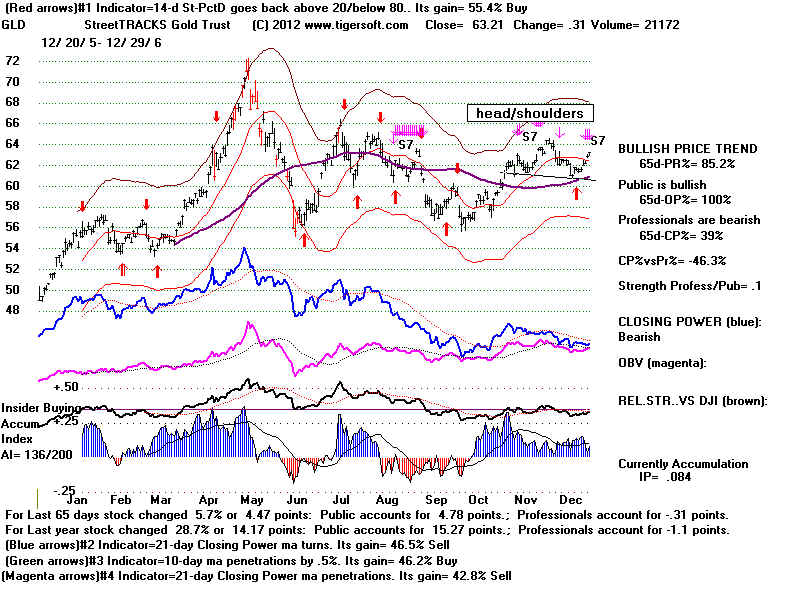

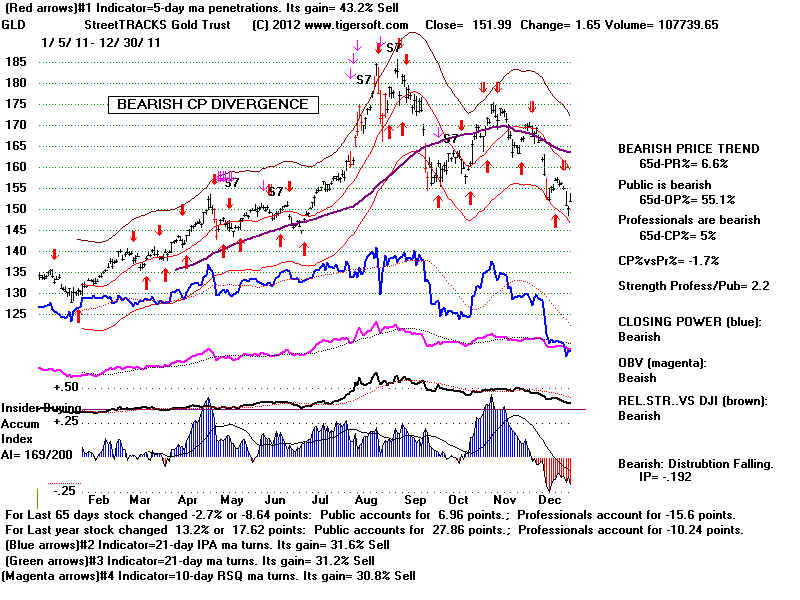

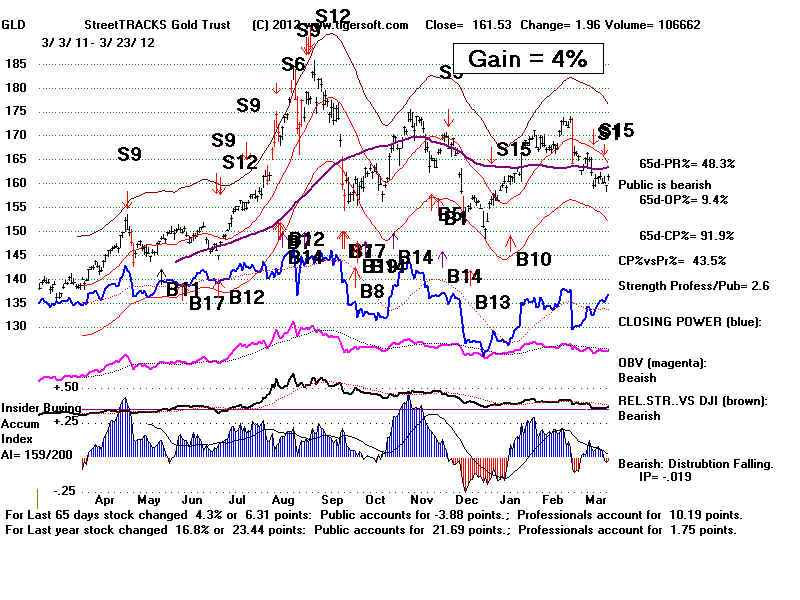

Since Peerless Buys and Sells do not work well with GLD,

what is best Stochastic system to use with Gold (GLD)?

