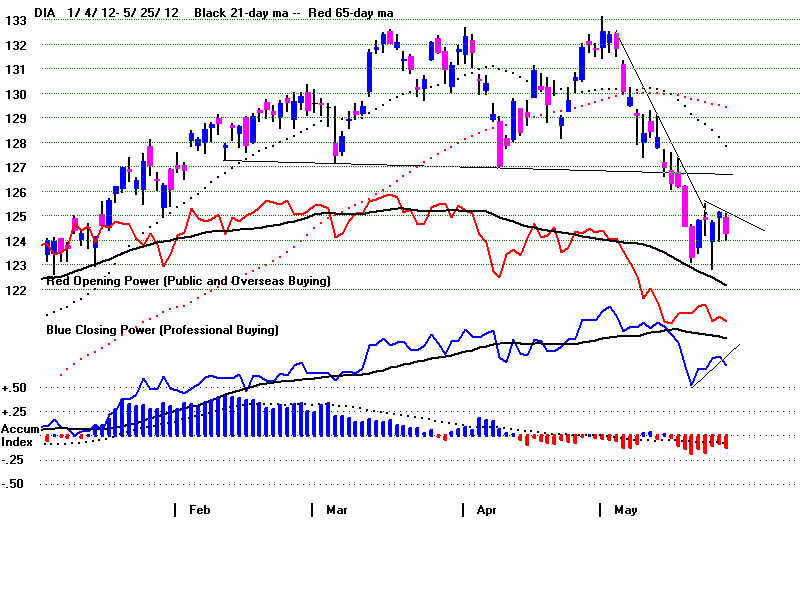

DJIA - PEERLESS - 5/29/2012

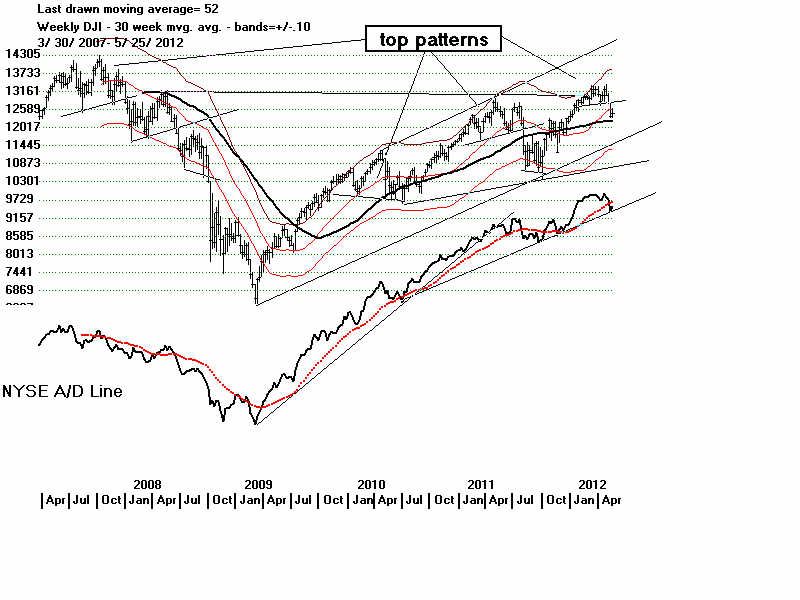

Daily and Five Year Chart

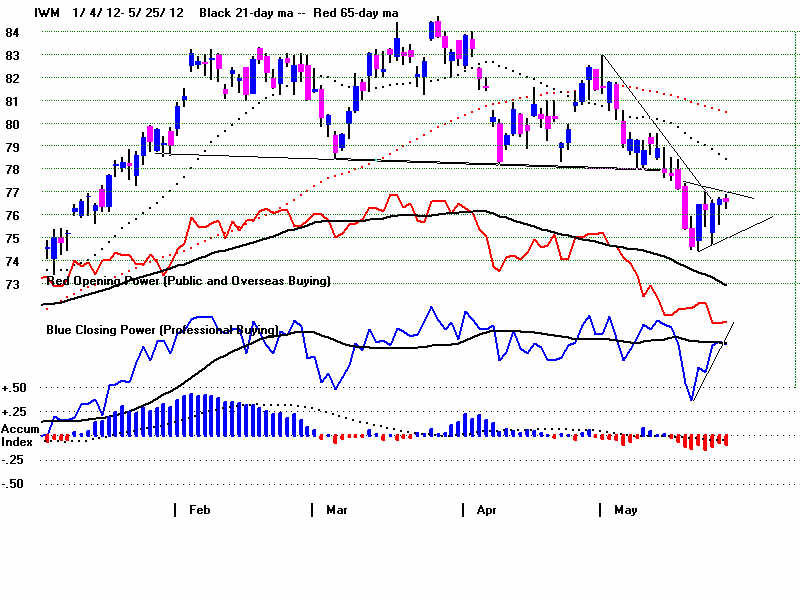

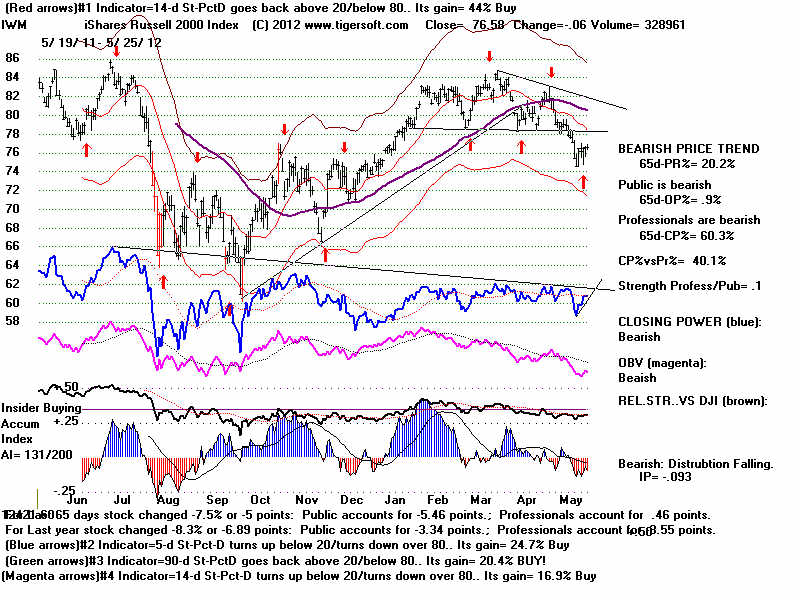

IWM - Candle Stick Chart

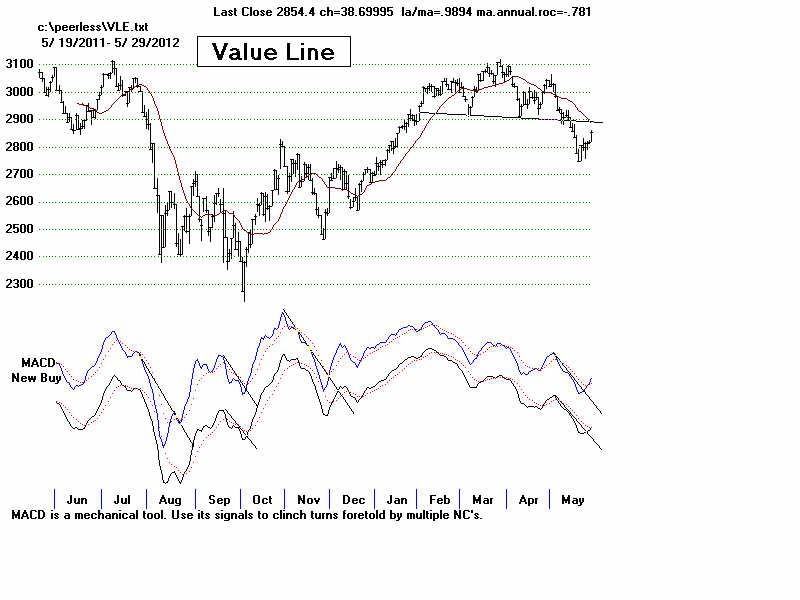

VALUE LINE

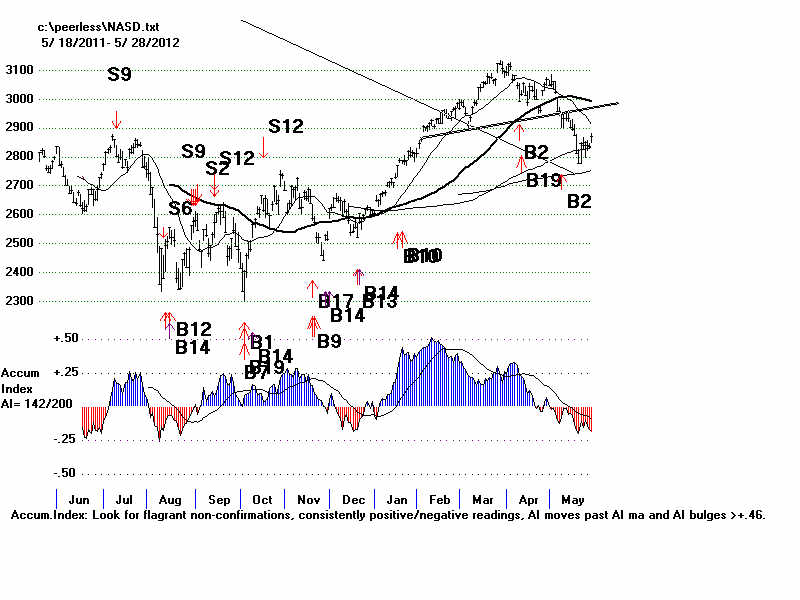

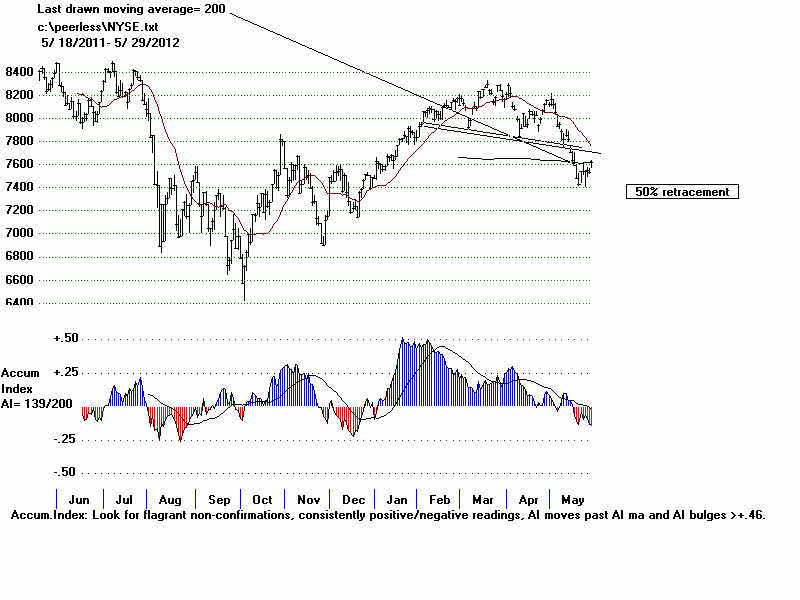

NYSE

