OF ANY ILLEGAL INSIDER TRADING?

Be A Whistle-Blower and Get Paid.

-----------------------------------------------------------------------------------------------------------------------------

Visit out www.tigersoft.com and our Killer Short Sales in Any Market.

-----------------------------------------------------------------------------------------------------------------------------

Under little-noticed new provisions of the

Under little-noticed new provisions of the new Dodd-Frank Wall Street reform law, whistle-blowers like Harry Markopolos who

tried for years to get the SEC to investigate Bernard Madoff's Ponzi scheme, will for

the first time be entitled to collect between 10% and 30% of the money recovered by the

government in insider trading cases. The uselessness of the SEC in the Madoff case

is bound to make one wonder if this whistle-blowing law will amount to anything.

The new law will allow whistle-blowers who bring "original information" to the

Securities and Exchange Commission or the Commodity Futures Trading Commission

to remain anonymous— even to the government. Working with an attorney as an intermediary,

insiders with information about fraud can bring allegations to the government without fear

that the government will somehow reveal their identity.

Between 1989 and 2009, the SEC paid out only $159,537 to public whistle blowers for

providing key information about illegal insider trading! Last year, the SEC announced

its first million dollar award for a whistleblower's report of insider trading information.

It involved a hedge fund adviser Pequot Capital Management, Inc., its chief executive,

Arthur J. Samberg, and David E. Zilkha, a Microsoft employee. This could be the

start of something new, where the SEC actually encourages public whistle blowing.

Because we see so much insider trading, because Wall Street money plays such a big

role in financing both parties' political campaigns and because the SEC's is not staffed

to do much real investigating, it's hard to believe the SEC will turn a new leaf.

If you know of illegal insider trading, contact us, our software can help you

document it.

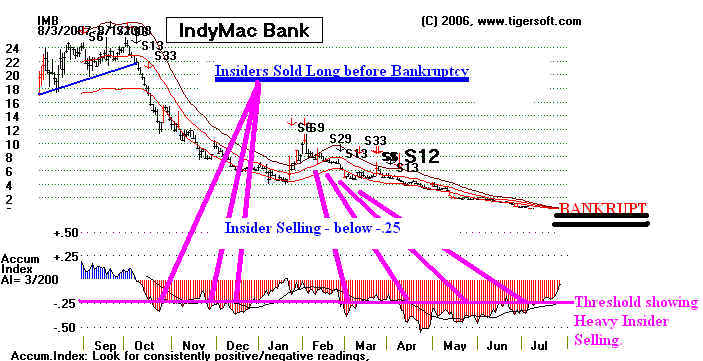

Insiders knew BANKRUPTCY was coming to INDY-MAC!

We take a drop by the Tiger Accumulation Index below -.25 when

the stock is much weaker than the general market to mean "insider

selling" in the broadest sense. Word of egregious corporate malfeasance,

fraud and insider trading has gotten out to numerous hedge funds, institutions,

stock brokers and their customers. All are selling into and snuffing

out any rally.

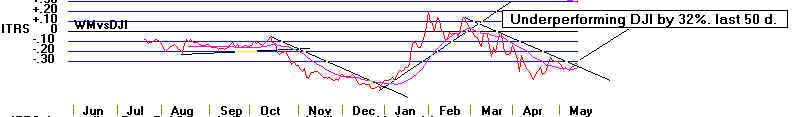

WASHINGTON MUTUAL: 2007-2008 Go To ZERO!

TigerSoft warned WM would go bankrupt in 2007 after seeing

how extensive the insider selling was by its CEO.

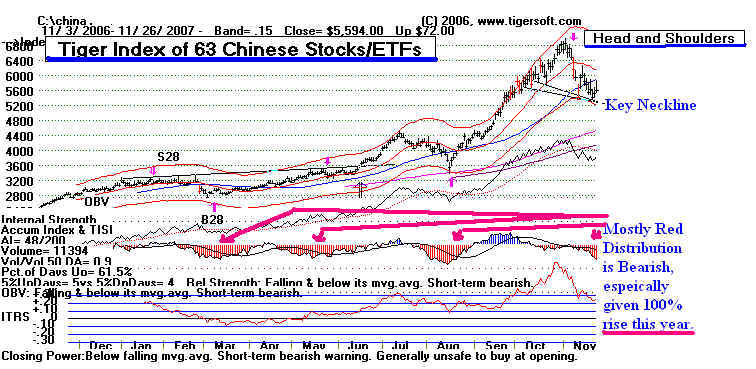

Chinese Stock Index Showed Red Distribution in November 2007.

Our TigerSoft predicted a Crash for Chinese stocks because of the

heavy (red) Distribution shown by our TigerSoft Accumuation Index,

because of the bearish head/shoulders pattern and because of

the many Peerless Sells on the US stock market in the second half of 2007.

Insider Selling in England

The British Northern Rock debacle made insiders a Billion Pounds

General Motors GM

shows how the alert short seller can use the

start

of each new wave of distribution to go short very profitably.

See

below how the Accumulation Indec ends a minor up-wave by

by

violating its own moving average.