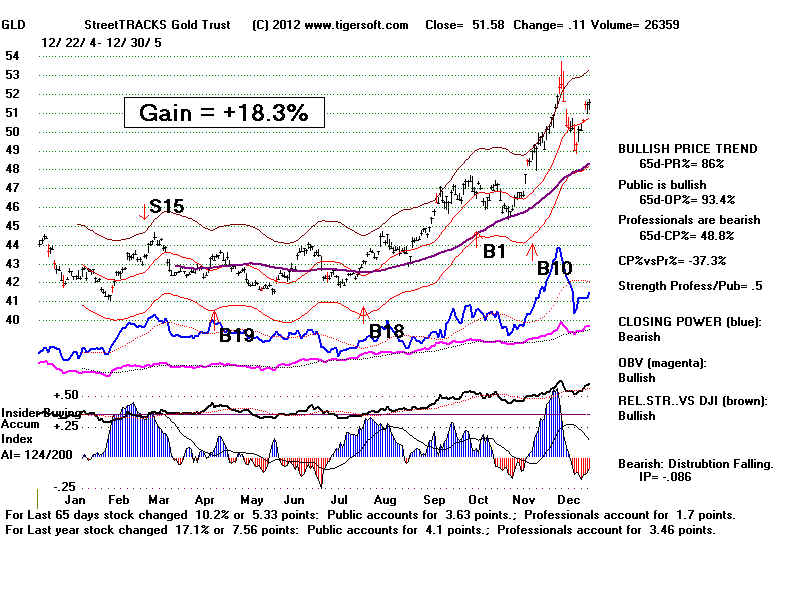

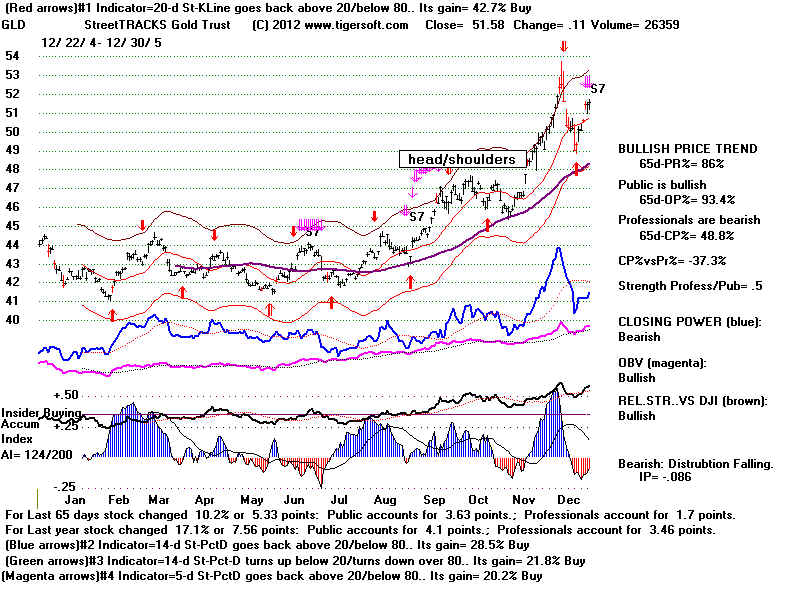

>14-day Stochastic-Pct-D crossing 20 and 80 works best but

also use breakouts above flat resistance to Buy and then Sell on simple price uptrend-breaks also.