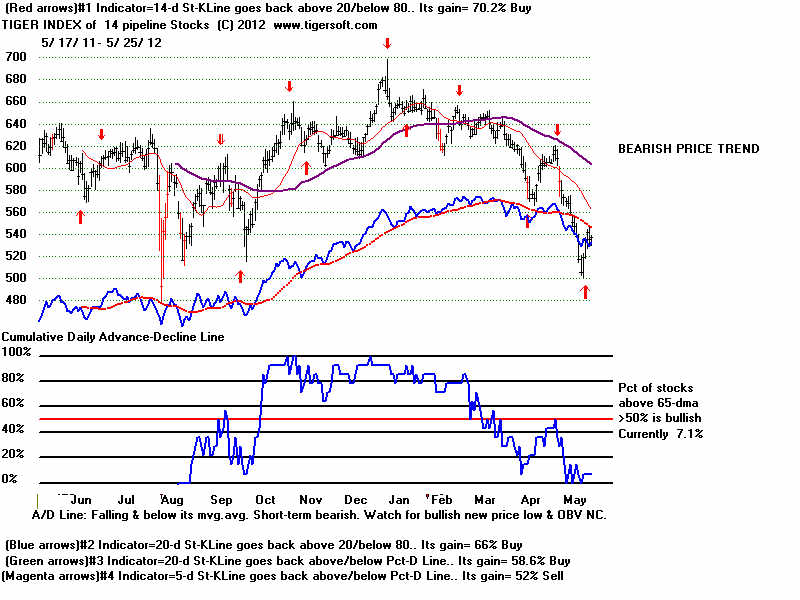

======= 5/25/2012 =======

2 groups show >50% over 65-dma

28 groups show <50% over 65dma

H/S - Head/shoulders = 15

Pct of Stocks over 65-dma - 4-day change

5/25/2012 5/23/2012 5/16/2012 4/27/2012 4/13/2012 4/4/2012 3/`28/2012

-----------------------------------------------------------------------------------------------------------------------------------------------------

