequently occurs on

the first rally up after the first leg

down in a new near market. See more discussion

of the importance of this rally's

strength further below and at a new non-Public Blog

I wrote tonight.

http://tigersoftware.com/TigerBlogs/8-17/index.html

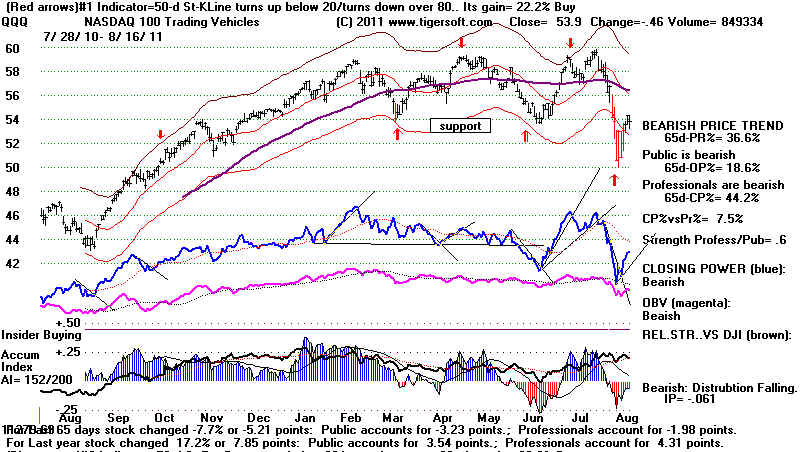

Bearishly, the DJI and QQQ have reached

and are now falling back from the levels

we expected would be resistance, using

the simple principle that broken support

become resistance. I advised

selling QQQ at the opening today (53.98). Now we

must wait for a retest of 11000 or even

10600 and a break in the new CLosing Power

downtrend to buy. See also how the

QQQ reached and fell back from its longer-term

declining CP trend that starts back in

July. This gives added importance to it. More

on this tomorrow night.

Traders, here are some new trading ideas.

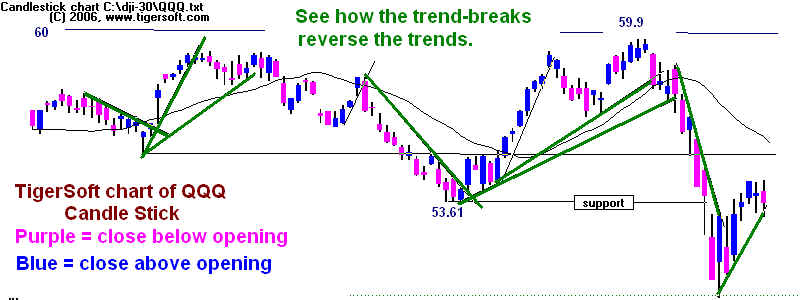

The first occurs when we draw (green) lines through the

bottoms of the Tiger candle-

stick charts of ETFs like the QQQ. below.

The futures are down more than 100 at this

writing. A break in the green

uptrend seems very likely tomorrow,.

The second key trendbreak

is with the Tiger Closing Power. See charts further

below. A CP uptrend-break in the

QQQ seems imminent.

Calculating The Slope of the CP Uptrend

To Show Exactly What It Will Take To Get A CP Trend-Break.

This procedure will have to be inserted

in the CP graphing program. If the math below

is too detailed, don't worry, the

important CP trendbreaks are easily spotted

on the Tiger charts. Know that they

are most important after non-confirmations

of new price highs or lows, when the CP

line is well-tested and when the CP breaks

its trend after a key test of of support

or resistance. Here we have a potential CP

uptrend-break following a test of

resistance.

Y = MX + B

I want here to show you how these CP trends are

actually calculated and how

we can even determine exactly how much

the Close must be below the Opening

the next day to break the current CP

uptrend.

The Closing Power uptrendline (as of

8/17/2011) starts on 8/8/2011 when

Closing Power is said to be 0. It

rises through the low Closing Power point

on its next dip's low. This is the

second day, 8/10/2011, when Closing Power is

+.68. The slope of the CP uptrend

through these two points is .34/ daily

( CP(2) - CP(0) ) / 2

Today, the 7th day of the CP uptrend,

shows the CP slope (i) crosses at 2.38,

while the current CP(i) is 2.60.

The CLosing Power is still above the uptrend.