Best 14 day stochastic Pct-D-Line crossing 20 and 80

2005 Gain = +29.7%

2006 Gain = +55.4%

2007 Gain = +23.7%

2008 Gain = -12.5% bear market

2009 Gain = +3.6%

2010 Gain = -11.6%

2011 Gain = -12.6% improved + 21.3%

2011-2012 Gain = -19.2% improved + 33.3%

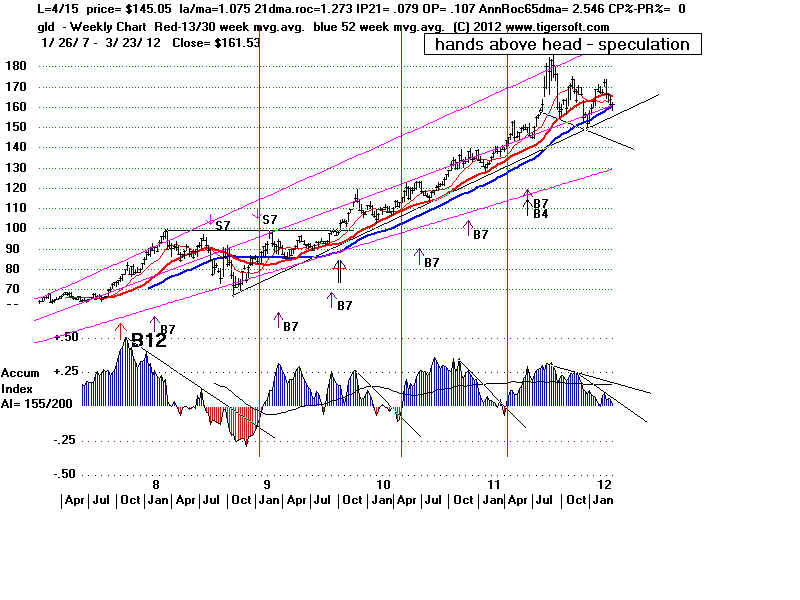

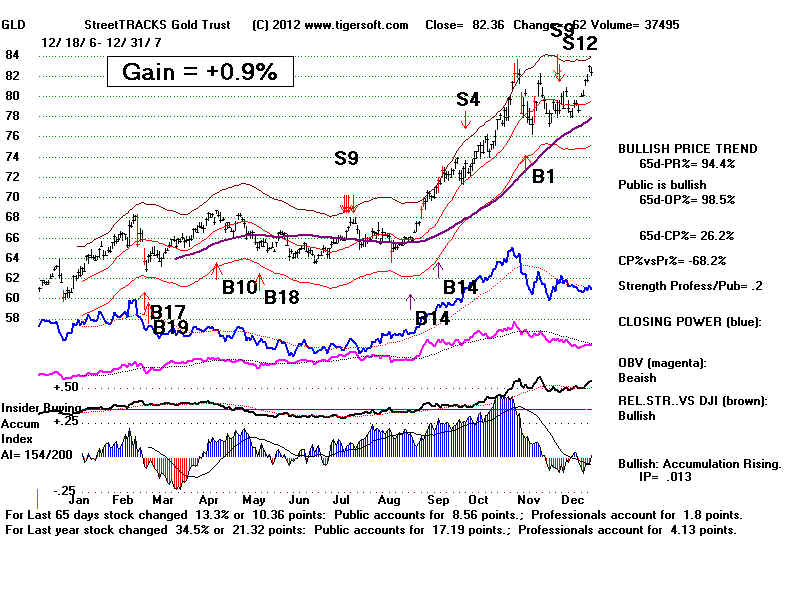

GLD

WEEKLY CHART

B7s

August 2007 take-off

May-June, 2008 rally to

upper band.