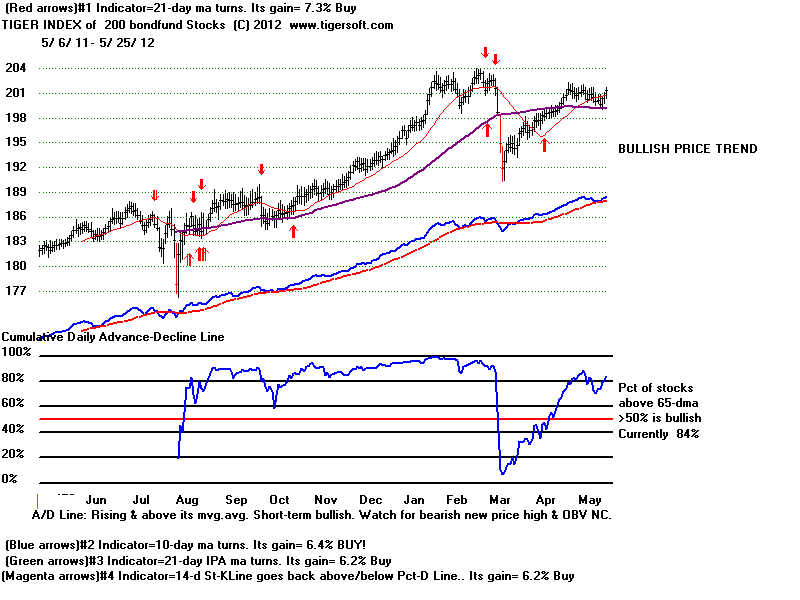

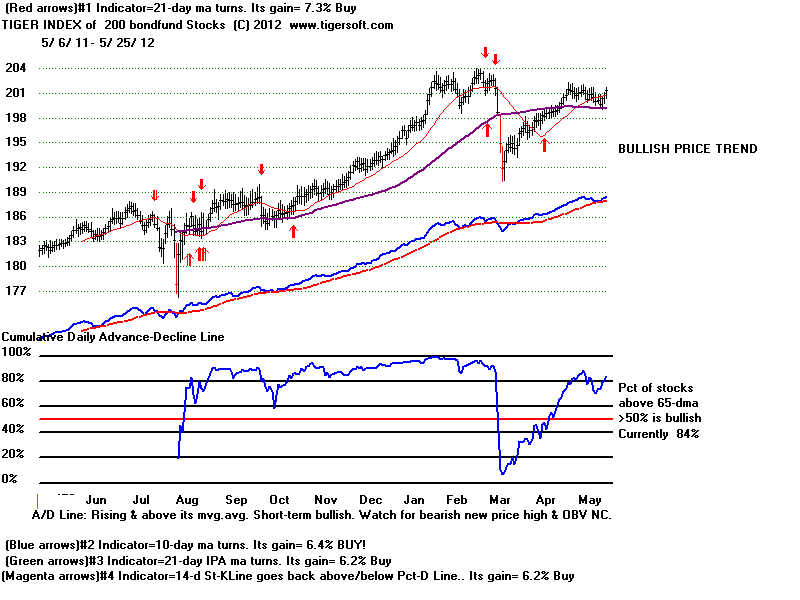

Bond Funds 84% +5% 79% +8% 83% 67% +7% 46% +6% 30% -5% 33% +18%

================================================================================

Home Bldg 48% 48% +10% 52% -4% 64% 48% +12%

BestREITs 47% -20% 67% +60% 93% -7% 100% 80% -7% 100% 93%

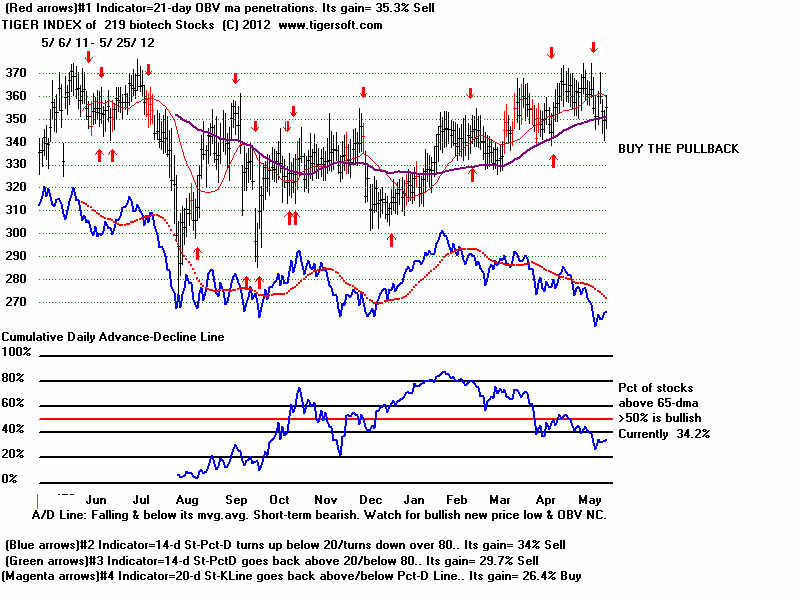

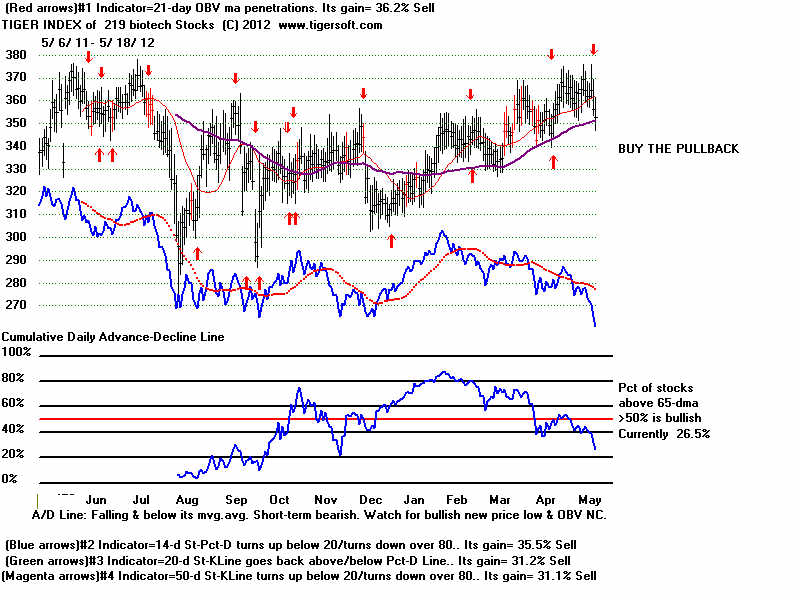

Biotech 17 H/S 47% +6% 41% 41% -6% 53% 29% -6% 71% -11% 77% -5%