But tomorrow the CP slope(i) will be

2.72. Unless tomorrow's Closing Power

is above 2.72, the CP uptrend will be

broken. The CP must rise by +.12 or more

tomorrow or the CP uptrend will be

broken. (Slope(8) = CP(7) )

Closing CP

Power(I) Uptrend

Day Date

Close Opening

Difference

Cumulative Slope(i) Line

( i )

(LA(i) OPNG(i) (LA(i)-OPNG(i))

Difference(i)

0

0

0

1

8/9/2011 53.03

51.31

+1.72

+1.72

.34

2

8/10/2011 50.86

51.82

-1.04

+0.68

.68

3

8/11/2011 53.1

51.58

+1.52

+2.20

1.02

4

8/12/2011 53.57

53.42

+0.15

+2.35

1.36

5

8/15/2011 54.36

53.77

+0.59

+2.94

1.70

6

8/16/2011 53.9

53.82

+.08

+3.02

2.04

7

8/17/2011 53.58

53.98

-0.40

+2.60

2.38

8

2.72

The Bearish Historical

Significance of The DJI Failing To Rally Up

Past Recent Broken Support

The

DJIA rally faltered as it approached the 11500 broken support-now resistance level.

The QQQ also backed off its broken

support at 54. This is normal What is important

is that If traders get sufficiently discouraged

by the market's inability to rise up past

these levels of earlier broken support, a new

selling wave can bring a deeper decline

and a much longer bear market. A minor

pull-back is allowable but it should be brief,

if we are going to see a good recovery and a

bull market resume.

It is very important for the bulls that the

market not just get back to the recent

highs near 12750-12800. Clear new highs

must follow in five months, with the A/D Line

leading the way. There have only been two

cases of a 13.5% DJI decline where the bull

market resumed quickly. They occurred in

the Summers of 1950 and 2010. In both cases,

the NYSE A/D Line led DJI prices to new highs.

See immediately below their two cases.

In the current market, the DJI has failed 15%.

That makes our case more bearish.

But we are operating with Peerless Buys now

We will want to watch the NYSE

A/D Line on the current rally. It is

still uptrending and today when the DJI closed

essentially flat, there were 595 more up than

down. This is probably a result of

the Fed's very low interest rates.

See

what the DJI looked like in the past as it tried to rally up after the first selling wave

in what became bear markets. http://tigersoftware.com/TigerBlogs/8-17/index.html

In the 12 bear market declines since 1966,

there were only 2 cases where there

was no significant counter-trend relief rally.

The decline just got worse and worse.

In 7 cases, the DJI rallied back up to the next

higher broken support levels, but then

failed and a bear market followed.. In 3

cases, the DJI rallied up through broken

support but then failed to make a clear new

high and a bear market followed.

1950 - 13.5% DJI Delcine and Bull

Market Resumption

Note how the NYSE A/D Line led the DJI upwards.

|

2010 - 13.5% DJI Delcine and Bull Market

Resumption

NYSE A/D Line led prices upwards to more new highs.

|

DJIA In

quick succession, Peerless has brought a B12, a B7 and a B14.

I have warned that

these occurred when the market was showing

unusually bearish

downward momentum, was unusually far below the lower

band and with the DJI

having dropped more than 13.5% from its highs,

usually an important

bearish tipping point.

When the signals bunch together, to detail them, use the commands

Operations + Trading Results - All

Signals  |

DIA

|

SPY

|

QQQ

|

==================================================================================

OLDER HOTLINES

==================================================================================

8/16/2011

DJI = 11405.93 -77 la/ma=

.979 21-dmaROC= -.979 P =

-287 (+29 ) IP21= -.087 V= - 287

OP= -.15

BREADTH STATISTICS:

69 (+31) MAXCP stocks - Bullish

MAXCP Stocks

28 (-41)

MINCP stocks - Bearish MINCP Stocks

(MAXCP stocks are those showing Tiger Closing Power

making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

At this point these are extended a long ways, so - use well-tested CP trendbreaks

to close out positions. Sell S7s occur when Professionals are much more bearish

than the Public is.

2 new

highs on NASDAQ. 30 new lows on NASDAQ

3 new

highs NYSE

9 new lows on NYSE

8/16/2011 ===> See Key Peerless TigerSoft

Index Charts: Industry Groups and ETFs

DIA

SPY QQQ

DJIA-Peerless TigerDJI TigerSPY

TigerQQQ GLD

SLV Crude

ETFs' Closing Power and A/D Lines Still Rising Short-Term. MAXCP Stocks

Bullishly

Outnumber MINCP

Stocks. Continue to hold Gold.