5 day stochastic Pct-D-Line

crossing 20 and 80

2005

Gain = +24.6%

2006 Gain = -15.7%

2007 Gain = -12.5%

2008 Gain = -5.1%

2009

Gain = -9.2%

2010

Gain = -19.0%

2011 Gain = +19.8%

14

day stochastic K-Line crossing 20 and 80

2005

Gain = +12.1%

2006

Gain = +3.3%

2007 Gain = -14.1%

2008

Gain = +34.5%

2009 Gain = +16.8%

2010

Gain = -6.8%

2011

Gain = -12.6%

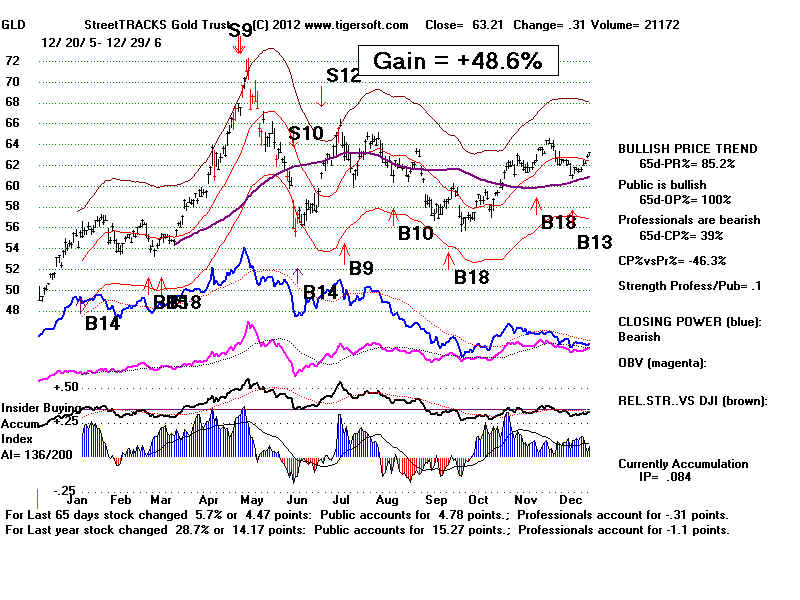

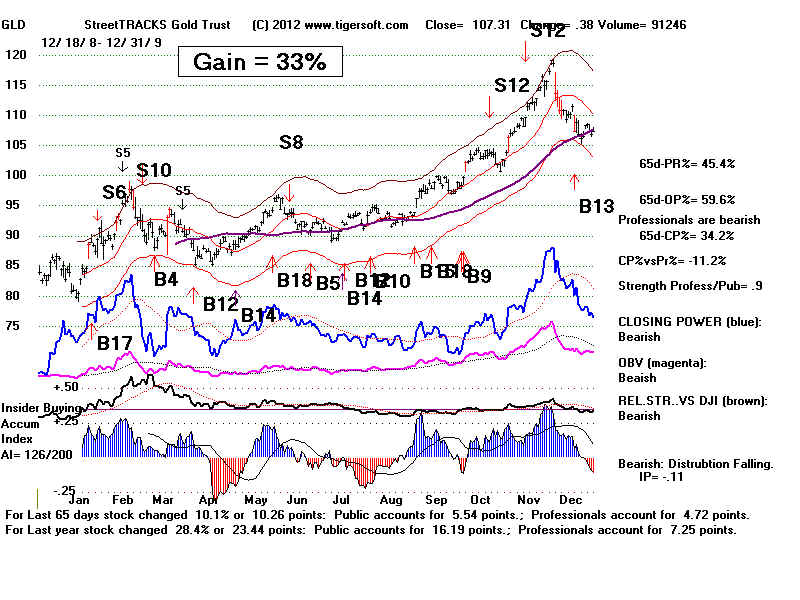