Utility Stocks 39% +5% 34% +8% 39% -22% 62% +2% 35% -4% 56% -8% 52% -6%

LowPrHighAI 35% -3% 38% +4%

Biotech All 34% +2% 32% +5% 40% -6% 53% +2% 37% -6% 63% -9% 71% -3%

Super 2011 31% 31% +7% 47% -4% 71% +4% 53% +4% 67% 73% -6%

Chem 30% +4% 26% +9% 35% -16% 56% 47% +2% 64% -7% 72% -4%

Software H/S 27% -3% 30% +8% 34% -17%

HighPrice Stks 26% -1% 27% +10% 30% -19% 70% 64% -3% 80% -11% 91% +5%

Retails H/S 25% 25%+12% 21% 58% +4% 58% -9% 75% -8% 83% -5%

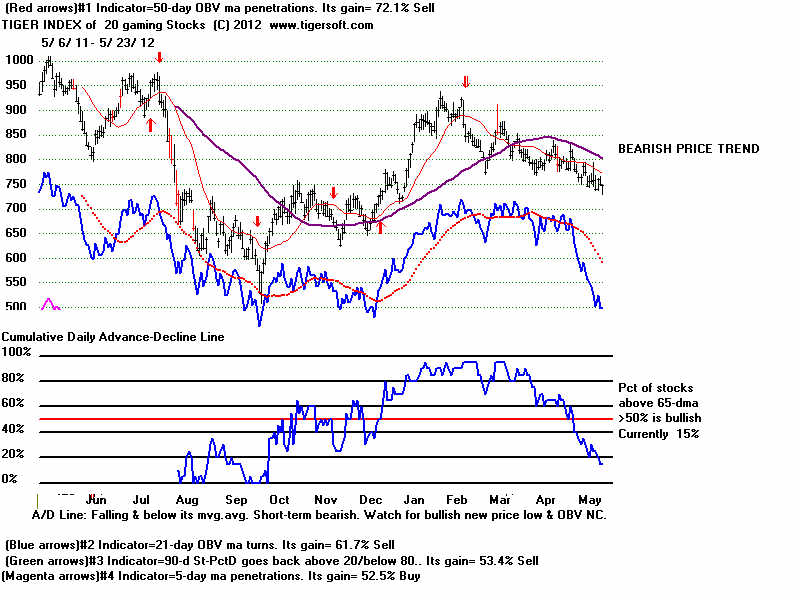

Gaming 25% +10% 15% -10% 20% -15% 65% 70% -+5% 85% -5% 85% +5%