QQQ's

rise has stalled out at the 54 resistance. Both its Opening and Closing Power

are below their falling 21-day ma.

It has almost recovered 50% of what it lost in July

and August. That is a normal

retracement amount. So, I have to advise selling it,

since it could not stay above 54.

More backing and filling between

11000 and 11500 on the DJI is likely. I would

think that the Fed will continue to

prop up the market, despite charges

of treason

by the Texas

Governor, himself a man who threatened succession in 2009. The

Fed is clearly charged with the

responsibility of preventing a financial debacle.

It was, after all, formed specifically to prevent another

1907-like financial panic.

Consider hedging. This gives

the Peerless Buys more chance to bring a better

recovery. Buying some

bullish MAXCP and selling short some bearish MINCP stocks

seems prudent, considering the

market's unusual weakness. However, the steepness of

the decline should be considered,

in part, the result of the recklessly volatile trading the

SEC now permits big brokerage

computers and hedge funds using leveraged short ETFs

and unlimited short sales on

down-ticks.

Bank stocks like BAC, C and MS

continue to look weak. Nothing has really been done

to prevent another 2008-like

debacle. This time, bailing them out will be much more

difficult politically. If

they break down now, they will again pull much of the market down

with them.

BAC's

counter-trend rally consists of a bearish rising wedge pattern that

could easily decline sharply from here.

|

C -

Notice how the Closing Power has not turned up. It could easily breakdown.

That would be bearish.

|

MS -

The recent Closing Power action is much weaker than prices.

|

MacroEconomics 101

Watch what the market reacts to. I noticed that the DJI was nicely

recovering from

the early 100 point sell-off when the

news spread that the three conservative leaders of

Germany, France and the UK all together

urged a balanced budget amendment to all Euro

governments. The market knows that

this would likely turn a recession into a

depression. The stock market understands

that if we had had a balanced budget

amendment in 2008, we would now be in a

depression. When the private sector will

not create jobs, the government must to

save capitalism from itself. Google

"How FDR Saved Capitalism."

http://www.hoover.org/publications/hoover-digest/article/7076

http://www.slate.com/id/2203035/

FDR saved

capitalism – now it's Obama's turn - CSMonitor.com

Merkel,

Sarkozy propose eurozone government

Merkel, Sarkozy want balanced budget laws in all eurozone countries

On Tuesday August 16, 2011, 10:49 pm EDT

DJIA

|

DIA

|

SPY

Tiger Index of SP-500 Stocks

|

QQQ

|

===================================================================================

Older Hotlines

===================================================================================

8/15/2011

DJI = 11482.90 +214 la/ma=

.964 21-dmaROC= -.992 P = -317 (+91 ) IP21= -.089 V= - 285 OP= -.137

BREADTH STATISTICS:

69 (+31) MAXCP stocks - Bullish

MAXCP Stocks

28 (-41)

MINCP stocks - Bearish MINCP Stocks

(MAXCP stocks are those showing Tiger Closing Power

making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

At this point these are extended a long ways, so - use well-tested CP trendbreaks

to close out positions. Sell S7s occur when Professionals are much more bearish

than the Public is.

8 new

highs on NASDAQ. 17 new lows on NASDAQ

12 new

highs NYSE 4

new lows on NYSE

8/15/2011 ===> See Key Peerless TigerSoft

Index Charts: Industry Groups and ETFs

DIA

SPY QQQ

DJIA-Peerless TigerDJI TigerSPY

TigerQQQ GLD

SLV Crude

ETFs' Closing Power and A/D Lines Still Rising Short-Term Let's see

how the market

does after the Opening. That is the

key. Gold's Closing Power turned up.

Will the Dollar break down? A

Falling Dollar Has Usually Been Good for Stocks.

MAXCPs outnumber MINCPs: Pros are

more bullish than bearish. But the

Momentum ( 21-dmaROC) is still

steeply falling and that usually means basing

is needed. DJI: 11000 is

expected to be support. The 11500 resistance has

almost been reached..

A new B14 was added to the series of

buy signals this reversal has produced. Usually,

the more Peerless Buy signals, the more

bullish the situation. The Buy B14 occurred

because the ratio of NYSE up volume to

down volume was so high today, 1963.9 to 39.9.