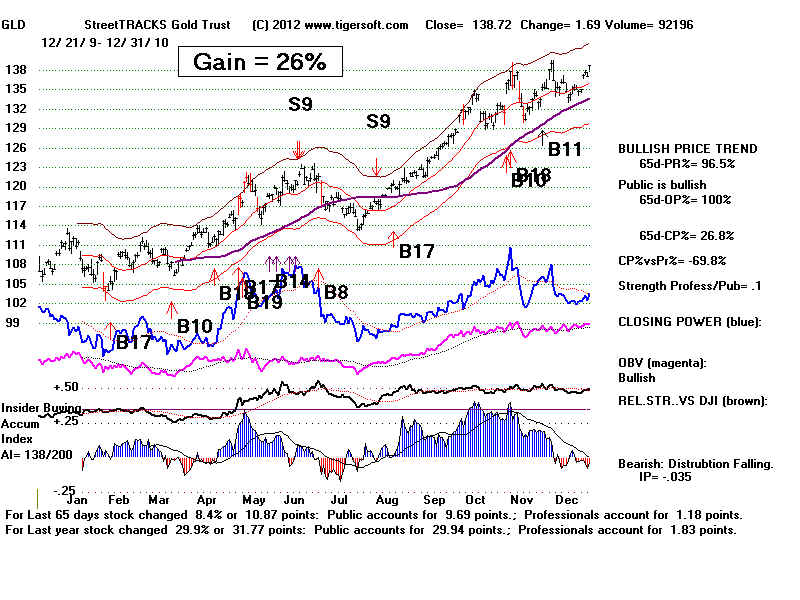

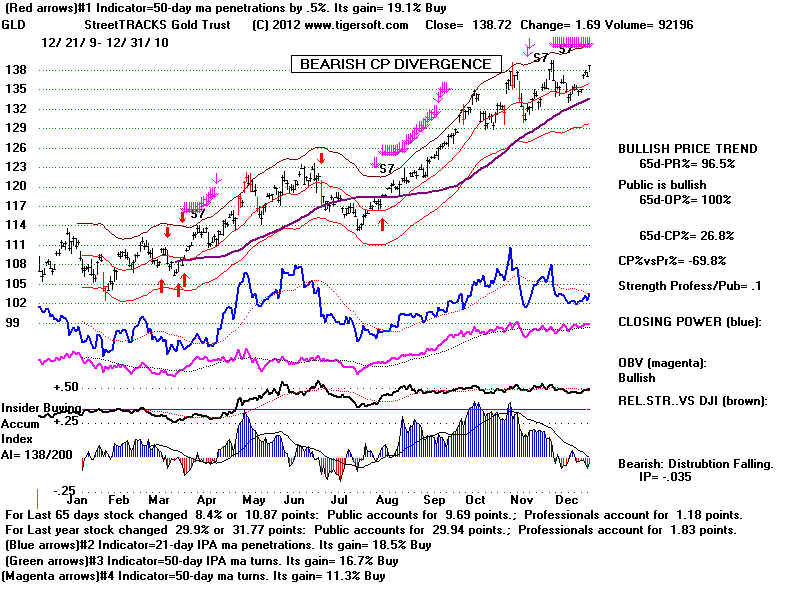

Best 14 day stochastic Pct-D-Line crossing 20 and 80

2005

Gain = +24.4%

2006

Gain = +55.4%

2007

Gain = +23.7%

2008 Gain = -12.5% bear market

2009 Gain = +3.6%

2010

Gain = -11.6%

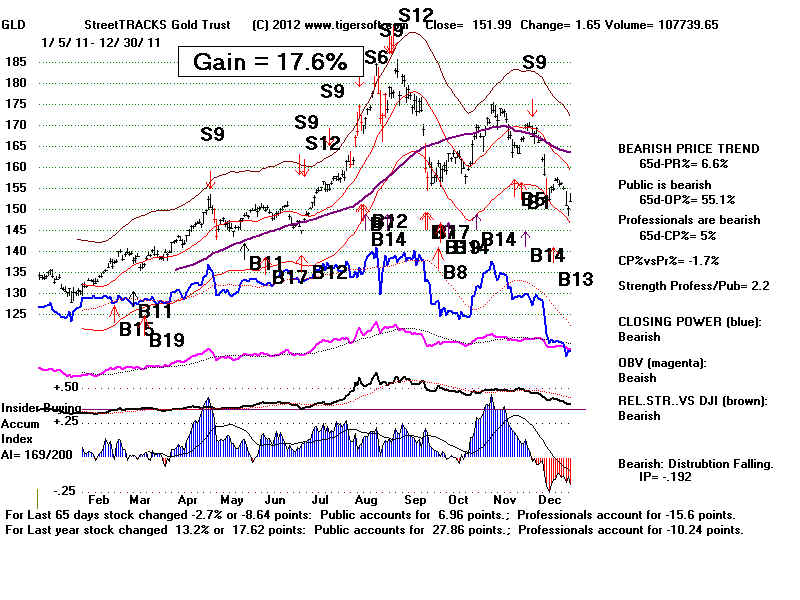

2011

Gain = -12.6%

improved + 21.3%

2011-2012 Gain = -19.2%

improved + 33.3%

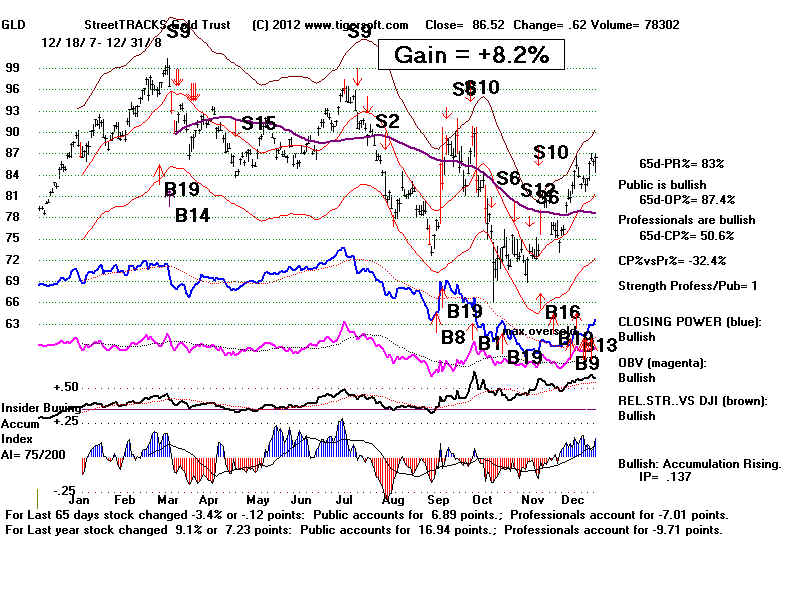