SP-500 Stks H/S 24% +11% 15% -13% 28% -3% 59% +1% 44% -3% 79% +4% 75% -6%

DJI-30 Stks H/S 23% 23% -4% 27% -20% 63% -4% 33% -7% 69% -18% 70% -20%

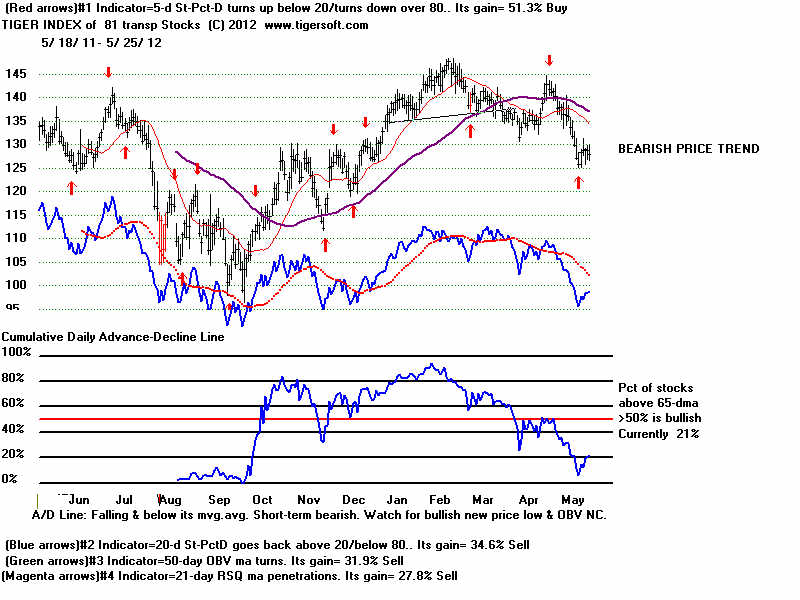

Transport Stks 21% +1% 20% +14% 21% -15% 51% +4% 42% +7% 56% -5% H/S 62% -2%

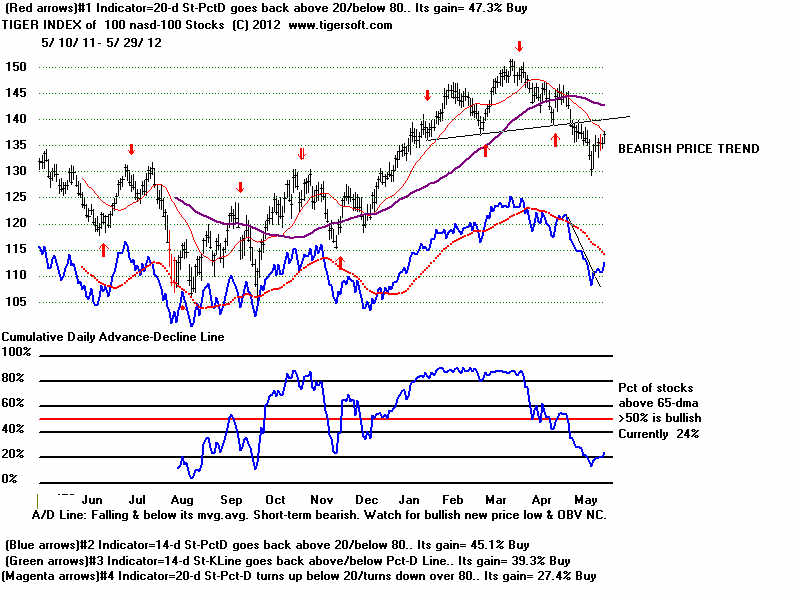

Nasdaq-100 H/S 20% 20% +7% 22% -9% 55% +4% 53% -4% 74% -8%

Low Priced H/S 17% +4% 13% +2% 20% -15% 36% 37% -5% 51% -10% 59% -8%

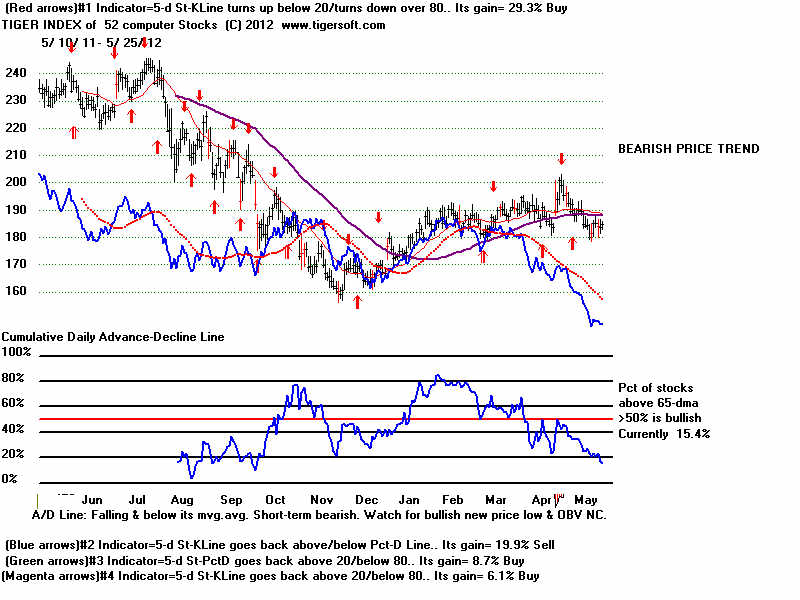