Buy B14s after a sharp decline in 2007

three times signalled buying had returned sufficiently

to bring a recovery to the previous highs

or upper band, though some backing and filling

was needed.

Rate of the Decline (Tiger's AROC)

The speed of the decline remains a

technical problem. Tthe Annualized Rate of Change

(AROC) of the 21-dma did not drop below

-1.0 in 2007 when the B14 produced rallies..

This year it reached -1.7 and now stands

at -1.0. From Sept-2008 to March 2009, one

of the warning signs then that we

mentioned on the Hotline was that the AROC fell

below -1.5. It takes a very big

decline to drop it down so much. A history of the 13

occurrences since 1929 of the AROC

dropping below -1.5 shows that it would have

been best to sell at this point in 11

cases. Only in 2 cases did this drop bring a rally

without a significantly deeper decline.

See my Tiger non-Public Blog of 8/15/2011,

Momentum's Tpping Point:

When Does A Correction become A Bear Market.

Look next at the 2007 chart with 3 good

short-term Buy B14s. It will be asking a lot of

the market to reach our upper band, but a

move by the DJIA back to the resistance of

the falling 21-day ma is not out of the

question. More likely we will see the DJI tag the

broken support of the March lows just

above 11500 and then fall back to re-test 11000.

At this writing the DJIA futures are down

69. Only a minor pullback is expected,

as long

as the QQQ Closing Power uptrend is

intact. Take QQQ trading profits if its Closing

uptrend is broken.

Buy B14s in 2007 Brought

Recoveries to Upper Band.

Current PEERLESS

Signals and DJIA

|

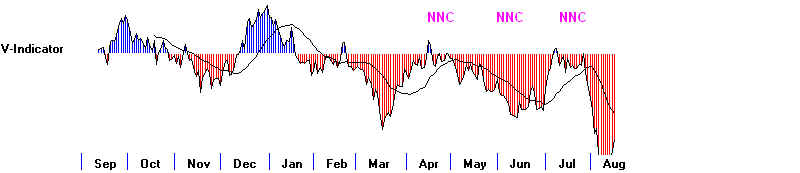

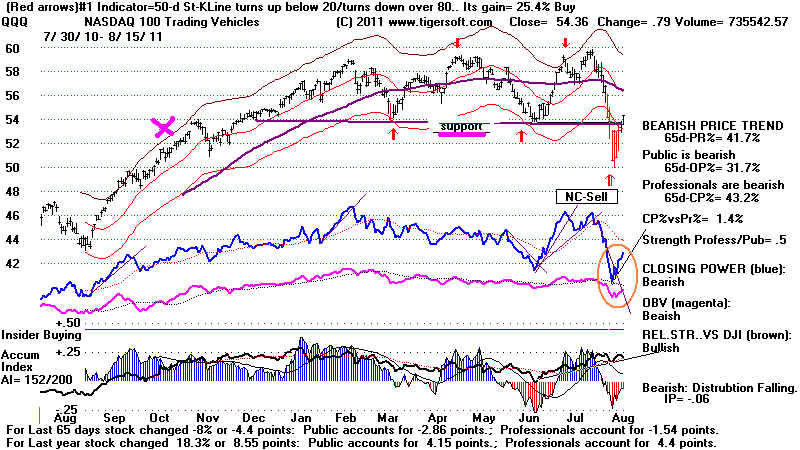

A Warning from the NASDAQ

We do want to see the NASDAQ do better.

Though it was up 47.21, and that seems

very good for the NASDAQ, the DJI rose

214, relatively more. When the Tiger's chart

of the NASDAQ is graphed, we see our

"NASDJI" relative strength indicator. it has

turned (red) negative. This is a warning

that traders again favor safety and dividends

to the unsure prospects speculative

gains. The NASDJI turning negative on a rallyh

usually means the rally has definite

limits. For now, the NASDAQ-100's (QQQ) blue

CLosing Power is still rising. So,

is its brown Relative Strength Quotient (RSQ).

3 Straight Up Days

What was most impressive was the QQQ got

back above 54, the broken support level.

It needs tomorrow to stay above 54 to

keep the good 3-day rally alive. Many short-term

traders take profits after 3 straight

up-days. Our program shows that the QQQ was up

61.9% of the times for an average 3-day

gain of 0.4% on the fourth day after three straight

up days. This is for the 21

occurrences in the last year.