20 day stochastic Pct-D crossing 20 and 80

2005

Gain = +15.7%

2006

Gain = +33.1%

2007 Gain = -22.8%

2008

Gain = +12.7%

2009 Gain = -29.2%

2010 Gain = -18.2%

2011

Gain = +3.1%

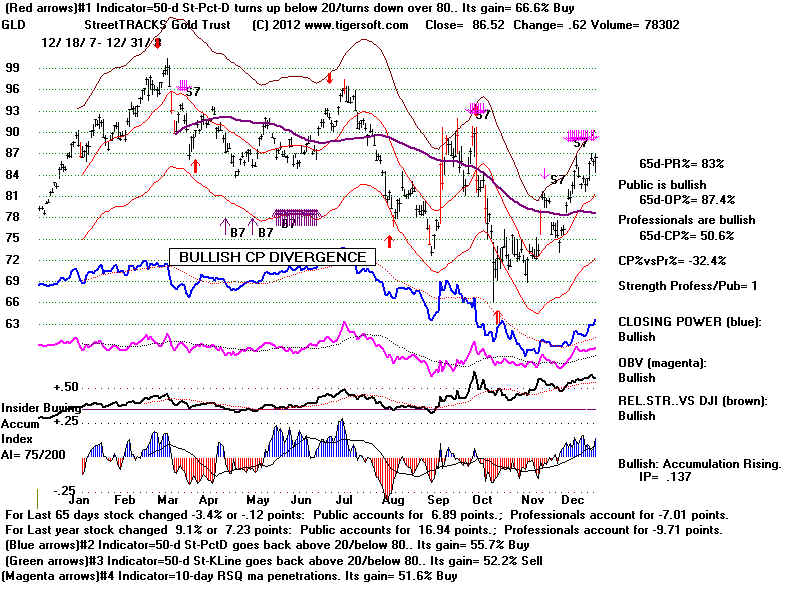

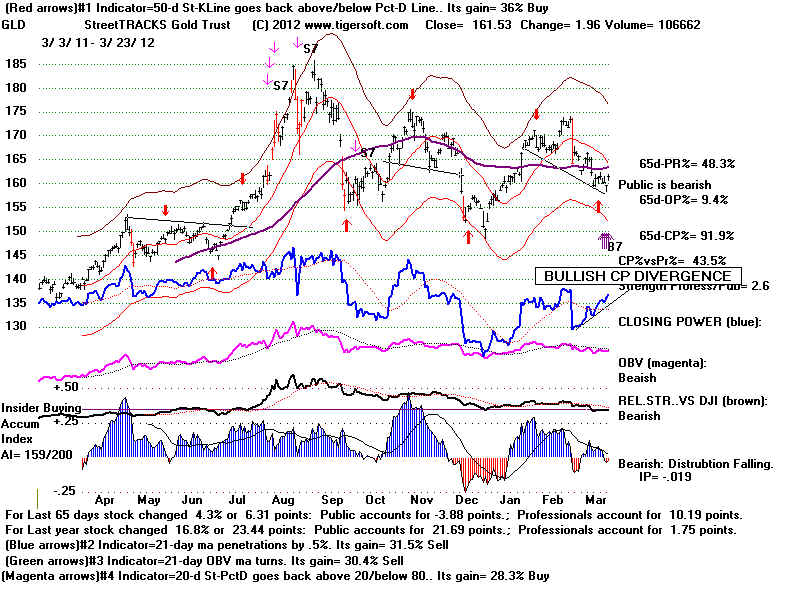

50

day stochastic Pct-D-Line crossing 20 and 80

2005

Gain = +12.8%

2006

Gain = -1.6%

2007 Gain = -29.0%

2008

Gain = +52.2%

2009 Gain = -8.9%

2010 Gain = -2.2%

2011 Gain = -21.5%