Computer Eq 15% -8% 23% +2% 25% -10% 46% 33% 48% -19% 56% +2%

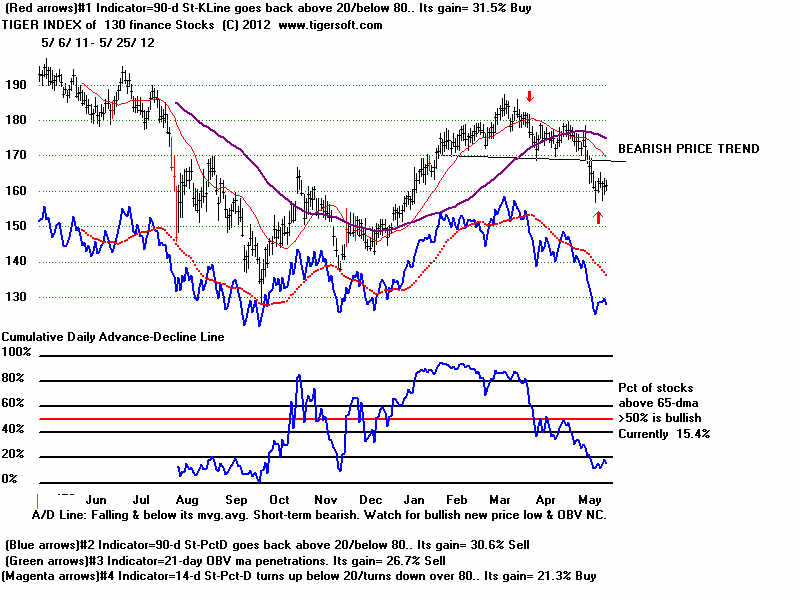

Finance Stks H/S 15% -1% 16% +3% 22% -14% 50% +8% 41% -5% 63% -20% 82% -6%

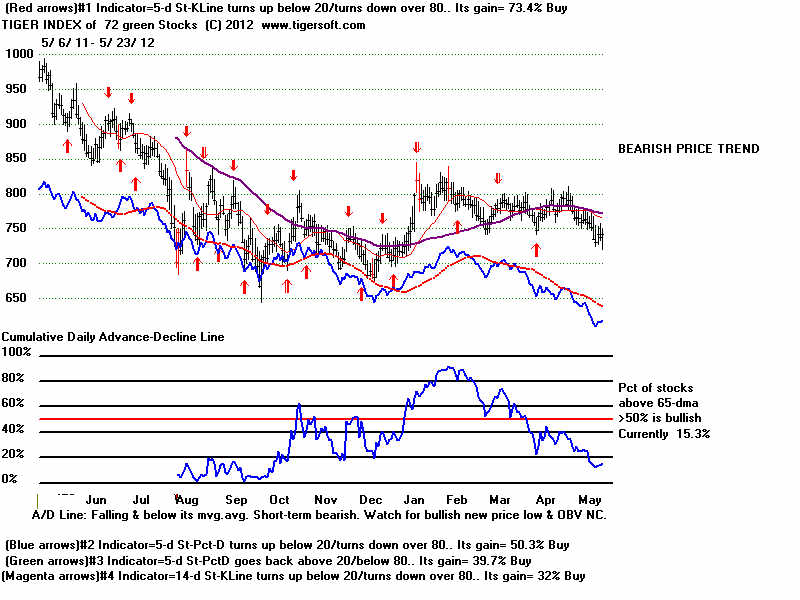

Green Stks 14% -1% 15% +2% 17% -8% 40% +1% 33% +4% 39% -12% 54% -7%

Ind. Materials 12% -2% 14% +5% 16% -9% 44% +2% 30% +2% 40% -12% 45% -14%

Chinese Stocks 10% -1% 11% 16% -6% 35% +2% 40% +2% 47% -2% H/S 52% -7%

Oil stocks H/S 10% 10% +3% 10% -7% 30% +2% 18% +4% 30% -10% 37% -15%

