5/8/2012

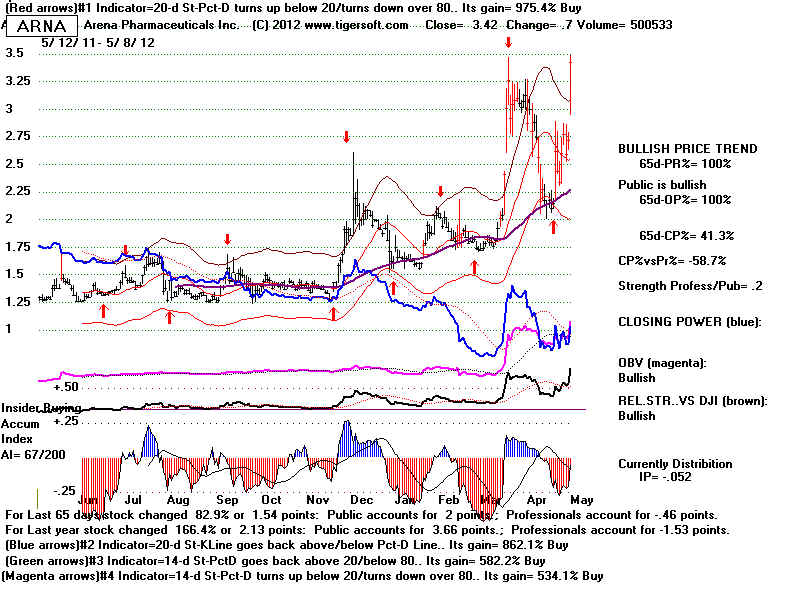

ARNA shows:

Consolidations at rising 65-dma must be considered Bullish re-Accumulation,

especially if high red colume is present. This was a stock with a very high short position.

| 14 | Arena Pharmaceuticals, Inc. | ARNA | Apr= 42,370,193 | March= 37,438,476 | change 4,931,717 |

Source: http://online.wsj.com/mdc/public/page/2_3062-nasdaqshort-highlites.html

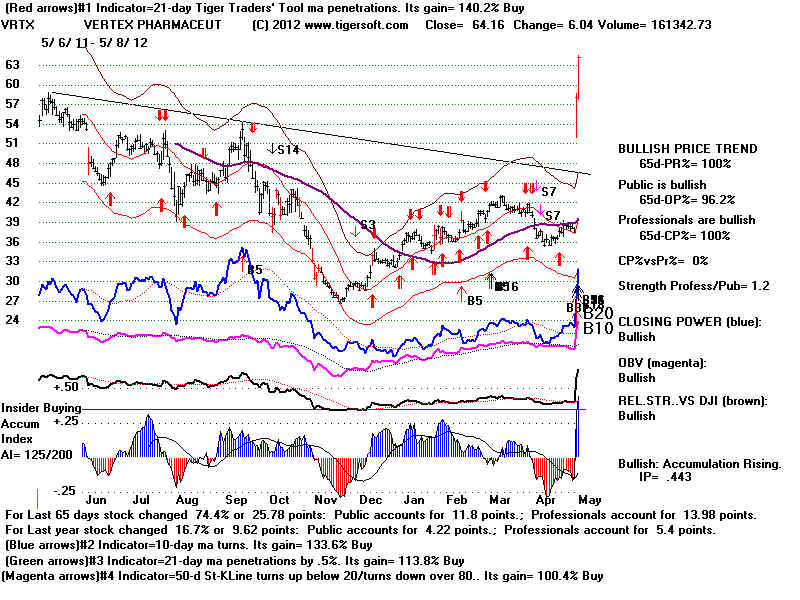

VRTX shows:

News can be unexpected enough to cause a rush to cover

short sales

when stock gets back above 65-dma and Closing Power

makes a breakout.

http://shortsqueeze.com/shortinterest/stock/VRTX.htm

Short Ratio breakdown for Vertex

Short Ratio is typically used by traders and speculators to identify trends in current market sentiment for a particular equity instrument. In its simple terms this ratio shows how many days it will take all current short sellers to cover their positions if the price of a stock begins to rise.

Vertex |

|

= | 4.20 times |

The higher the Short Ratio,

the longer it would take to buy back the borrowed shares. In theory, the more short

positions are currently outstanding, the faster it will be to cover shorted positions.

Vertex Short Ratio Assessment

http://www.macroaxis.com/invest/ratio/VRTX--Short_Ratio

Based on latest financial disclosure Vertex Pharmaceuticals Incorporated has Short Ratio of 4.2 times. This is 25.37% higher than that of Healthcare sector, and 28.44% higher than that of Biotechnology industry, The Short Ratio for all stocks is 89.19% lower than the firm.