( Peercomm + Charts-2011 + Daily Stocks + QQQ + Operations + Streaking Daily Probabilities

)

The same statistics for each year since 1999 show too much variability to generalize

except to say that a low percentage up on

the 4th day after 3 consecutive-day rallies,

as was seen in 2008, is a sure sign of a

bear market. A pronounced pattern (72.2%)

in which the 4th day is UP after 3

straight up-days was a key bullish attribute of the 2009

bull market.

After 3 Up Days

After 3 Down Days

QQQ

Pct of time

Avg 3-day

Pct of time

Avg 3-day

Year

4th day is Up

Gain after 3 days up 4th day is Down Gain after 4 days down

--------

-------------------

------------------------------

------------------------ ----------------------------------

1999

50.0%

+0.4%

25.0%

+1.6%

2000

62.5%

-0.9%

36.9%

+0.1%

2001

52.9%

-0.6%

33.3%

+1.0%

2002

42.9%

-0.9%

55.0%

+0.5%

2003

47.1%

+0.8%

62.5%

+1.0%

2004

38.9%

0.0%

60.0%

+0.5%

2005

43.8%

+0.3%

38.5%

+0.1

2006

41.2%

-0.2%

63.6%

-0.8%

2007

64.0%

0.0

20.0%

+1.4%

2008

33.3%

-1.9%

35.0%

-0.4%

2009

72.2%

+1.0%

22.2%

+2.1%

2010

55.0%

+0.3%

50.0%

+1.0%

2010-2011

61.9%

+0.4%

41.2%

+0.9%

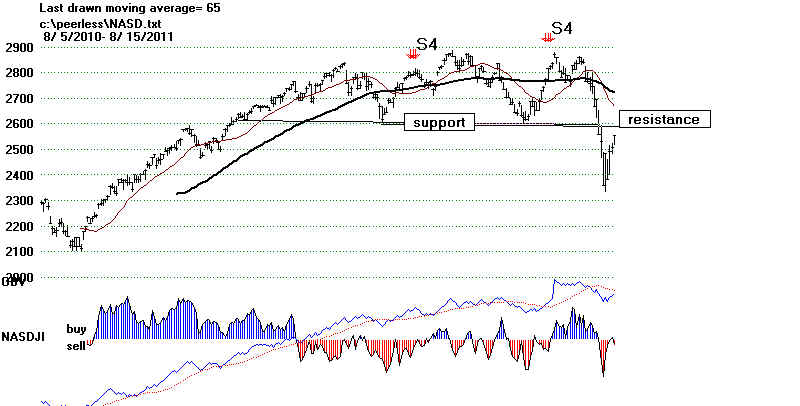

NASDAQ - The S4s are automatic. They show a negative

non-confirmation (NNC) by the

Accum. Index and NASDJI Relative Strength

Indicator on a rally 3% over the 21-dma.

The NASDAQ, unlike the QQQ, has not been

able to get past the broken support

at 2600. Watch to see if it can.

That would be very constructive. On the other hand,

a reversal back down from it, would

suggest a need to re-test the lows.

|

QQQ

|

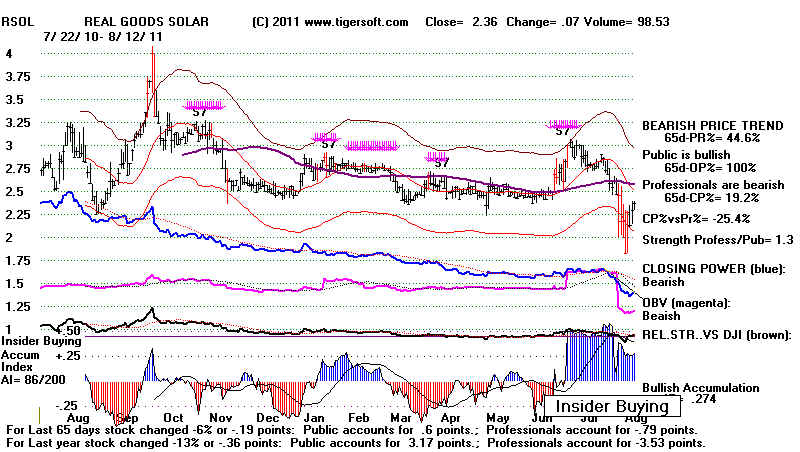

Our Solar Stock Speculation - RSOL

|

====================================================================================