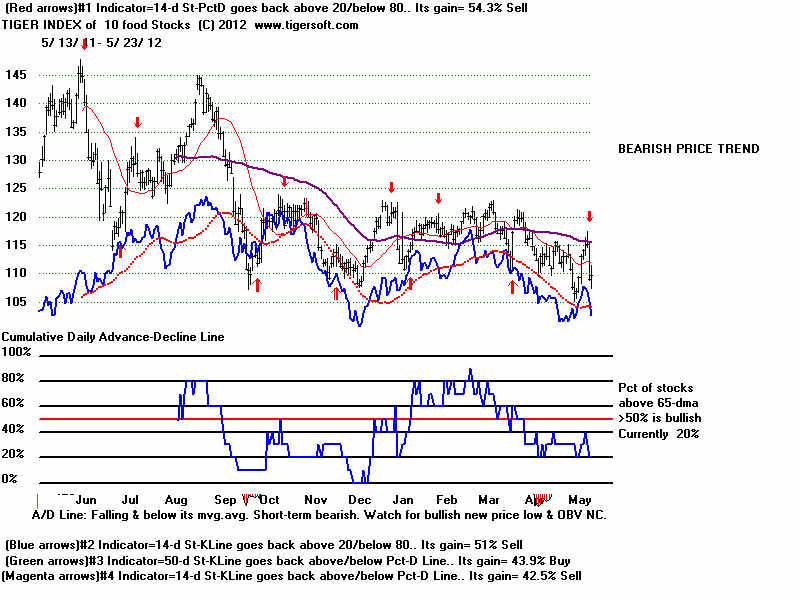

Food Commodi 10% -10% 20% -20% 20%-10% 40% +10% 30% 50% 50% -10%

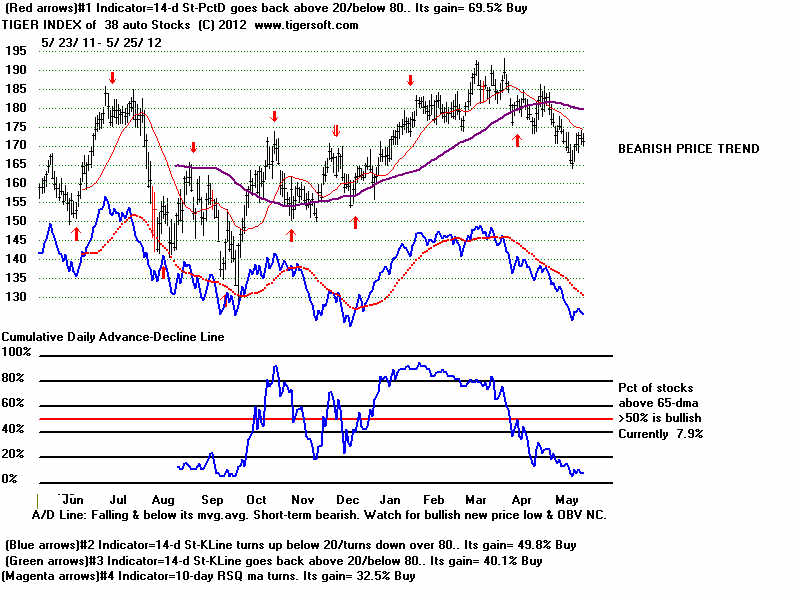

Auto Stocks H/S 8% -3% 11% +6% 16%-10% 29% -3% 37% -5% 76% +10% 66% -18%

Gold/Silver Stks H/S 9% +4% 5% +2% 5% -9% 14% +1% 11% +3 7% -14% 9% -24%

Pipelines H/S 7% +7% 0% -7% 7% -14% 43% +7% 14% 29% -7% H/S 29% -21%

Military H/S 4% 4% 11% -30% 48% 26% 52% -15% 59% -23%

Foreign ETFs H/S 0% 0% -37% 3% -2% 42% +5% 26% 52% -38% 81% -13%

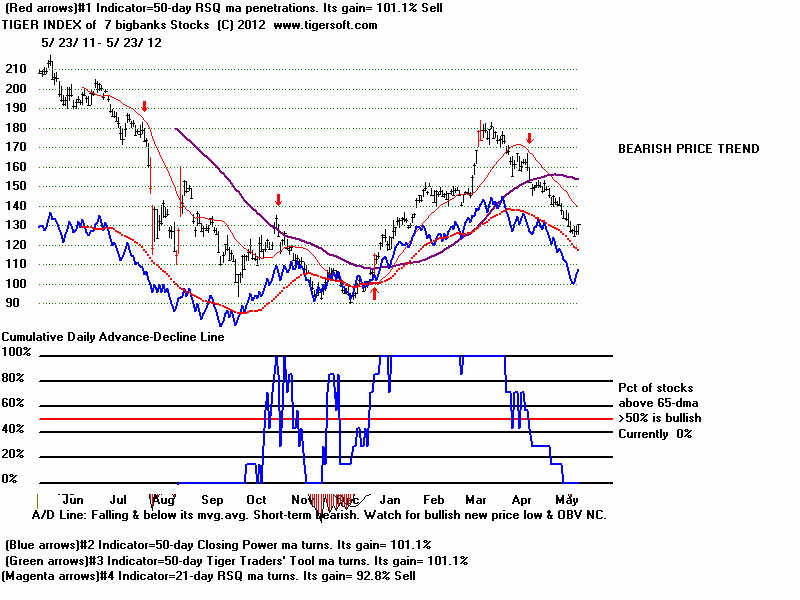