SO MANY

EXAMPLES

OF INSIDER TRADING.

Mostly the SEC looks the other

way. Insider selling, as we measure it,

before

the collapse of a stock is rampant. Investors and traders need

TigerSoft

for their own protection. Below are a few more TigerSoft links

showing

insider selling, i.e. heavy (red) Distribution from TigerSoft

before

a dramatic plung in share prices.

Washington

Mutual - ex-CEO Killinger

CitiGroup - Board

member, ex-Goldman CEO,

US Treasury

Secretary under Clinton - Robert Rubin

Bank of America - Ken

Lewis

Ryland Group - Dreier Chad

Donald Trump

Here are the three greediest of the greedy - CEOs

who

defrauded shareholders and committed insider trading and

stock

manipulation. thestackeddeck.com's

This was

prepared before Goldman Sachs took the stage in 2007-2009,

Ken

Lay of Enron CEO

Card

Caption:

This part-time Bush advisor and full-time millionaire was

selling company stock while telling employees to buy. Big surprise Enron folded

under his watch. He happily drove up energy prices in 2001 by manipulating

the energy futures, causing deadly "brown-outs.".

Dennis

Kozlowski - Tyco CEO

Caption- "A true Tycoon of corporate

malfeasance: tax evasion, grand larceny,

enterprise corruption, falsifying business records, and securities fraud."

Martha Stewart and

Sam *the weasel)

Martha Stewart and

Sam *the weasel)

Waksaal of Imclone.

TIGERSOFT's ACCUMULATION INDEX

and CLOSING POWER ARE THE DIFFERENCE.

One

more example - CitiGroup. It hit $1.00 a share in March 2009.

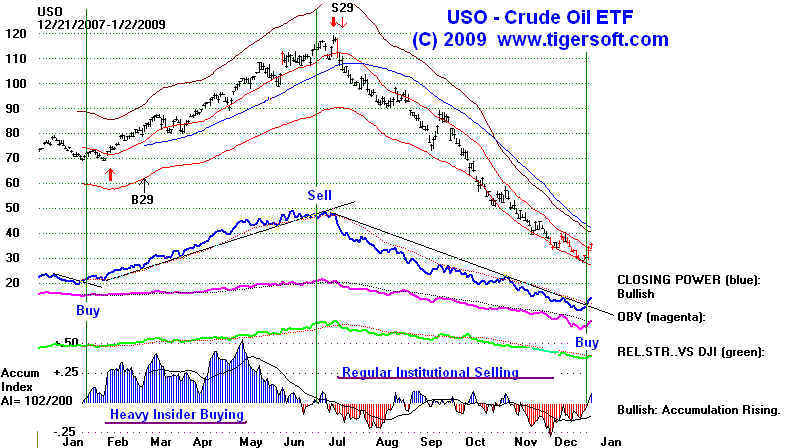

CRUDE

OIL: 2007-2008 Illustrates how quickly the Tiger Accumulation

Index can change from BULLISH ACCUMULATION to BEARISH DISTRIBUTION.

The trend-changes of Tiger'S Closing Power confirmed the trend-change.

Both tools were

invented by TigerSoft and have been back-tested as far

back as 1928.

====================================================================================

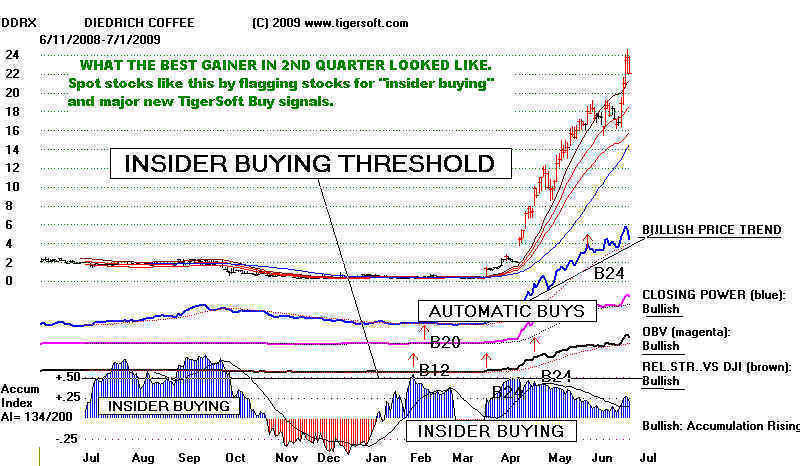

INSIDER BUYING IS THE SINGLE BEST

PREDICTOR

OF A FUTURE EXPLOSIVE SUPER STOCK

Bulges of intense

(Blue) Accumulation show insider buying. If the insiders are

savvy and the

general market holds up, prices will soon breakout to new highs

and advance

quickly. Only after prices have already risen a long way will the

good news that

propels them upwards come out. That is when the broad public

usually buys.

We want our people to get in at the beginning of the move. The

early major Buy

signals tell us when to buy. We hold as long as the trend is up,

using the blue

50-day moving average. TigerSoft makes finding such stocks

very easy.

Our Peerless Stock Market Timing tell you when the market is safe.

|