OLDER HOTLINES

====================================================================================

8/12/2011

DJI = 11269 +126 la/ma= .942 21-dmaROC= -1.158 P = -408 (+124 ) IP21=

-.106 V= - 324 OP= -.144

BREADTH STATISTICS:

38 (-20) MAXCP

stocks - Bullish MAXCP Stocks

59 (-70) MINCP stocks

- Bearish MINCP Stocks

(MAXCP stocks are those showing Tiger Closing Power

making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

At this point these are extended a long ways, so - use well-tested CP trendbreaks

to close out positions. Sell S7s occur when Professionals are much more bearish

than the Public is.

2 new

highs on NASDAQ. 20 new

lows on NASDAQ

6 new

highs NYSE

19 new lows on NYSE

8/12/2011

===> See Key Peerless TigerSoft

Index Charts: Industry Groups and ETFs

DIA SPY QQQ DJIA-Peerless TigerDJI

TigerSPY TigerQQQ GLD

SLV Crude

While the QQQ Closing Power is Rising, Nimble Traders Should Be In QQQ Long.

However, another test by the DJI of its lows is likely.

Be sure to cover short sales when their Closing Power downtrends are broken.

High Accumulation High Caps are apt to be the best upside performers.

Bears, be careful here. This Summer we have still not seen a serious NYSE A/D

Line bearish divergence from the DJI. Usually such bearish A./D divergences

and our normal Sell S9s occur just before big declines of 20% or more since 1929.

New Buy B7. Again we get a

hard-to-believe buy signal right after this sharp 15%

decline in the DJI. It is based on

the idea that we should be buyers on the next decline

to the lower band after a Buy B12.

Unlike the Buy B12 and Buy B14 (which I dismissed).

the earlier Buy B7s have previously

occurred as far below the lower band as we are now

and with as much downward momentum.

Here are cases with the DJI

Date of B7 DJI

Gain Reversing

Sell Date DJI

Short Gain

---------------- ------- ------------

---------------------- ------------- ---------

-----------------

10/23/1933 88.1

+12.3%

Sell S12

12/1/1933 98.9

1.7%

la/ma ann.roc P-I

IP21 V-I Opct

.934 -1.193 -103 (56) -.12 -370

-.086

No Paper Loss

DJI rallied to resistance of neckline in overhead head and shoulders, fell back to

a second Buy B7 anf then rose past upper band.

------------------------------------------------------------------------------------------------------------

12/11/74 595.35 +42.0%

Sell S9

8/29/75

845.34

la/ma

ann.roc P-I

IP21 V-I Opct

.933 -1.75

-314 (-29) -.238

-4

-.397

DJI rose immediately and then

rallied strongly. Note how low the P-Indicator

was in this instance.

------------------------------------------------------------------------------------------------------------

8/11/11 11269

+126

la/ma ann.roc P-I

IP21 V-I Opct

.942 -1.158 -408 (+124

-.106 - 324 -.144

The QQQ

(53.57) is the leader of the 3 key general market ETFs. Its QQQ/DJI (brown)

Relative Strength Line is rising,

If it can surpass 54 on a closing basis, I would remain

short-term bullish and stay long any QQQ

trading position. But if the QQQ falters

on Monday or Tuesday and fails to get

past 54, expect the QQQ's Closing Power

uptrend to be broken. That will be a

short-term Sell.

More Tests for a Bottom Are Usually Needed

Have we seen a bottom? We might

want to look at how the DJI bottomed after the 10%-

15% mini crashes of October

1978, October 1979, March 1980, Janaury 1990, October 1997

and January 2000.

These 10%-12%declines would probably have been a more rapid

15% free-fall, If the easy-to use

leveraged short selling ETfs had been present then along

with the right to sell short on

down-ticks, as is legal now. Note that the 1978 bottom

required four tests of 790 level before a

rally, the 1979 bottom needed 3 tests of 800,

the 1980 bottom had to have 3 tests of

760 as did the March 2000 bottom of 10000. Even

the Jan-Feb 1990 10% decline needed a

second test of 2550 a month after the initial

plunge, before the DJI could resume its

advance.

October 1997's bottom did see a

rapid spring-back upwards all the way to the declining 21-day

ma. The Accumulation Index hardly

went negative in the 1997 decline, unlike now. There

were multiple Peerless buy signals and

the Closing Power for the 1997-SPY reversed itself

dramatically. This time around the SPY's CLosing Power is rising, but not nearly so

quickly as in October 1997.