7 Big Banks H/S 0% 0%

DOW STOCKS

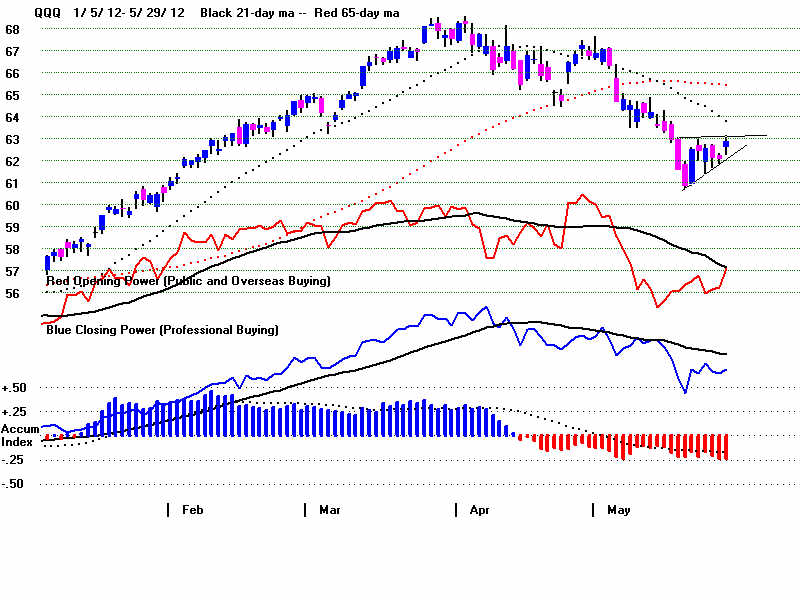

NASD-100 STOCKS

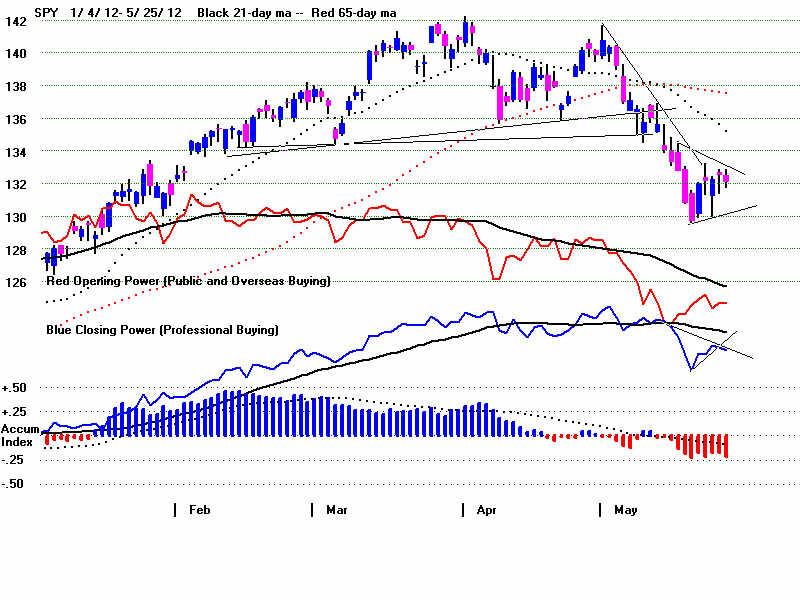

SP500 STOCKS

INTEREST RATES

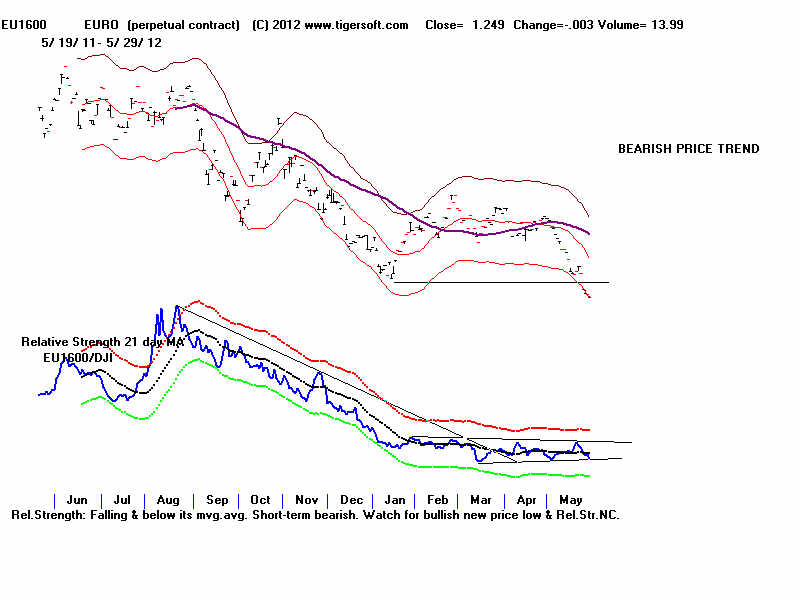

EURO |

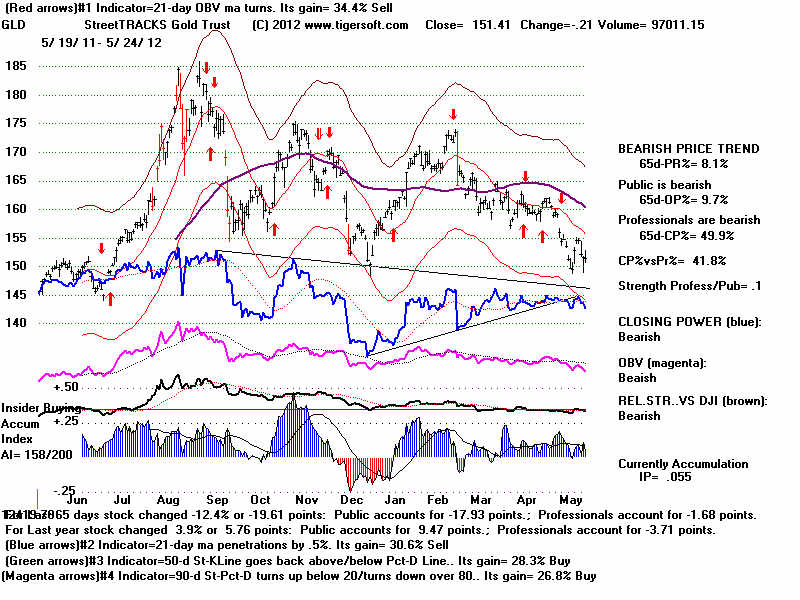

GOLD

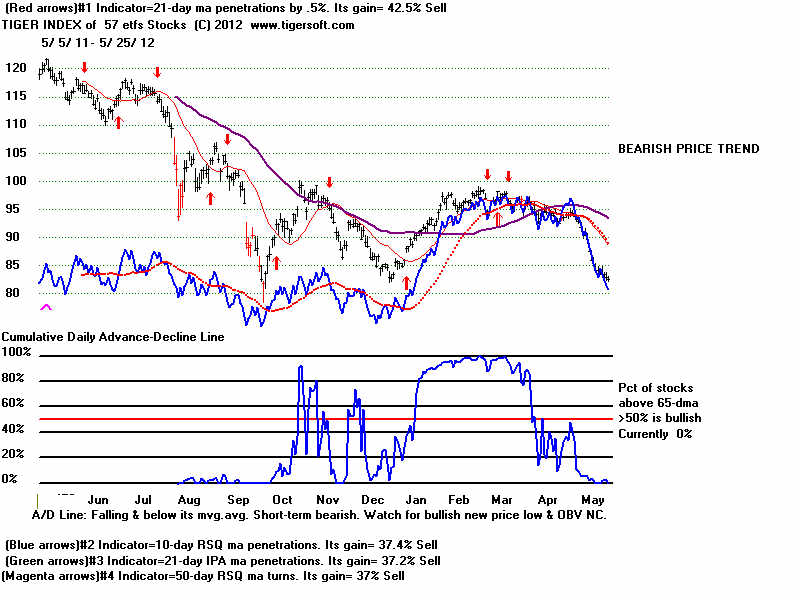

ETF

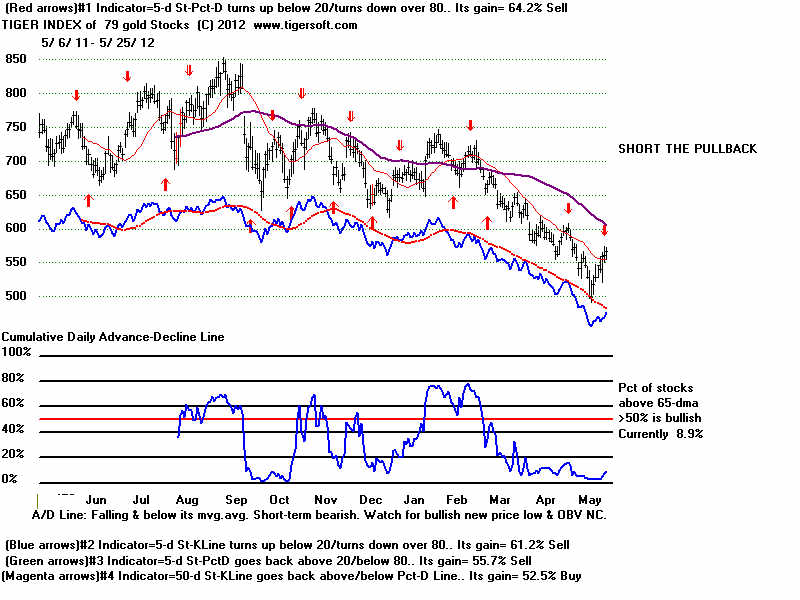

GOLD STOCKS,

SILVER

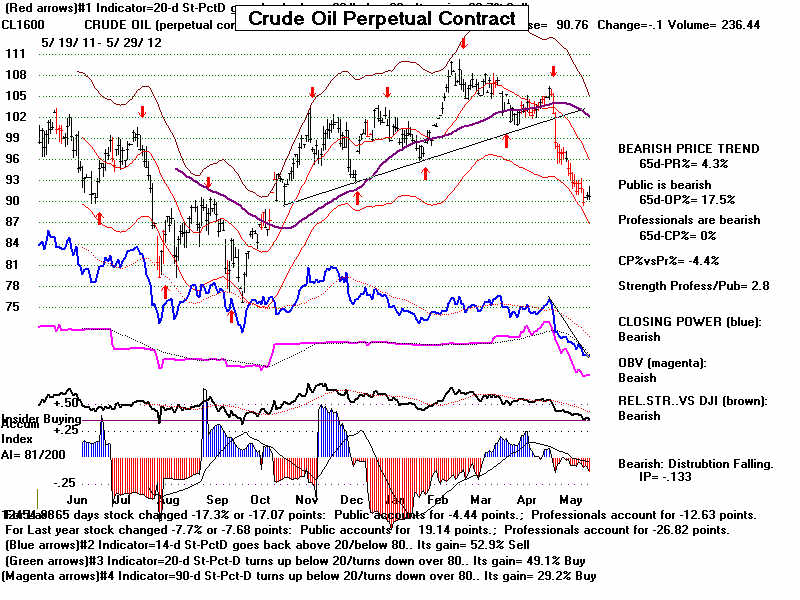

Natural Gas - GAZ

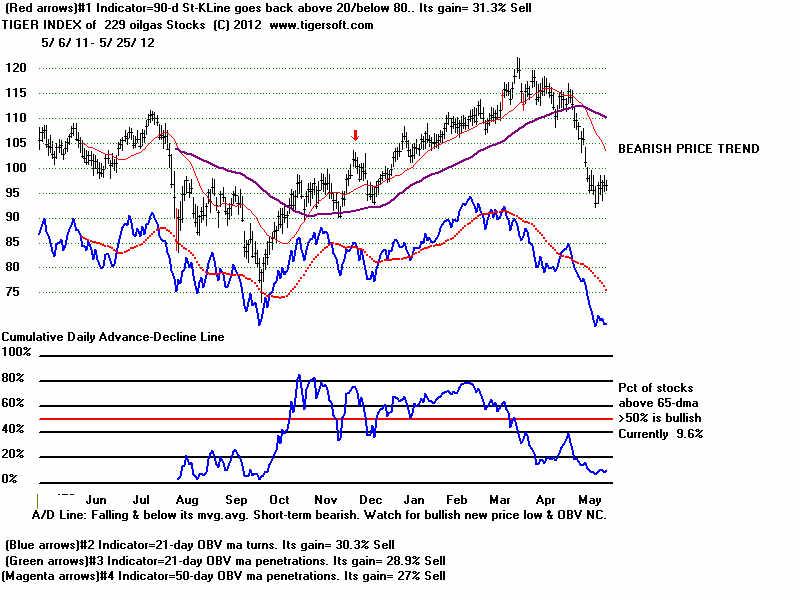

Index of Oil Stocks

BONDS |