I have warned that most often after such

a steep sell-off, notably 1940, 1950, 1990 and 1998,

the DJI

retests the first set of lows and even breaks below them. So, until the QQQ gets

back above 54, more new lows is a scary

scenario we cannot afford to dismiss

even with the new Peerless Buys.

The jury is still out. Except for nimble traders,

I have suggested mostly waiting on the

sideline is the prudent thing to do. A close by the

QQQ above 54 would help remove the

bearish scenario of 1940, 1950, 1990 and 1998.

A retest of the lows would still seem

likely though before a rally back above the 65-day

ma is likely.

But for now, rallies are under way to the

points of breakdown for the DIA and SPY.

The QQQ has already reached the

resistance created by the June low at 54. A further

move up by the QQQ past this resistance

will be bullish, but a turn down on Monday

by it, will bring new selling by

chartists. Mondays this past year have been the most

bearish day of the week. Since

1965, the DJI has risen only 46.7% of the time in the

week after August 13th (next Sunday), but

over the next two weeks it has risen 55.6%

of the time. (Peercomm + Charts-2011 + Runs/Setups + DJI Future

based on past Seasonality + 8 + 13 ).

I would say that the seasonality and the

charts favor a pullback and quite possiblu a

a new low. If the lows hold,

a the suprise move might be to the upside.

QQQ

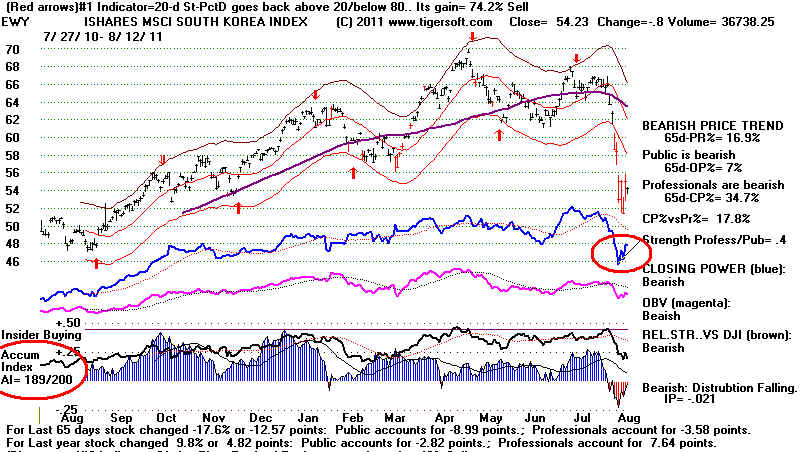

7/28/2010 - 8/12/2011

Avg. Daily Trading Results

(Peercomm + Charts-2011 + Daily Stocks + QQQ + Ind-3 + Day of Week Trading.Results).

Pct Up Avg Gain

Monday 48.9% -0.2%

Tuesday 51.8% +0.1%

Wednes. 61.1% +0.0%

Thurs. 61.1% -0.1%

Friday 49.0%

-0.1%

PROFESSIONALS HAVE COVERED AND ARE BUYING VERY SELECTIVELY

The Closing Powers are still rising

for the DIA, QQQ and SPY. I believe this shows

Professionals have shifted to

covering and some buying. The quick decline in the

number of MINCP stocks (those with

Closing Power at new lows) from over 1000 at the

beginning of the week to only 59

shows that they have locked in profits on their

short sales, as we have mostly.

But since the number of MAXCP stocks (showing

Closing Power new highs) is still

under 60, I would say that Professionals are

very careful in what they are

buying, if anything. And it's not hard to understand why.

Many stocks are down sharply from

their levels 6 months ago. 4 of first 9 days this

August have seen the DJI down more

than 275 points. There are too many air pockets

to invest prudently.

8/2/2011 DJI -276

8/4/2011 DJI -513

8/8/2011 DJI -634

8/10/2011 DJI -520

WHAT STOCKS SHOULD BE CONSIDERED FOR PURCHASE?

Safer blue-chip DJI and

SP-500 stocks with highest AI/200 have done the best since

the reversal upwards, over

the last 5 days. As a group, the top ones do much better than

the lowest. Some of the

lowest AI/200 stocks have bounced back, but most have

rebounded quite weakly.